Vicor Short Thesis: AI CHIP MANIA ACCELERATES VICOR’S COMPETITIVE DEMISE & PROVIDES AN ASYMMETRIC SHORT OPPORTUNITY

“Sorry to interrupt the festivities, Dave, but I think we’ve got a problem.”- HAL 9000

I am short Vicor on the recent Nvidia related 50% pop in the share price combined with Vicor’s loss of competitive advantage and abysmal operating effectiveness.

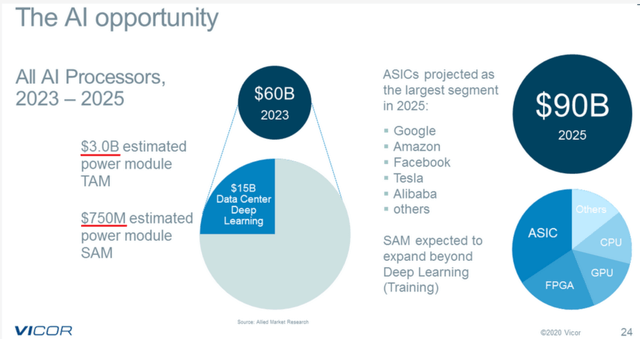

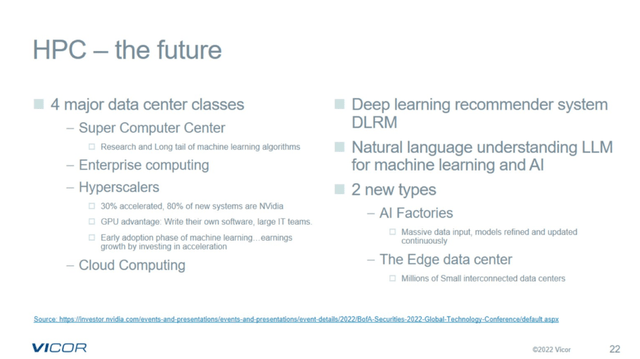

Vicor provides modular power systems, with a focus on AI Datacenter, HPC, Automotive, Industrial, and Defense environments. The XPU and Datacenter AI environments are its most important (and sexy) end markets. Vicor power solutions have traditionally been bleeding edge, allowing customers with demanding high-density power needs to use its products to achieve optimal performance. Vicor solutions achieved early recognition in Google 48V server infrastructure and on Nvidia’s Flagship Datacenter AI GPU’s.

Contrary to management’s repeated claims that their factorized power approach will rule the datacenter; Vicor’s technological lead in this area has largely eroded.

My extensive research also reveals that Vicor has serious execution issues that go far beyond what management has historically communicated to investors with respect to manufacturing capacity constraints/delays. Quality control, inspection, scheduling, and everything a customer expects from a critical power module supplier are poor and simply fail to meet the standards of world class operators like Nvidia. This has cost Vicor repeatedly over the years in missing its full financial potential, but now, as its technological leadership has evaporated, its operational ineptitude caused it to lose the critical end-market management has been promising Vicor would dominate for a better part of a decade: AI Datacenter.

Not only is Vicor not an AI winner; it is an AI loser. The boom in AI datacenter demand is accruing to its competitors, like Monolithic Power. Vicor is now being shut out entirely. The result is its revenue is likely to decline over the next two years.

Despite generating no aggregate FCF over the past five years, Vicor is valued today at >5x revenue after a 50% Nvidia related AI hype run-up.

I believe as the market becomes more aware of the severity of its immediate challenges and the loss of its competitive advantage, VICR shares will fall by 30%-50%.

“The world that Vicor owned is now loaded with competition and not only competition but some of it is very low-priced competition”-Power Expert discussing Vicor’s ability to compete and win back share, if it ever solves its manufacturing problems

Summary Bullets

- Vicor (VICR) shares have rallied 50% on the back of Nvidia’s datacenter guidance under the assumption LLM training-related GPU demand surge for Nvidia will drive near-term demand for their GPU and broader datacenter power solutions.

- Vicor, which was Nvidia’s supplier on the A100, lost the flagship Nvidia H100 Datacenter GPU power distribution network (PDN) supplier business to Monolothic Power (MPWR). This means Vicor does not participate at all where the bulk of the training demand driving Nvidia’s Datacenter upside is coming from. This situation will persist for at least the next two years.

- While manufacturing/delivery deficiencies were what cost Vicor this business initially, MPWR and alternative multi-phase solutions proving that they have caught up enough to meet current datacenter demands has effectively made the IP conversation “irrelevant” within this space. The “If it ain’t broke, don’t fix it” adage now applies to Vicor’s newly embedded competitors. Vicor needs MPWR to screw up to have a chance of getting datacenter business back. Even so, those closest believe the door to Nvidia is not just “shut,” it’s “locked permanently.”

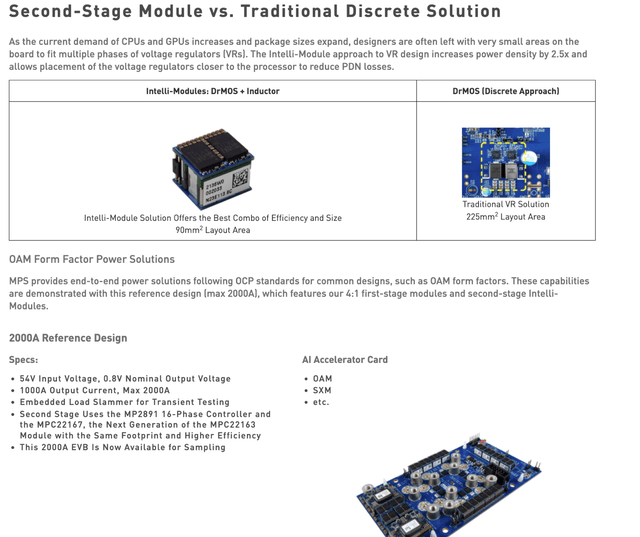

- Additionally, Vicor is losing meaningful share to MPWR in hyperscale datacenter which is where secondary demand would come from. MPWR now has higher efficiency and peak current 12V to 5V convertors which are also cheaper and a reduced footprint 48V to 12V DCM module. Recent customer checks indicate Vicor has been designed out in favor of MPWR going forward for these parts.

- AMD’s recently revealed new MI300 Datacenter GPU has also launched with an MPWR based PDN solution. This is a resounding signal that the second expected mass market datacenter player in AI hardware lost confidence in Vicor and is moving forward with Vicor’s competitor.

- Vicor has effectively squandered a decade of technological superiority in the datacenter space it ought to be dominating currently—it is now on the outside looking in, and is at serious risk of losing all business in this space. Vicor has consistently struggled with its manufacturing- expert checks on its manufacturing problems from present and past customers paint an awful picture that goes well beyond Covid supply chain challenges with issues described as structurally deep rooted.

“They're not very mature in terms of scheduling, hitting schedules, and manufacturing quality. They, they just don't have that, so when they say they can do something, you cannot believe them. They will miss a schedule by three x, you know, like an eight month schedule. They're not delivered at 24 months sometimes. So it’s very hard to work a project with them, it really is a people problem there.”-PDN Expert #5

- These manufacturing issues cost Vicor the Nvidia business at the worst time ever.

“ And from what I hear, that NVIDIA-Vicor relationship is fractured. They'll say for life. I would say probably for decades. They hurt NVIDIA really badly, really badly. And so I think one of the claims that Vicor made early on was that NVIDIA was actually going to two different architectures now. They were going to continue to use the Vicor architecture, and they're also going to go to a multiphase architecture. They were going to do both. There isn't any truth to that.” -PDN Expert #1

“ NVDA cut out Vicor completely. NVDA doesn’t think Vicor supply security and on time delivery is good enough and their tech is just okay. That’s’ why NVDA is now using MPWR. NVDA will probably choose one of the other big power semis suppliers as 2nd source. MPWR has 100% of H100. Vicor is out of the game for this generation. NVDA will have been trying to bring up other 2nd sources as well, they are not comfortable with just 1 supplier in this case.”- PDN Expert #2

- These manufacturing problems have been going on for years and the general take is that Vicor’s Founder ANDCEO, Patricio Vinciarelli (“PV”), has simply refused to invest in the human capital needed establish a world class manufacturing org or acknowledge just how badly Vicor have been failing on this front.

- Nvidia’s A100 supply business was responsible for the vast majority of Vicor’s Advanced Product revenue growth over the past three years. With this business moving to MPWR on the H100, Vicor’s Advanced product business will experience material revenue declines once the remaining Nvidia backlog is burnt through.

