Sprout: Management’s Hubris And New Evidence Drastically Bolster The Short Thesis

Time to revisit the original thesis from March 2023:

1) Sprout’s 2023/2024 ARR guide is very aggressive considering the post-Covid macro environment in software.

2) They are facing a significant ARR growth cliff starting in Q4 2023 as they begin to lap large new pricing structure increases and the Salesforce Social Studio (“SS”) sunset tailwind boost begins to subside.

3) They are facing increased competition from Sprinklr who is now targeting more customers in the $50k-$250k ACV range

4) They are facing strategic industry headwinds as customers consolidate software vendors which will require notable M&A and internal dev resource investments.

I told you that the combination of the above would result in an imminent ARR miss and reset of growth expectations and or some combination of M&A and can kicking related obfuscation out of management.

Six months later it’s pretty clear the thesis was spot on.

Trying to put a forward multiple using existing growth targets being underwritten by longs is far too problematic because of:

1) The continued guidance walk-backs that took place over the last 2 quarters.

2) The limited visibility impacted by both the SS migrations and pricing changes on the next year.

3) Irrefutable new evidence accidently revealed by management with respect to a major organic slowdown upmarket.

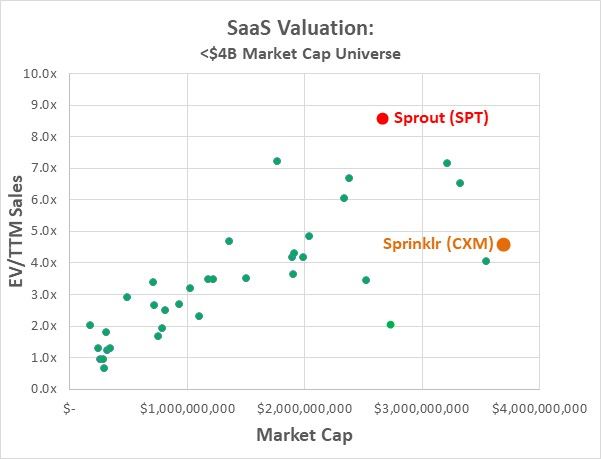

And the stock is still extremely expensive amongst its SaaS peers:

Source: 10/19 Market Close

At nearly 10x revenue you must underwrite a multi-year growth narrative with near complete certainty; something that Sprout simply doesn’t have.

Key Thesis Bullets

1) Their net-new ARR was down 8% in H1 2023 despite a 150%+ increase in new customer seat pricing and the accelerated Social Studio sunset tailwind.

2) Their net-new $10K+ customers were down 17% H1 2023.