- Nvidia’s advantage right now in training GPUs for LLMs is rooted in its overall software stack. This means Nvidia has added leeway with respect to prioritizing manufacturing/supply chain resiliency over incremental power efficiency. That doesn’t bode well for the Vicor business model as Nvidia is likely to choose a second source to MPWR from amongst the diversified giants like TXN/DELTA/IFX/ADI. This move will grow the market and drive fresh R&D dollars from these giants into these solutions which will in turn further erode Vicor’s already seriously diminished value proposition.

- Vicor’s near and intermediate term financial models were heavily dependent on massive growth in its GPU PDN and datacenter related end markets with the assumption that they would be the only game in town. From a Needham Vicor initiation report three years ago:

“Vicor has relationships with the two largest CPU, three largest GPU, largest FPGA and more than a dozen accelerator vendors and has emerged as the power IC supplier of choice for 48V and AI applications”

“Conventional multi-phase voltage regulator technology cannot keep pace. As power levels increase, the growing size of and EMI generated by conventional multiphase VR limit how closely the processor of these solutions can be placed and that increases power lost between the VR and processor”

The above is objectively no longer true as MPWR and its multi-phase architecture have now thoroughly disproven each of these critical assumptions.

- Experts checks indicate the narrative around their competitive position was already eroding due to MPWR’s success with Nvidia. ChatGpt/LLM’s Cambrian AI moment actually accelerates this trend in the datacenter. Vicor was supposed to be a leader/big winner when this moment arrived and instead finds itself on the outside looking in.

“Today multiphase has really caught up and is generally better. What was impressive was Vicor’s packaging not the actual tech. Now companies like MPWR took the multiphase tech and sticking them all inside a brick also.”-PDN Expert #1

“Vicor has this factorized approach where they can integrate transformer and converter in the same package which gives customers some design flexibility at the point of load. Historically, other semis companies mostly didn’t do this and the customer has to buy a chip from TXN/IFX/ADI and then also need another transformer on the board. But now everyone has realized this and the IC design most companies like MPWR, TXN are working to integrate the transformer into the silicon chip too to do the same thing. They already have this for smaller voltage products. This is why Vicor was considered good before and won that first NVDA biz but now other tech is catching up and the other guys have much better supply chain and their own manufacturing.”-PDN Expert #2

- Management has not updated the street on these assumptions yet. This despite going from claiming to investors you will be the only game in Datacenter AI town to now yourself being banished from the town is not something that ever really gets acknowledged. Especially not in a Founder-led company. This challenge is further exacerbated by the fact that Vicor invested heavily in manufacturing capacity ahead of its anticipated datacenter domination.

- But from a practical measuring stick standpoint, management seems to recognize they have missed this short to intermediate term window and are shifting Datacenter/HPC design engineering resources towards other end-markets like automotive and avionics. Not what you want to see chasing the stock on an AI/Nvidia datacenter tailwind thesis.

- Vicor’s very serious manufacturing capacity issues have provided actual cover from acknowledging its competitive position simultaneously degraded. However, management will soon need to shift investor focus from manufacturing capacity issues to go-forward financial guidance that reflects being largely displaced from datacenter AI power solutions.

- CEO is also Founder, PV, and has been running the company since 1981, which in this case, supports the short thesis notably as objective disclosures around current developments will always be spun positively and with a backwards looking technology leader bias lens. PV’s amazing accomplishments over the past 40 years as a brilliant engineer are now in fact part of the problem: his way of thinking has gotten them here from an execution standpoint. This is going to lead to some serious negative surprises for longs in the name as he is unlikely to ever admit Vicor is now notably behind a competitor from an overall supplier value proposition standpoint. Vicor’s ability to reverse this competitive erosion after having squandered such a big lead is not something that typically happens in the semiconductor space.

- The recent AI Datacenter Mania 50% pop in a few weeks gets you a free shot on goal for this short. Investors, in their rush to get exposure to any plausible Nvidia/AI beneficiaries, actually bid up the most troubled and guaranteed near-term loser on the datacenter AI theme.

- I believe the stock will trade down to $30 over the next 12 months.

Quick Background

I went long Vicor in 2018 and wrote up a pitch for it little later on SA as the thesis gained some traction. The idea and my work on it stemmed from my related work on ML/GPU’s/ASICS/Crypto in 2017/2018.

Pitch was simple:

1) Proliferation of ML/AI in computing will drive demand for power hungry ML/ GPU’S/ASICs with progressively smaller process-based chips which require commensurately lower voltage per transistor. This trend leads to efficiency/performance degradation in existing 12V Power Distribution Networks (PDN’s), and thus requires a broad secular transition to 48V.

2) Vicor’s factorized power approach leaves it uniquely positioned versus peers with multiphase voltage regulators who are limited by electromagnetic interference in customers’ ability to place multiphase regulators as close to the chip as possible. Vicor’s packaging/IP overcomes this, reducing power loss/performance degradation by allowing its customers to place Vicor bricks right next to the chip.

The combination of 1+2 with an underfollowed small cap stock would lead to multiple expansion and a long-term fantastic secular investment in semi land. The near-term catalyst was evidence of Vicor’s gold bricks on Nvidia V100 datacenter GPU’s. This would occur at the same time that Nvidia’s Gaming business would implode because of crypto, and thus I would win on both sides of the trade by triangulating an underfollowed name with major leverage to Nvidia’s then nascent and secularly growing datacenter business versus its massive and soon to be rerated gaming biz due to a crypto implosion. This worked out pretty well though for the most part I wasn’t in Vicor a long time nor did I size it as large as the short. I then kind of forgot about Vicor….

I checked back in on it a few times over the years and the V100 win wasn’t really panning out as expected for them with respect to revenue upside nor was the idea of an explosion in demand from other GPU/ASIC players or the broader theme of transitioning to 48V in datacenters. The CEO’s extremely confident pitch pretty much never changed, and his company developed a history of over-promising and under delivering. Then Covid happened…

Nvidia A100 demand took off and so did all chip stocks- Vicor shares 5x’d. Then in 2022, the stock was in free fall with the rest of semis, but I’d come across mentions of it having supply chain issues that were jeopardizing the Nvidia business. This was ultimately confirmed at GTC on March 22 nd of 2022 when Nvidia introduced the H100 with no Vicor visible on the GPU Card. Subsequently, Vicor’s manufacturing issues became more well-known as management announced they would need to bring the electroplating process in-house.

From the Vicor 2021 10-k…

Now the 2022 10-k…

So, Vicor initially expected to complete this line in H1 2022 and for volume from it in late-2022. Vicor is now hoping to complete it this year with the most recent update being that it should have vertically integrated production by Q4. I have now come to believe that things are much worse than they appear, and that electroplating issues are just the tip of the iceberg with respect to manufacturing/quality control issues. Despite being skeptical of Vicor’s ability to deliver a functioning facility at year-end, I think it’s irrelevant at this point. I believe Vicor has done irreparable damage to its long-lasting relationship with Nvidia and that it’s credibility and reliability are in question across the entire sector, far beyond what most people currently realize

I’ve followed these developments on a cursory basis but not shorted the stock as semis have been so strong since the October bottom and Vicor was justifiably relatively weak during the initial rally. Then AI chip mania arrived, and the shares rallied 50% in three weeks. I am now short the stock.

The Short Pitch

This recent tech rally has lifted all semi boats very quickly and Nvidia’s blowout earnings really popped the power-semi names with exposure to their datacenter business, namely MPWR and VICR. This is no surprise as MPWR has 100% of the Nvidia H100 48V biz and now a decent amount of the A100 biz while Vicor still has legacy contractual A100 48v biz. Knee jerk the move is not surprising, but any objective analysis here should actually conclude Vicor is now worse off than they were before because of this surge AI related semiconductor interest. I actually think what’s transpiring in the sector will accelerate Vicor’s demise.

Short Thesis Summary

Datacenter AI Loser: Vicor is already out of the H100 and thus does not participate at all where the bulk of the surging training demand driving Nvidia’s Datacenter upside is coming from now and going forward.

Market Share Loss: Vicor has also lost meaningful share to MPWR in hyperscale datacenter designs which is where secondary demand would come from if it had adequate supply. Expert checks indicate Nvidia seemingly has zero intention of working with Vicor again in foreseeable future. Most importantly, Vicor has squandered the technological lead I was previously so bullish on.

Manufacturing Challenged: Vicor presently is supply constrained at the worst time ever, and its history of manufacturing issues has now cost it the high-volume end market opportunity management has been promising investors would be exclusively Vicor’s for the past decade. Now it’s MPWR’S business to lose, and I don’t see that happening.

Lost Competitive Advantage: MPWR’s current price point (~$50) is a fraction of Vicor’s. Even if Vicor can solve its manufacturing issues over the next year and restore some credibility the industry economics by 2025 (its earliest window by my estimate to try and win back meaningful market share) are going to be far inferior to what Vicor was investing ahead of capacity wise, driving down returns on capital and the potential profit pool.

Timing: The recent AI Mania 50% pop in a few weeks gets you a free shot on goal in this short which I thought I would not get again.

Vicor’s Nvidia Sized Problem & Their Eroded Technological Edge

Up until a little over a year ago, Vicor was sitting in the datacenter AI driver’s seat with Nvidia. Its position as Nvidia’s exclusive high-end datacenter GPU PDN provider supported the marketing of its factorized power approach being technologically superior to multiphase despite several experts in the space arguing that was/is simply no longer the case. Investors were simply waiting for Vicor to scale manufacturing and ride the secular demand boom in Nvidia’s datacenter business. But then Vicor ran into manufacturing problems ( quite predictably based on its spotty track record) and Nvidia found someone else who could deliver at scale.

Here are some excerpts from some expert calls which shed more detailed light on the technological implications of all of this.

VICR Background from PDN Expert #1:

“Vicor introduced their resonant tech around 1990 and everyone remembers that in the power design world. Typically, one could fit 1 watt per in3 and Vicor hit 10 watts per in3 it was a big jump. It became the topology that everyone chased. The flip side is it was very expensive so Vicor was considered a last resort only buy if you really need it. Today multiphase has really caught up and is generally better. What was impressive was Vicor’s packaging not the actual tech. Now companies like MPWR took the multiphase tech and sticking them all inside a brick also. But anyway, that was the real difference.

“Now what's happening is you're seeing companies like MPS that took the multiphase technology and said, "I'll tell you what, we can do the same thing. Let's take all of those parts, and we'll stick all of those parts inside of brick also." So if you were to look at a Vicor brick and you would look at a MPS brick, people look like these black rectangles, they look the same from the outside. And performance-wise, they do about the same thing from the outside. It's just that what's inside is different. So a Vicor brick vs a MPWR brick both look the same from the outside and performance wise they do about the same thing from the outside. The operating efficiency of multiphase is typically better than resonant. You have a GPU or CPU that we are providing the power to. Say it’s a 1V power bus that needs 800Watts. Where does that 800W go? It all comes out of heat. Whether the brick is 80 or 90% efficient means you have to get rid of 80W or something.

“MCHP, IFX, etc. all make multiphase controllers and AVGO, CSCO, etc. devices all use multiphase devices not resonant converters. Some in the super computer world like NVDA could afford Vicor; the rest, not so much.”

Expert’s take on Vicor’s factorized power approach vs multiphase:

“The common mechanism is 48 to 12V and 48 to 5V first step conversion, and then you have the controller that takes the 12 or 5 and takes it down to 1V. Vicor would tell you that’s an advantage of ours not having to do that in multiple steps. but that is not true. You still need extra controller, their PRM which is in essence the same thing that’s in a multiphase controller. So Vicor is basically the same steps as multiphase. And so there is a lot of marketing hype that comes out of Vicor, much of which isn't true. For example, that the resonant topology is the leading architecture, and nobody is going to be able to get close to that. That's not true.”

“Just like all the other topologies, it is double-stage conversion and resonant conversion has pros and cons. But to look at figures of merit, how efficient is the conversion end-to-end, Vicor actually is on the lower side. Most of the other companies do better in terms of power conversion efficiency.”

“And I think what made Vicor special wasn't their topology. It was their packaging.

They got a very high-current module into a very small package. But now everybody else has figured that out too. Monolithic Power has even higher-current modules in similar packages that can get just as close to the ASIC. I think that what Vicor is planning for is that they believe that at some point, the power supplies have to go on-package, and Vicor believe that they'll be the first to do that. And personally, I don't think that's going to happen. I think it's a pipe dream. But if it does happen, I think everybody else will be ready for it too. Right now, Monolithic Power, I think in terms of architecture, they're actually ahead of Vicor. In terms of efficiency, they're ahead of Vicor. On 48 volts, sure, they can operate it at 48. They can even operate their intermediate bus at either 12 or five, and most of the power converters are more efficient at five volts than they are at 12 volts. And so there are a lot of choices.

“There are other competitive advantages and disadvantages. For example, the Monolithic Power system is a programmable device that has a full PMBus compatibility, and you can program almost everything from output voltage to switching frequency to start-up time to sequencing, the phasing. All of that is programmable, and the control loop itself is actually inside the power module.In Vicor's architecture, that's not true. Vicor's architecture is just the power stage, and so you still need the control loop and you still need the PRM front-end converter. So it takes three modules on Vicor's side to equal two modules on a multiphase side.”

Expert’s take on Vicor’s tech being more power efficient:

“One of the things that Vicor talks about is efficiency. And I'm a figures-of-merit guy. So you want to tell me about the power supply. Tell me about the figures of merit. And everybody is worried about the efficiency, the efficiency of the Vicor module is really high, and it's not true. So let's get rid of that untruth.

“And I will tell you that the Monolithic Power modules are more efficient than the Vicor modules. But I'd also tell you, who cares? We're sitting next to an ASIC that we're powering. And we're saying that this ASIC is consuming 1,000 watts. Maybe 0.7 volts to 1,500 amps.

It's consuming 1,000 watts that it's going to dissipate as heat. And you're telling me that if the power supply is 90% efficient, I need to get rid of another 150 watts? So what? I already had to get rid of 1,000. What's another 150? So the 90% sounds like a big number, but in the scheme of things, what it means to my thermal cooling system, what it means to the water flow, it's insignificant.”

PDN Expert #2 color on same topics.

Background take on technology implications:

“Vicor is very focused on 48V (covert from 48V to point of load down to low voltage). MPWR, TXN, IFX, STM: they are not just focused on 48V, we all have a wide array of power solutions portfolios; 48V is the minority of applications vs it’s 90% of Vicor’s portfolio.”

“It’s a power module company, they have their proprietary tech and use integrated inductors in their power module. But they don’t have a very strong technology in the individual components, they just put them together. They don’t have a competitive silicon MOSFET...they have some IP but not the most advanced. They compensate for that with better IP around the final module packaging where they integrate the inductor in the module to reduce size and be more efficient in conversion. The tech that MPWR and the other semis guys have is integrated into 1 IC chip .... all of these companies design their own components, their own MOSFTs, etc. we all have ability to do it in 1 IC. Vicor cannot control individual components, they use older technology. The power converter system efficiency overall depends on the individual MOSFET performance and the overall system design: these power semis companies are good at both so can provide good solutions for 48V. Vicor is only good at the final module solution – this integrated inductor approach not always necessary.”

“Vicor has this factorized approach where they can integrate transformer and converter in the same package which gives customers some design flexibility at the point of load. Historically, other semis companies mostly didn’t do this and the customer has to buy a chip from TXN/IFX/ADI and then also need another transformer on the board. But now everyone has realized this and the IC design most companies like MPWR, TXN are working to integrate the transformer into the silicon chip too to do the same thing. They already have this for smaller voltage products. This is why Vicor was considered good before and won that first NVDA biz but now other tech is catching up and the other guys have much better supply chain and their own manufacturing.”

The section above and those that follow were based on extensive expert calls and research I had over several weeks. The consistent and resounding message I continued to get, was that Vicor had a technological edge that it simply squandered away to peers. Month after month, Vicor’s engineering and manufacturing deficiencies continued to keep the door open for peers to optimize their solutions and try to create a level playing field in datacenter PDNs. The likes of MPWR then just needed an opportunity to prove themselves. Then finally, Nvidia had enough and could no longer wait for Vicor as DC GPU demand exploded. Suddenly, Vicor was nowhere to be found.

Vicor Losing Nvidia

PDN Expert #1 take on why Nvidia doesn’t need them going forward:

Q: if there are all these other 48V solutions, why does NVDA need to bother with Vicor?

A: They don’t need Vicor: MCHP, ADI, IFX, MPS all have new solutions. Vicor is standing there saying you need us but the truth is no they don’t. Vicor tells stories that look good on paper but it’s all marketing bullshit. I mean it was true at some point in time, but it's not true anymore. The Monolithic Power Systems bricks now, they go to 160 amps. That's higher than the highest of the Vicor modules. And yes, the Vicor module did allow you to get very close, with the Monolithic Power Systems, their new bricks get even closer. They’re still talking about why you can’t use multiphase architectures but that is not true, go talk to NVDA, AVGO, etc. they work fine and they’re cheaper. In 1990 this may be true. Vicor hasn’t done anything new since 1990.