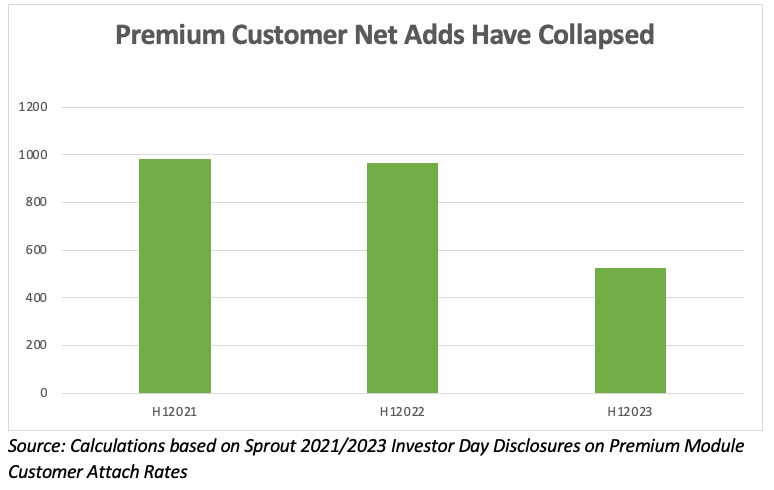

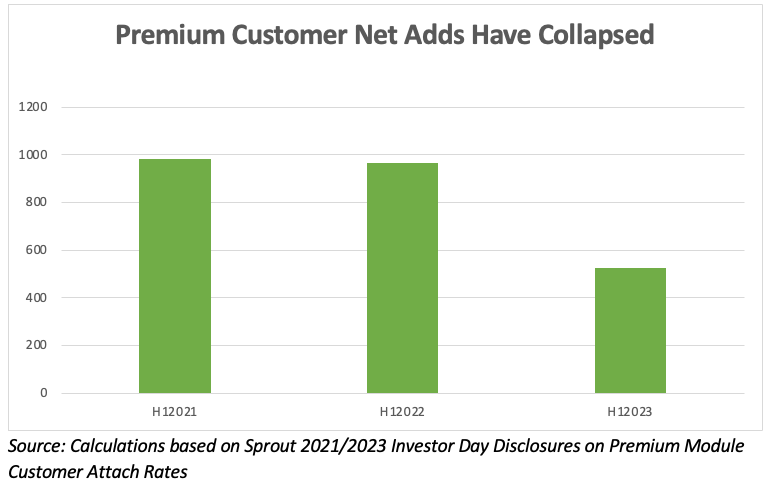

3) Their net-new premium module customers were down 46% H1 2023.

4) Their net-new premium module 2+ attach customers were down 50% in H1 2023.

5) Despite these substantial declines, Sprout management highlighted their premium module customer growth as accelerating in 2023 during their Q2 earnings call and subsequent investor day because they somehow didn’t account for the impact of overall customer declines distorting their attach rate metrics.

6) On the back of all of the above, they cut their annual guidance, redefined their long-term guidance, and acquired a new premium module for $140ML.

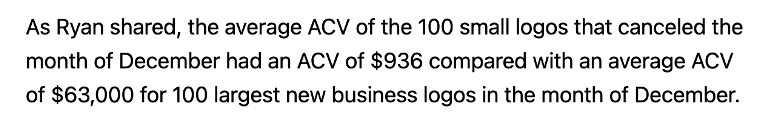

7) They attributed their guide cut to removing what were roughly $1400 ACV customers ARR from their forecast. They cited churn unpredictability due to new pricing and provided ZERO color on premium/$10k+ customer adds massive deceleration despite the fact that 90%+ of net-new ARR was already coming from the upmarket before their pricing changes.

8) Their sales reps are saying that “inbound funnel has collapsed”, customers are “oversold”, they are “fishing in a pond with no fish”, and that customers have seat “shelfware”.

9) Their CMO resigned last month.

10) A very sophisticated 6+ year Sprout enterprise customer that recently left for Sprinklr highlighted ROI deficiencies with the Sprout platform attributable to limited internal development resources and technological capabilities as the reason for their migration.

11) Countless Salesforce.com expert calls all contradict multiple claims management has made regarding competition and the size of the opportunity there.

12) The Social Studio cliff looks bigger than ever at roughly 40% of net-new ARR YTD.

13) At their investor day, they raised their TAM numbers and provided a bunch of selective and often self-contradicting slides saying everything is accelerating without even the slightest hint of any of the above confirmed issues or macro challenges in software. Instead, they are describing themselves as an “Iconic Software Company”.

14) The stock is still incredibly expensive at nearly 10x EV/TTM Revenue

The Math Simply Doesn’t Work

Sprout added $66ML and $72ML in net-new ARR during 2021 and 2022. They will add somewhere between $75-80ML “organically” this year. Current sell-side forecasts are for them to add $250ML in net-new ARR over the next two years. That’s about 75% more than the three-year trailing average over each of the next two years.

Sell-side is deriving at least 2/3rds of growth from new customer ARR with the remaining 1/3rd from NDR growth from a combo of seat or product expansion. New ARR growth of 20% from here makes no sense in this tape once SS sunset rolls off and with former Sprout enterprise sales execs now telling us inbound funnel used to represent well above 50% of new business and has “collapsed.” As for NDR, churn/seat headwinds likely to continue being problematic, and formers saying upselling has largely dried up which is supported by 50% decline in net-new premium module customer adds in H1 2023 and forced them to turn to M&A in Q2.

I expect street estimates will notably come down again for 2024 and 2025 and that a bull scenario here is more like 20% ARR growth, with perhaps HSD customer growth and the balance from pricing and upsell.

While I believe drilling into everything with respect to recent financial underperformance and guidance changes is quite illuminating from the short side, I think a better place to start is by focusing on what you are qualitatively underwriting long this stock at nearly 10x EV/TTM REV.