“Even my supercomputing company that asked for Vicor modules – I told them that is sole source and if they can’t deliver you’re in a lot of trouble. And then they couldn’t deliver. So ppl like statistics but then it affects you the wrong way you are screwed.”

Q: Do you think they will lose NVDA A100

A: Yes for sure. It’s a certainty after whatever contractual requirement is there gets worked down. NVDA would have cancelled everything they can with Vicor already.”

Expert’s take on Nvidia supporting two source approach down the road for H100 that sees Vicor designed back in:

“It's interesting because I get this question a lot. And I mean, think about the logistics of that board and managing the bill of materials and the manufacturing process and all that. What company in their right mind would want to maintain two separate architectures for the same part? Logistically, it's an absolute nightmare. And from what I hear, that NVIDIA-Vicor relationship is fractured. They'll say for life. I would say probably for decades.

“They hurt NVIDIA really badly, really badly. And so I think one of the claims that Vicor made early on was that NVIDIA was actually going to two different architectures now. They were going to continue to use the Vicor architecture, and they're also going to go to a multiphase architecture. They were going to do both. There isn't any truth to that.

“What is true is that NVIDIA was able to cancel all of the contracts that Vicor couldn't deliver on, and they couldn't cancel any contracts that Vicor was delivering on. So whatever NVIDIA is using right now, those are the contracts they couldn't cancel. They phased out everything that they could from Vicor. So if they could cancel a contract from Vicor, they ditched that module altogether, redesigned their board to accommodate somebody else. I think in general, that's Monolithic Power. And then in a few cases, they weren't able to cancel the contract. So they're going to complete their contract with Vicor, and then they're probably gone. I asked my buddy, how long do you think it will be before NVIDIA talks to Vicor again? And he said, probably never. I think that's probably an exaggeration, but I do think it will be a decade.”

PDN Expert #2 Nvidia loss take:

“ NVDA cut out Vicor completely. NVDA doesn’t think Vicor supply security and on time delivery is good enough and their tech is just okay. That’s why NVDA is now using MPWR. NVDA will probably choose one of the other big power semis suppliers as 2nd source. MPWR has 100% of H100. Vicor is out of the game for this generation. NVDA will have been trying to bring up other second sources as well, they are not comfortable with just 1 supplier in this case.”

PDN Expert #3 take on Nvidia/Vicor:

“ Anybody who's baking in Nvidia volume for Vicor, I think they should stop thinking that. I can't see why, because Nvidia doesn't need them like other people do. You know, NVIDIA isn't that high density actually, you know, relative to the super high end of density, you know, they, they, they have a little bit of space and so other vendors, resident solutions that are not quite as nicely packaged, get them the half of the space savings that that Vicor provides that they need to get to the density and that's okay for them. You know, in their A 100 and, and now these, these, the, what is it, H100, the new generation, they don't need that density. They, they have, because their, their solution is not that dense because they use a separate CPU to GPU back plane.”

It’s pretty clear from these expert calls that not only has Vicor lost Nvidia, but the narrative around Vicor’s superior competitive position has now completely eroded. I don’t believe this is a temporary “speed bump” while Vicor gets back on track, it’s a complete loss of share in AI Datacenter, including the need for Vicor to demonstrate that it can reliably deliver its modules at a competitive price in follow-on RFPs- to be competitive going forward, Vicor not only has to prove out their offering again, it has to prove it can deliver reliably, and at a better cost. At this point I am quite skeptical this will happen, and the consequences of this are Vicor being shut out of the datacenter business entirely.

Nvidia Ripple Effects in Hyperscale

This take is further supported by commentary out of a large hyperscale customer. Here is a top two Hyperscale Cloud DataCenter Engineer commenting on what’s he’s been using Vicor for in past and how that is changing.

Hyperscale Datacenter Architect Expert #4 on where Vicor is losing content now:

“I'm using the 12 to 5, 12 to 3.3 from Vicor. So they're not the same voltage rail. Now I am replacing some Vicor content.

Like for example, I'm not going to use the 12 to 1.8. I'm going to use the Monolithic Power five to 1.8. So Monolithic Power's BOM content has increased from like three years ago, they were actually not in three years ago because their currents were too low.

And they're finally getting high current parts, 15, 20 amps. They're finally in the right space where I can use them. So now they're in 100% of all servers going forward from the H100 and other high-performance computing SKUs. And like I think, two years ago, they were in probably 40% of servers. Today, they're in 60%.”

“So two years ago, [MPWR was] in probably 40%, now they're in 60%. So their share is going up. They're finally making parts of higher current. I think before, their challenge was they were not having high current parts.”

Where Vicor is going to lose content going forward:

“I will replace older servers of A100 with new power architecture with Monolithic Power's silicon. Because now they've caught up on the current offering, like with the 20 amps per regulator like the ZVS modules for Vicor has. So going forward, I'm designing the Vicor out.”

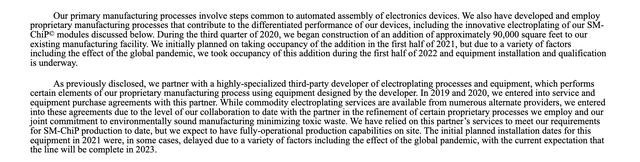

I can also confirm that Vicor has been recently replaced by MPS on the mainstay 48v-12v DCM part at a one of top two hyperscalers. This is a very big deal going forward as MPS’s previous solution here was 2x the footprint of Vicor’s. [note: by “footprint,” the industry is referring to the physical area a part take up on the circuit board] This also doesn’t bode well for Vicor’s other end markets where it essentially made a name for itself with these DC/DC power modules.

Here is MPS’ new competing solution:

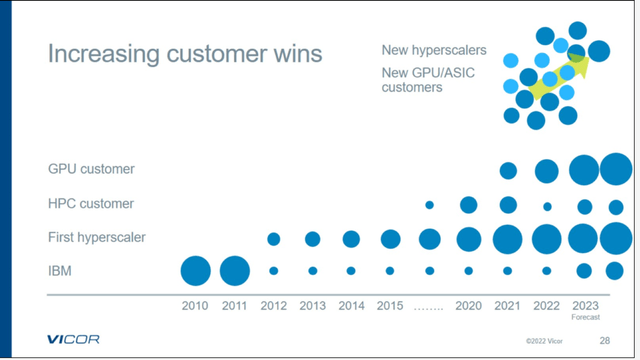

These comments have clear financial implications when compared against Vicor’s hyperscale customer slide bubbles from its 2022 annual shareholder meeting:

Added color on H100/A100 mix from start of the year:

“ So the A100 HBM2e and HBM2 shipments, I guess, their shipments have somewhat, I would say, reached peak. I would think that volume will be steady over this year. And then soon, the H100 will ramp up. The A100 volume will remain steady for two years. Because people will still use those for inference, just not in the floating point 32 mode. Because that only consumes 750 watts. And it does have the NVLink, NVSwitch. And no one is in a rush to upgrade everything. Because also, the cost, keep in mind, I can get eight of those A100 for about $132,000. That's like the standard NVIDIA pricing if you don't negotiate. I think it's probably 60% to 70% discount from that.But the H100, if I want eight of those, it's probably like $400,000, $500,000. So on a cost of doing business, the server itself is profitable if I want to run production models and move everything to H100. Because I don't see the actual throughput benefit if I'm running it in just an integer eight basis. Especially because the GPU is not the bottleneck. The memory bandwidth and the CPU is the bottleneck.”

I think this last comment also introduces some subtle but important things to consider at the high-level server volumes for anyone extrapolating Nvidia’s guide to related suppliers. Server shipments, by units, are still expected to be down in 2023. And clearly Nvidia’s mix shift to H100’s is heavily weighted to pricing vs units as far as revenue upside goes. This means even those suppliers exposed to the H100 are going to be limited in their relative upside as they don’t realize the pricing benefit-Nvidia largely keeps that for itself. I can also confirm that since the H100 has started to ramp recently that hyperscalers are not ordering new A100’s

So, Vicor is out of the H100 configurations going forward and is being designed out of some legacy A100 configurations at top hyperscale cloud service providers. If this was just the extent of their problems, Vicor would be a great short here on the reality check coming to those thinking they are a play on Nvidia datacenter upside. But Vicor has far more serious issues…

Vicor’s Manufacturing Issues

When I was long Vicor in 2018, there was the occasional bear take that the company lacked the manufacturing DNA to ever properly scale and would likely find a way to screw things up before AI related demand for it exploded in the datacenter. There really was no way of verifying this take beyond some anecdotal evidence here and there, but with Nvidia and Google working with them you were still going to give them the benefit of the doubt. And even if this was a risk, Vicor had several years to get their manufacturing ducks in a row to make sure things went smoothly.

Unfortunately, the skeptics ended up being 1000% right. I don’t think I’ve ever done deep work on a company-related issue where competitors/customers/former customers all have been in such unanimous agreement about something so critical to a business.

The consensus take is Vicor is essentially manufacturing inept, and for years, it got by because of niche end market demand volumes and leading density solutions at a time no other real alternatives essentially existed. You basically had no choice but to work with Vicor. That has now but changed- Vicor is in a very difficult spot.

Expert’s take on what went recently wrong manufacturing wise:

“So this is my opinion. I'm not sitting at the table at Vicor, but I do have friends at Vicor and know a lot about what happens there. So let me say that it's really a multitude of things. First, there was a process that gets outsourced by Vicor. And for whatever reason, their manufacturer lost the secret sauce, so was no longer able to do plating. Why? Nobody is exactly sure. Vicor is building a new factory. They're going to be able to do the plating themselves. Supposedly, that's not really proven yet. Will they or won't they, don't really know.”

“From the Vicor control standpoint, remember that Vicor, it's not a traditional company. It's a guy and that one guy controls everything that happens at Vicor. And so is a lot of this ego-driven, probably because PV (Patrizio Vinciarelli, Vicor CEO) isn't going to budge on what he thinks the ultimate solution is and engineers that Vicor, for the most part, we're only able to do what PV tells them to do. And it's not like they have any autonomy or anything else.

“But at this point, I would say, it probably doesn't matter because NVIDIA was Vicor's single largest customer. And I think it will be a decade before they could fix that relationship, if they could fix that relationship.”

Another expert commenting on the same issue:

Q: What happened with Vicor’s manufacturing?

A: Multiple factors. One was supply chain components shortages during COVID. And then module manufacturing issues.They were not able to deliver products in time, struggling with qualification and capacity insufficient with the COVID boom. Vicor would not get high priority from suppliers/3rd parties.

After multiple conversations on the topic, it’s now clear to me that Vicor’s initial big manufacturing stumble was with respect to their electroplating outsourcing partner. Vicor has highlighted this “highly specialized third-party developer of electroplating processes and equipment” with a commitment to environmentally sound manufacturing in their 10-k.

From the Vicor 2022 10-k:

My research indicates that Vicor’s partner on electroplating is New Hampshire based Greensource- a “green” PCB fabricator.

Greensource got a lot of buzz as an eco-friendly U.S. based PCB manufacturer and initially things seemed to be working great at low volumes, but as volumes went up they quickly ran into manufacturing issues. Selecting a green partner for electroplating when world class commodity providers were available globally, ahead of company defining anticipated volume ramps with the world’s leading GPU manufacturer, is the type of strategic manufacturing misstep one has come to expect from Vicor.

And Vicor’s proposed solution to the problem? Bringing this all in-house. That has also been met with further strategic manufacturing misstep skepticism.

PDN expert #2 take on when Vicor’s CHIP factory will come online:

“So, they’re opening a new CHiP module factory which will take 2 years minimum and then you need qualifications; it will take some time to do that. I think it will take them another 1-2 years from now to set it up. Each equipment is different, you have to bring older tech; a lot to do to get good yields and then qualify the process... at the earliest, I see them getting this up by the end of 2024.”

PDN Expert #1 take on the same question:

“ PV says, you know what, Vicor is building this new factory, we never did plating before but we always wanted to and our problems will be fixed. Everybody says wait a second, the company that has specialized in plating, couldn't do it, you never did it, but we should trust you wherever we trust you. And so I think there's a lot of concern about the fact that it's really easy to say what you're gonna have and what you're gonna do, but until you did it, we're not really believers so let us know when you did it.”

PDN Expert #3 take on their broader manufacturing issues and whether bringing plating in-house solves them:

“I don't think they'll come out ahead because when you see other things that are pretty simple, they fail on, you know, optical inspection. Like, you know, we get parts that are just visibly damaged, defective and it's like, it's one thing to make it, and it's another thing to let it get out to the door in a tray at our factory where if, if we're running at volume, these are not being micro inspected, we are trusting them for that. You know, we, we suffer yield loss because we put parts on our boards that are like, wait, what? Like this thing could never work. A side's all cracked. And they're like, oh yeah, so how'd that happen? You're like, this is not plating, right? I wouldn't say that they're going to fix that actually that taking it in-house won't fix the sort of problem, the plating problem they just had, it'll happen and, and their guys, unless somehow they magically populate the factory, the plating line with people who are better than the people they've acquired for their other local, you know, Andover and Providence operations, it's not gonna go any better. I don't think it's gonna be a silver bullet. And I don't think, I mean in the last, you know they've got just so many problems that are not plating related that it, if you said to me, okay, the plating from now on will be magically better oh okay, like that, I, I'm not sure what that does for me, there's still problems 1, 2, 3, and four to fix after that.”

I found this take to be the most insightful as the expert is speaking from direct experience and views Vicor’s manufacturing problems as structural across quality control, process, remediation, communication etc.

What’s the root cause of these long running manufacturing issues?

It appears to be a cultural problem that simply continues to be ignored/compounded by the Founder/CEO.

Here is a former Vicor manufacturing engineer commenting on the culture and how that might have impacted manufacturing woes:

“I wasn't there for that to see that change of heart if it even did happen. I don't know if it would have happened. I can't see them really changing their ways. They pretty much said that's just the culture of the company. I think that's stemming from the very top of the line. They tended to kind of just take the cheap way out it seems because there were certainly ways of doing things a little better.”

“And as you mentioned, when you see yourself scaling up significantly you prepare for that in the sense of adding maybe more advanced engineers, more engineers, in general, maybe more specific management to address these new needs that are coming up and people to help scale the company up. And I didn't really see that happening in my time. I'm not sure if I can imagine them doing it now.”

Broader Implication of Vicor’s Manufacturing Issues

Vicor’s manufacturing failures occurred at the worst possible time- it lost Nvidia just as the market took off. But the ramifications extend beyond just the near-term inability to participate in the AI gold rush, Vicor now needs to solve its manufacturing issues AND regain credibility with customers at a time when a competitor’s offering is going for a fraction of the price (MPWR’s PDN content at ~ $50). The challenge of this is further exacerbated by the fact that Vicor clearly burned a lot of bridges over the years. It also doesn’t help that Vicor has made capacity expansion investments around much more lucrative unit economic assumptions, and so far has provided little color on pricing expectations going forward in a suddenly competitive landscape.

But industry experts are obviously aware of this challenge ahead.

PDN Expert #1 on the competitive landscape facing them going forward:

“Again, I could only give you my opinion, but I'll tell you that having a billion dollar factory and having a billion dollars in business is two very different things. And actually had this conversation with somebody recently and asked whether or not PV actually believed that if he had a billion dollars in capacity, that would automatically translate to a billion dollars in sales. And they weren't really sure if he believed that or not, but it's, it's what he's spewing. The question really is if and when he fixes his issues, does he still own that world? And I think the answer is no, I don't think he does because I think Infineon right now has a very viable thousand amp plus capability. Microchip I think has a viable thousand app plus capability. Clearly MPS has a very clear, you know, one killer app and above capability analog devices just proved their killer app plus capability. And so the world that Vicor owned is now loaded with competition and not only competition but some of it is very low priced competition. So one of the questions has to be, not only is it that Vicor is going to be able to recover and build modules, the question is, is he going to be able to build those modules cheap enough to compete at the MPS prices and still pay off his brand new factory?

“I mean we have a lot of customers that are in the 1,000 to 2,000-amp range, a lot of customers. And with very few exceptions, they're doing multiphase, not Vicor. Vicor was an elegant solution that was quite expensive. And so NVIDIA could afford Vicor, I think NVIDIA was the bulk of Vicor's consumption. But the average company wasn't willing to spend the money on a Vicor modules. So at this point, everybody has a module. There isn't anybody that doesn't.

“Whether it's an individual phase or whether or not it's a packaged bigger module like Monolithic Power makes, everybody has one. And when you look at it, in fact, we're actually designing right now a validator for these high-current customers, and we started looking for power supplies that we could use for our own demo board. And we were surprised, but every VRM manufacturer came out to help us. Everybody wanted us using their module.

Analog Devices showed us their new LTM4700, which was, it was nice. It was a $240 module that had a one-year delivery. Monolithic Power said, ours is $53 and you can have it tomorrow. And you know what, we'll actually design the board for you, and no need to pay for the modules. We'll just send them to you. They were, that's pretty aggressive.