Sprout’s Compounder Bro Problems

Long-term owners might not care so much about near-term guidance “noise” and public management teams understand that when they engage in reframing. I imagine there are funds out there now positioning for a Q3 beat off the new guide framework who view this as a Rule of 40 SaaS own going forward, and think the recent missteps are an opportunity. That’s fine but when the underlying fundamental checks don’t comport with this or the narrative management is providing, you really have major problems.

I will remind everyone that Sprout management took a bunch of shots at Sprinklr at the end of 2022 and early this year. In my initial report, I argued these shots were illogical for a company trying to position themselves as going up-market into the enterprise. I also shared some customer calls that contradicted what Sprout management was saying.

For those that don’t recall the details, here is a brief refresher of Sprout’s position…

“But those were the structural business challenges that Sprout made early on. You compare that to our competitors in the very high end of the enterprise. And they -- number one, they've been built via M&A. And so each of our high-end enterprise customers -- or competitors, excuse me, have been built with dozens of acquisitions over the years, which has kind of created this amalgamated code base, this amalgamated UI and UX.

And so if you're a customer of one of our competitors at the high end of our market, you've purchased or you are working in software that is customized. It's been curated to you, the individual customer, which means that from a UI perspective, you're kind of moving back and forth between multiple software systems, between multiple different code bases.

On the back end, it requires time and maintenance dollars in order to maintain and upgrade your software. It also means from a customer support perspective, if I, the customer, have something that goes wrong and I call you on customer support or try to get in touch with my customer support perspective, the support person ultimately may not know what instance of software I'm living in.

I may not know how to answer the question being asked because I didn't build your specific instance of code. I didn't build your specific instance. And so I'm not able to address the problem. I have to get a very technical person on the phone. I may have to get a consultant or a professional services person on the phone, which takes time and which costs money.

And so all of those things mean that if you're a customer, you're working in a software product that's hard to use. It costs more money, and it takes more time to see innovation, and it also costs more money to see innovation and those things.

And what that means to the vendor or to our competitor is that it becomes increasingly expensive to maintain that model over time, which is why you're now seeing layoffs both in R&D and go-to-market. And it also weighs on innovation because rather than being able to scale your R&D efficiently, you're having to invest in maintenance R&D as opposed to just growth and innovation R&D. And so it's – those things become an anchor on you as a vendor as well.”Sprout VP IR, March 2023

Now, here is an excerpt from a recent expert call with a $10bl EV SaaS company that migrated from Sprout to Sprinklr over the past month.

“For us, it was to solve the manual issue. So right now, if you run a paid media campaign on any of the platforms for social, Sprout has trouble accurately reporting out, depending on the platform, what was organic, what was paid. Sometimes it rolls up the numbers. It gives you a combined number, but it had trouble segmenting it. It also had trouble tracking paid media alone on certain social platforms. And when we did generate reports, we couldn't trust the data .It would be off or inaccurate and they had a hard time explaining to us why it was inaccurate. And then what they asked us to do was like, we think we have a solution for one platform, not all the platforms, but we want you to pay the upgrade. And I think they're sort of like reading the tea leaves with how Sprinklr operates. And it is a lot pay to play on the Sprinklr's side depending on what features you want. And they don't do a whole lot of one-touch service.

Everything is sort of bucketed depending on utilization and spend on the Sprinklr side, which is why they have such a moneymaking machine I would say, for what they charge on social, but it's worth every dollar. So like the end result was because we couldn't trust the social reporting data on the Sprout side, and we're running paid across our campaigns across the board, we have to do things manually.

And then when you have global campaigns and you're running campaigns on LinkedIn in EMEA and APAC, in LatAm, every one of our social leads in those regions had to manually collect data and reported out and then our analysts had to piece those together to create a quarterly roll-up.

And that was arduous in that the entire functionality for Sprout is supposed to automate this content for you so you have a few clicks, you enter dates, you have parameters and you have your reporting. And Sprout also had a tagging issue where like if I posted a post in Germany, in France, I couldn't get the segmentation for what we posted in America on our LinkedIn channel, too.

So we would have to once again go through and manually separate the links ourselves versus being able to tag, segment and report out in Sprout. And we told them this and they don't have a fix. So we're talking about six figures in man-hours for us manually reporting over the course of the year for the pieces together.