So how does Analog Devices sell a $300 module against Monolithic Power's $50 module. How does Vicor sell a $100 module against Monolithic Power's $50 module? The longer it takes Vicor to get back on track, and I don't see them getting back on track anytime soon, I think they're a year or two out. My buddy says 2025. By that time, think of how much history is on these Monolithic Power modules and these multiphase modules. And PV is still going to be out there saying, multiphase doesn't work. Only the Vicor architecture works.

“Except that these companies will have had years of history on their 2,000-amp module. So what is PV's argument going to be? We have one too. We have one that's only a little bit more expensive. Yes. We couldn't deliver in the past, but we're going to be able to deliver in the future.”

PDN Expert #5 take on the same topic:

“So I do think Vicor is, they're teetering on the edge of the, you know, technology, other technology like transistors have kind of bypassed them and the complexity that they don't have to deal with in their control or others have, have got solutions that, you know, now you can, it is code you drop into this arm processor and, and it, it roughly works and then you just have to, you just have to tune it. The competition is getting there. And I think combined with the practical reality is that anyone who's ever, you know, designed anyone who's ever dealt with Vicor will give you the same story I'm sure, because it's, I've talked to a couple of them and everyone's like, oh my god, you know, they just can't lead times are super long. Sometimes you get surprising zero yield where you're just, you know, you, you're at yield lead time and then four weeks before delivery they're like, yeah, we yielded zero, sorry. So it's gonna be another eight weeks. Like that sort of thing. As a practical owner of a product, you're willing to deal with a little bit less good technology to get reliable tech to get things that, that when they say they can do it, they do it.

“They're not very mature in terms of scheduling, hitting schedules, and manufacturing quality. They, they just don't have that, so when they say they can do something, you cannot believe them. They will miss a schedule by three x, you know, like an eight month schedule. They're not delivered at 24 months sometimes. So it’s very hard to work a project with them, it really is a people problem there.”

Not exactly encouraging commentary with respect to yield or overall execution capabilities. And it explains a lot as far as historical profitability issues go.

While Vicor management is obviously not publicly acknowledging the challenges ahead in datacenter, they are making moves which signal they recognize the need to look elsewhere for growth now. My checks indicate that they have shifted top design engineering resources away from HPC/Datacenter towards automotive/avionics. Again, a horrible sign if you have piled into the stock on an Nvidia AI demand thesis which was the story Vicor was selling hard before.

Highlighting AI Datacenter and Nvidia’s dominance was clearly something that mattered a lot to Vicor’s financial model, so no surprise, management aren’t eager to update investors on what the intermediate outlook looks like with alternative suppliers taking this business and potentially no new Nvidia orders for a long while (if ever again).

But what about Vicor’s prospects in these other end market?

PDN Expert #1 on their potential in entering Aerospace market:

“The space business- that's where I live. I mean that's my history. We're very, very conservative. We're very reliability-centric. And here comes Vicor saying, we never built a module for space, and we're having all kinds of delivery problems because of reliability on our commercial modules. But you should trust us with your space converters. How does that argument work?

“I really don't understand. And they're actually asking the space community to pay for the research and development to help Vicor make this space converter. I just don't see that playing. I really don't. I just don't see the space market doing that. The space market, as a whole, if you look out in the out-years, that scares me because I come from a space background. I live in the space world. I do a lot of work in the space world. And when you look at the SpaceXs and Blue Origins and all these companies, they're all going to commercial-grade parts.

“They're not buying military via space-grade parts anymore. They're only buying space-grade parts in Class one military and government missions. But at commercial stuff, they're using commercial parts, mostly automotive parts. And so if PV manages to get into that space market, I think he's going to be surprised that it's not those $5,000 modules he is expecting, but it's going to be $200 modules.”

Vicor prospects in automotive from PDN Expert #5 in the automotive power space:

Q: Do you see Vicor succeeding in automotive?

A:N o. For Autos it’s not just about conversion efficiency and small size which is what Vicor has focused on; in Autos it’s about reliability and power/head stability issues. Vicor maybe can get into DC-DC converters or something but that is commodity and competitive space. Very hard to change suppliers in the autos food chain b/c of all the testing, licensing, etc.

These takes aren’t exactly shocking at this point. Automotive and Avionics have far more exacting manufacturing demands then the markets Vicor has participated in thus far, and so its track record warrants skepticism. Also, as far as automotive goes, you are talking 2025 or later for anything needle moving as an investor and thus this is not exactly a place you want to be thesis-wise over the next few quarters.

What about opportunities outside of Nvidia in the datacenter?

PDN Expert #2 take on 48V adoption by AMD and INTC:

“NVDA using mostly AI chips that needs much higher power, that’s why they went 48V

For INTC there is not much reach for high voltage in CPUs, maybe eventually or for some applications they do. NTC/AMD small CPU parts are lower voltage. 48V is for large cloud computing needs like NVDA, AMZN, GOOG. AMD new cloud GPU will start on 48V too....not likely to use Vicor unless Vicor proves better performance. AMD has to get designed in with suppliers so better with good reputation companies to do that.”

PDN Expert #1 take on their prospects with Intel/Amd..

Q: INTC / AMD could potentially use Vicor for high performance compute products, or has the well been poisoned / no reason to?

A: Vicor’s core product was the 48V to 1V converter which they can’t deliver. So there is no customer who can get that module. Vicor did recommend a new module to us that requires a new PCB design but they said can’t deliver for another year. So don’t think anyone will adopt that. They will deplete their Vicor inventory and after that Vicor cannot deliver product. Vicor is building a new facility to do the electroplating but it’s too little too late. AMD, etc won’t adopt Vicor after all of this experience NVDA had. MPWR has been so aggressive and good. IFX, others coming out with new products. No reason for Vicor. If I was to bet on anyone , we’re betting on MPWR. Their cost is good, their support, their solutions are all good. They have a lot of history with AMD and INTC and they were waiting and now ready to eat the Vicor market

This take was recently supported by the reveal of AMD’s MI300 Datacenter GPU which I can confirm is using MPWR.

Hyperscale Cloud Datacenter Architect Expert #4 describing the MI300 PDN solution:

“So here, we are going to go with 12 phase for like a 12 okay. So there's no 48 to 12. You don't need a 48 to 12 here. We're going to go like the module, we're better off -- like not the DCM, we would be better off using a discrete like regulator and then external Fet and inductor for this power level. It's 500 watts fully taped out.”

Expert #4 explaining that MPWR supplies this:

“So this is an MPS part actually. So we're using an MPS based solution for this. And then we are -- okay. So then we have…the 100V9,-1V8,3V3, these are all parts that AMD will be buying from MPS. And then the 12 to 5 we buy from MPS.”

Again, not a pretty picture as far as datacenter prospects go, and that’s pretty evident in Vicor’s large decline in new bookings. Analysts and Vicor long-term bulls have consistently pointed to CPU/GPU leading customers as the most important reason to be long Vicor. At this pace, it’s not clear if a single one of them will rely on Vicor as a supplier of choice at any point in the near future.

Founder/Management Commentary Over Past Several Quarters Raises Serious Red Flags

As I stated earlier, the knee jerk move here was to buy this stock with every other semi if not more so because you might think they sort out their supply issues soon and then start to benefit.

This is a massive trapdoor- what is now happening is essentially an acceleration towards validating the multiphase vendor approach for hyperscale datacenter over Vicor’s from here on out. And as these vendors are all largely vertically integrated diversified semi giants with superior manufacturing and far more reliable supply chains; Vicor’s datacenter competitive position has now been rendered untenable. This is occurring at a time that Vicor is venturing down the far more expensive path of building their own in-house production capacity. Vicor is also not really diversified and essentially has bet the ranch on dominating this space. The CEO’s founder personality is also a serious problem from here on out as he’s clearly a strong personality whose been running the show since 1981. Even when I was long the name, I found the track record with respect to guidance quite concerning and that has continued. This was something I was willing to accept then because of the Nvidia setup, but now without Nvidia, it’s a major concern. You can now easily conclude that management color from here is essentially useless as the Founder/CEO’s personality/history prevents him from acknowledging that Vicor is in fact in very serious trouble.

He will continue to sing the same super-optimistic tune.

Vicor CEO on Q1 call:

“In Q1, the high performance computing market saw the introduction of artificial intelligence chatbots, using large language models, which have significantly stimulated the market for AI systems at hyperscalers and social media companies globally. These new chatbot capabilities open up completely new areas of AI to the masses and have a much higher customer satisfaction than traditional search engines. Our Factorized power solutions are being used to power the rollout of this exciting new technology and as higher performing processes are introduced. A lateral vertical solutions will provide the higher current density and lower PDN losses that these next generation AI processes demand with increasing current levels and lower operating voltages.

“As I commented in our last call, new five-nanometer processes being introduced to the market using lateral power conversion solutions are hindered with high PDN loss, which limits performance from otherwise achievable levels. Lateral vertical factorized power enables the full potential of AI processes by reducing processor and PDN losses.”-VICR CEO, Q1 2023 CC

While that was happening, Monolothic Power had this to say:

“Here are a few highlights from 2022. We introduced a new product line of isolated power modules for applications exceeding 1 kilowatt with a fully integrated controller, isolator and power devices. Our initial revenue ramp for this highly integrated and reliable solution is targeted for 2024.

These modules are critical building blocks for power management applications for datacenters, EVs, plug-in traction inverters, EV chargers, solar power, wind turbines, battery power storage and other industrial applications.

Our products are designed to set the industry standard for these critical system-level applications. MPS’ first advanced data converter products for high precision industrial and medical applications were made commercially available during 2022, and we expect to have an initial revenue ramp in 2023.

Full year 2022 Enterprise Data revenue grew $135.1 million over the prior year to $251.4 million. This 116.1% increase is primarily due to higher sales of our power management solutions for cloud-based CPU and GPU server applications. Enterprise Data revenue represented 14.0% of MPS’ total revenue in 2022, compared with 9.6% in 2021.”-MPWR, Q4 2022 CC

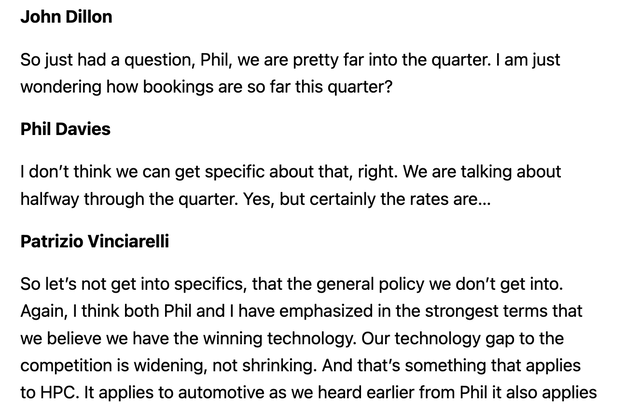

Coming back to Vicor, PV(the CEO) cuts off the VP of Global Sales as he’s about to comment on bookings during the Q4 call:

A former employee’s take on the CEO:

“I think he lives and dies with the company. I think everyone who has worked with him knows he is one of the first coming into the company, he is one of the last leaving the company. He is always there. He has a son, but I think the son will not take over the company. I don't know anyone who could be taking over. So I think he must be in the mid-70s, but he looks like 10 years younger or 20 years younger. He's highly energetic. So I don't expect him to really hand over. It's his baby.

Industry expert’s take on the CEO:

“Let me say that I don't know him personally. I know a lot about him and so I can only give you my opinion, but my opinion from what I hear from those that are close to him is there is no team. There is PV and the PV puppets and a lot of PV puppets. So there is nobody that is allowed to have individuality. There is nobody allowed to have an opinion differing from pvs. There's only executing PVS plan. That's it. Do I think that that's problematic? Of course I think it exacerbated this issue. Of course. Do I think that anybody's gonna change PVS mind? Not a chance in hell. I think he'll run down the rabbit hole and he will, he'll run this into the ground and that's fine. At the end of the day he'll still be rich.”

I have a good deal of experience with these type of CEO/Founder related elements to a short thesis and this one sticks out like a sore thumb. This type of personality combined with what is unfolding in the space makes for an ideal setup for a short as the CEO is going to point to the macro tailwinds repeatedly when self-inflected wounds, loss of performance differentiation, and lack of price competitiveness are the main drivers accelerating Vicor’s competitive demise.

As the company is effectively his child, the CEO is never ever going to acknowledge failure or admit his tech is no longer superior. He will double down on the narrative he’s been espousing for the past decade because there is no convincing him it might be wrong. So, he’s going to go from telling investors multiphase will never work to that its commodity and has issues in the most demanding power environments and that Vicor’s next Generation tech will leapfrog it. Maybe he will be proven right one day, but at this point you have to look at the track record. Vicor failed to execute when the market was too small for any giants to care, and now with every industry player targeting high-density Vicor finds itself playing catchup. And the reality is mass market adoption is a commodity market defined by manufacturing quality at scale. His commentary indicates he still thinks this is a bespoke HPC battle he’s fighting which is precisely why they are on the outside looking in right now. I would expect several messy quarters ahead as the whole landscape is shifting away from them. And clearly I’m not alone in reading into his comments on the conference calls and annual shareholder meetings this way.

An Industry Expert take on this:

“I listened to the fourth quarter earnings conference last night, and it was really amazing how much nonsense PV was spewing. And I actually wrote to my buddy at Vicor this morning, and I asked him, do you think that PV actually believes the stuff that he's saying? Or does he know he's lying? And my buddy said, I don't honestly know.

“But most of what he said wasn't true. In fact, one of the investors actually got heated on this call, and he, PV kept blaming the delivery issues on COVID and the pandemic and supply chain. And one of the investors said, you keep saying stuff like that, and yet NVIDIA is delivering. Monolithic Power Systems, they're delivering. They're executing on their contracts. You're not.

There are red flags galore here. Talking about getting into space/automotive now when you are supposed to be crushing it in datacenter on AI is something intelligent investors are not going to ignore. From where I sit as an investor, it looks to me like you know things are getting worse and you have just a little time before the backlog cover disappears and exposes it fully and you are essentially hoping you can just stabilize the ship with the manufacturing revamp and buy enough time to take a longshot down the road to get back in the game. But deep down you know your recent failure with Nvidia just opened pandora’s box as far as competition goes going forward and potentially signed your death warrant on the blue-sky narrative you been selling investors for better part of last decade.

I also think it’s important to remember this has always been a big risk for Vicor as they are not unique in their silicon IP or components and obviously nowhere close to the analog chip diversified giants supply chain wise. R&D/HPC volumes where never an issue for Vicor as it was sitting on industry leading density solutions, but every bull was banking on them being the only game in town once that Cambrian moment arrived in datacenter with the manufacturing/supply chain chops to match.

That moment just arrived and Vicor fumbled the ball at the goal line as the number one seed, and is now sitting at home watching MPWR supplying Nvidia a lower cost superior solution as the market explodes. This is the exact opposite of what was supposed to happen here. Vicor was supposed to be enjoying the overearning spoils of selling its HPC priced solution at multiples of the price of MPWR, into a demand euphoria environment, to the sole LLM training GPU crack-dealer in AI. The risk down the road would have been Nvidia seeking a larger more diversified supplier at lower price point to replace them, but that would have been far off in investors mind for a company set to experience hypergrowth from such a disproportionate demand impact on their business.

That’s usually the playbook in this space.

Instead, Vicor looks like it needs to worry about the entire sector moving at hyper speed past them now, and multiple giant semi players providing solutions outside of MPWR’s. Competitive technology share loss scenarios catalyzed by a scaling manufacturing misstep don’t get much worse than this as their entire “differentiated approach” now looks to be on the verge of being rendered obsolete.

Vicor Financial Picture and Related Implications

The Vicor financial story has been about hypergrowth off a low base in Advanced Products for Datacenter/HPC offsetting legacy brick revenue slow declines. Back in 2019, Advanced Products revenue was $75ml and 28% of total revenue vs its legacy DC-DC and AC-DC brick converter revenue of $188ml. By 2022, Advanced Products was generating $243ml in revenue (up 43% YoY) or 61% of total revenue vs Brick Revenue of $155ml.

In Q1 of this year, Advanced Products was down 20% sequentially from Q4. Backlog was down 11% from Q4 and book-to-bill was sub 1.0 with no specific disclosure of how far below, but you can estimate it was considerable. The stock is now trading at 105x 2022 GAAP eps and 71x 2023 estimated earnings with expectation that earnings essentially double in 2024- the downside possibilities versus consensus are massive here. With Advanced Products sagging, legacy brick’s relative mix grew, representing roughly half of revenue in Q1. That business is highly commoditized and worth very little, which means you are paying about 10x trailing sales for Advanced Products with Nvidia out the door and rapidly rising competition ahead. My sense is you are looking at what will be a $30 or lower stock before the year is out as the market gets smarter about how rapidly and negatively things are changing for them.

Here is what total revenue/advanced product rev/backlog have looked like over the past 7 quarters..

Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | |

Rev($ML) | 84 | 90 | 88 | 102 | 103 | 105 | 98 |

Advanced Product Rev($ML) | 43 | 52 | 53 | 67 | 59 | 63 | 51 |

Backlog ($ML) | 292 | 342 | 423 | 410 | 371 | 304 | 271 |

As you can see, overall revenue has been flat sequentially for about four quarters while Vicor chewed through $140ml in backlog. It ceased reporting an approximate book-to-bill ratio (now just disclosing whether it’s over or under 1.0), but the math tells you it’s obviously been running well below 1.0.

As for how things play out from here backlog wise, management has been transparent about what’s going on.

From Vicor’s Q2 earnings call last year on July 21, 2022:

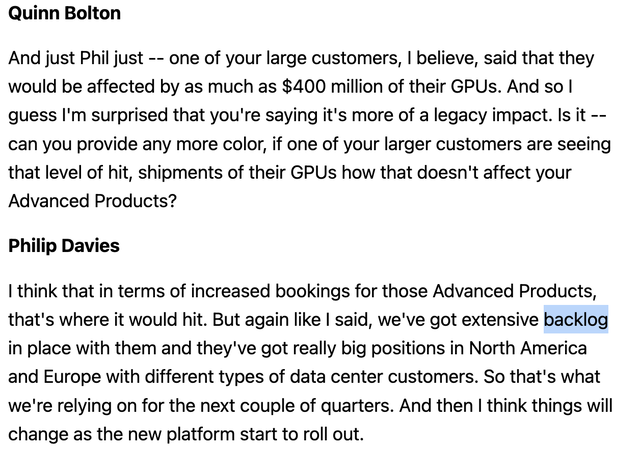

“Thank you, Jim. Q2 bookings are a result of securing long term NCNR orders in prior quarters, that now form a large part of our backlog. The outlook for the datacenter market is positive, as hyperscalers continue to build out their machine learning technologies and capabilities as well as upgrading their 48-volt CPU racks with the latest Intel and AMD CPUs.

“Our backlog, which stands at over $400 million is strong and made up of major HPC customers with a mix of older and newer programs, that are just beginning their ramps. Our objectives in the next two to three quarters are to catch up with customer demand and reduce lead times.

“So, hi, Quinn. So NCNR is non-cancelable, non-returnable that was necessary pretty much across the board because we are booking out really way beyond some cases 40 weeks. Our lead times are at 32 weeks for Advanced Products, but obviously big customers to secure their supply chain and guarantee they are able to build their product have been placing very large orders with us, NCNR orders with us in prior quarters. Very lumpy, very up, very high, in some cases and so I'm not concerned about bookings at all, with the backlog being so strong and visibility out there, it's, okay. I'm very confident in the backlog.”

Roll forward three months to Vicor’s Q3 earnings call on October 25, 2022:

Discussing backlog and blaming book-to-bill on the macro:

“Thank you, Jim. As Jim mentioned, our book-to-bill ratio came in below one in Q3, reflecting the second quarter in a row where this has occurred. At a high level, this trend is reflective of the deteriorating macroeconomic environment. However, it's important to point out that we maintain substantial backlog as we enter Q4. From an end-market perspective, and on a more positive note, the outlook for the datacenter market in North America at the current time is still good, as hyperscalers continue to build out their machine learning technologies and capabilities, as well as upgrading their CPU racks with the latest Intel and AMD CPUs.

“Managing the transitions to newer processor platforms in our customer base will require some maneuvering of our NCNR backlog in Q4 from Gen3 to Gen4 factorized power modules. I remain confident in our position in the HPC market and in the customers that we have worked hard to develop in recent years. Our factorized power solutions remain the highest performance in terms of current density, low noise, and overall power system efficiency. Our Generation-5 technology, a new FPA module, which we are now beginning to introduce to lead customers will be a game changer in cloud computing and machine learning with a significant step up in current density.”

There is a lot to unpack here. Management blamed the book-to-bill ratio coming in below one on the macro, and then tells you the outlook for the datacenter market is great. They then say that managing the transition to new processor platforms will require maneuvering NCNR backlog from Gen3 to Gen4 in Q4. This is all followed by a statement that they still have the highest performing tech in the market and that their Gen5 tech will be a game changer in datacenter.

While management has yet to come out and say it, Vicor’s large bookings declines are not just macro driven and have in fact due to the mounting headwind of Nvidia shifting their business to MPWR for the H100. The NCNR comments also indicate Vicor had to “maneuver” backlog, or better put, negotiate with some customers based on their manufacturing issues requiring new parts to satisfy now discontinued old parts. My research has confirmed that customers/experts in the cloud datacenter market view MPWR as superior to Vicor today and are forecasting significant Vicor content share declines going forward. Vicor management must be aware of this if they are making comments about Gen 5 being a game changer.

And the mixed messages continue based on some management commentary around Nvidia….

The one time they seem to have slipped and discussed Nvidia directly.

From Q3 2022 CC..

“So, that’s what we are relying on for next couple of quarters. And then I think things will change as the new platforms start to roll out”

This answer to a question which was focused on China issues last year is prefaced by a direct acknowledgement of Nvidia indicates they are “relying” on old orders with them for now “and then I think things will change” later. You can read what you want out of this, but the conditionality at the end isn’t exactly encouraging. And that conditionality obviously makes a lot more sense once you have really dug into what’s been going on.

Q4 earnings call on February 24, 2023…

Backlog and cancellations:

“I’ll now address bookings and backlog. Q4 book-to-bill came in far below 1.0 and with one year backlog decreasing 18.1% from the prior quarter and 11.9% from the same period last year, closing at $304 million at year end. Q4 bookings included cancellations, cancellation of orders as well as new orders for next generation program in our high performance compute business. The net effect was reduction in backlog of $15 million, which contributed to the $18.1 million sequential decline in total backlog.

Q1 2023 earnings call exchange..

Backlog expected burn in H2:

Analyst:

I guess my only question is with the drawdown in the backlog in some of the timeframes you've given for new products and new OEM contracts. And all of the above with the new factory pretty much not being online till July, August, or in that timeframe. I've kind of viewed this year as a transition year. Do you see the backlog being significantly drawn down? I don't want to say to zero, but, as we enter Q3-Q4. I mean, will the backlog just be eliminated at this point.

Patrizio Vinciarelli:

So it's hard to tell exactly what's going to happen. But in terms of bookings, we believe that the low point took place in Q4, with an improvement in Q1, a further improvement in Q2 expected. But because of the uncertainties with respect to some of these programs, ramping, which is really sappy we can control. It hard to believe exactly what is going to happen for the parts of the year with respect to backlog.

Our revenues in Q1 were not limited by backlog. We're still playing catch up with respect to the backlog. And even in Q2, we're going to be playing catch up. So in one way of looking at it, in terms of taking care of customer needs, in the short term, the monkey is not on the back of the front end of the business is still on the back end in terms of operations, stepping up to the bar, given the challenges without sourcing of some of the chip processes, which is still being a fact though it was a month, getting the apple within the quarter.

Cancellations in Q1 vs. Q4:

As you can see, the picture with respect to what’s going on with backlog/Nvidia etc. isn’t exactly very clear. Management obviously could provide better color considering the seriousness of the issues they are facing, but for now, they appear to be taking a only “need to disclose” approach with respect to current demand problem details and just providing technology pipeline optimism going forward. Vicor appears to be attempting to satisfy what it has failed to deliver with its next-gen products. One could speculate based on Nvidia Q2/Q3 datacenter warranty charge disclosures that this is what Vicor have agreed to do for Nvidia, but maybe that “defect” component supplier wasn’t Vicor. Whatever the case may be, Vicor obviously has substantial Nvidia orders sitting in their backlog that haven’t been fulfilled. Those either are going to be fulfilled when Vicor’s new manufacturing capacity hopefully comes online in H2 or maybe Nvidia is going to be pursuing some sort of legal breach of contract remedy by the end of the year to get out of this and the revenue impact from this transpiring will show up in H2.

Whatever happens with respect to this legacy Nvidia backlog though isn’t going to change the fact Nvidia has a new lower cost supplier with superior manufacturing prowess who is already delivering and who is now the preferred supplier going forward. This is evident in Vicor’s lack of new bookings in advanced products and will become much more visible in the quarters ahead on a reported revenue basis.

Judging by the expert takes on all of this, the cat is fully out of the bag in the industry with respect to Vicor’s issues. Management doesn’t seem to want to acknowledge this- that’s understandable considering how awful the intermediate/longer-term business read through is on that. So, the Founder/CEO is now talking up what comes next, which apparently will be on package dominance to reassure his investor base.

Again expert takes on this are contradictory.

PDN Expert #1:

“I don't really believe that that's a valid viable approach. The package itself has very limited space. It's not one high-current core power rail that you need to feed these modules with. It's many of them.