And the length of time that we have to put like really solid granular reports by region, by content, by campaign, it's all like hand tracking, pulling the export data off of each individual social platform, which was the entire reason you buy a solution like Sprout Social.

It's try to combine that reporting and put it all together for you. I can't do it accurately, and I can't do it at the level of detail we want, can't segment by a region. We told them all this. And when I first saw that and I onboarded here, this was like one of the first things they mentioned is that their reporting is just an awful experience for our paid media analysts and for the time it takes to report out.”

I’d point out at the manual reporting issues and API reliability problems were called out by a $50bl+ market cap tech company as a reason for moving off of Sprout in my initial report. This same issue is being highlighted again by a large SaaS company that has been a long-standing customer of Sprout. And I’d further note this company is moving NOW and will be spending 2x as much on Sprinklr which tells you all you need to know about the ROI challenges. I can’t emphasize how bad this looks for the compounder bro narrative. This is a massive SaaS company that is presently looking to take a knife to costs, and they are going to DOUBLE their SMM spend by moving off of Sprout and onto Sprinklr because it will save them money.

THIS IMPLIES QUITE DAMNING SMM ROI MATH VERSUS THE ENTERPRISE MARKET LEADER WHICH IS WHERE THE ENTIRE OPPORTUNITY AHEAD LIES ACCORDING TO SPROUT MANGEMENT.

I’d also note that this jumped out at me because the customer was highlighted by Sprout in their IPO S-1 and had been with them for 6+ years.

As an investor, I have a very hard time reconciling Sprout’s management earlier position that their chief upmarket competitor’s weakness was that their platform required too much custom development with multiple Sprout enterprise customers citing specific technological deficiencies in Sprout’s own platform as their chief reason for abandoning it. And in the case of this expert you actually get explicit detail as to why Sprinklr’s tech investments and engineering/development resources set them apart.

Some technical color:

"What you're paying for on Sprinklr is, like we said, the reporting, the full-on integration with all the social media platforms and the business manager, the ad units. And then they go another level, so if you use UTM trackers, and you want more granular campaign integration, part of the onboarding and the training is, you're going to have a session with Sprinklr where they're going to take all your UTM parameters, and they're going to build it into the publishing window.

And so when it's time to publish your content, you have a UTM tracker with all the prefilled fields that are in. So now you're just clicking drop-down menus. This is our September campaign, this is our Tier one product that we're launching, this is a video and this is for x parameter or whatever you want to find it is. This is for EMEA, this is for London, U.K. You can predefine all those.

They will build it into the software system with you, and then you have UTM integration with campaign tagging and reporting by geo-targeted region. So like as granular as you can get it with a full tracking link that is also Bitly customizable. You can integrate your Bitly same time as well. And Sprout lets you integrate with Bitly also, but you have to do the UTM building separately on your own for whatever you use.

One other thing I wanted to mention is that you get with Sprinklr too is if you're a global footprint, you're a global team, global publisher, it's going to recognize when your social media lead in London is publishing something as an example. It will know that their login and they'll geolocate them in the region. And then it's going to default auto tag and say, hey, this is an EMEA post, this for Germany or France.

And so like by default, it's going to segment the stuff that you're publishing by region just based on login and location, and you don't have that with Sprout. As a matter of fact they can't sort it at all. It's just one data dump, which is why we had to manually report our all stuff ourselves, which is another big win for us. So we said if you are publishing in multiple locations and you have global activations and you want to measure them by region, Sprinklr does it all automatically and Sprout cannot do".

This is not what you want to hear from a sophisticated customer when management is setting 2028 aspirational revenue goals and FCF margins based on 120%+ enterprise/mid-market NDR’s as far as the eye can see. Because this expert really paints quite the polar opposite picture while maintaining a positive tone about his experience with Sprout:

"The last three companies I worked at all started with Sprout Social and all ended up outgrowing it in terms of like functionality and scale. Sprout, I think, is a great starter software for small to midsized companies that maybe are taking an approach to social media that's like we want a good platform for us to handle a variation of basic social media needs.

But if you care about efficiency, and you want your social media and your content strategy to perform with the best companies in the space, in the industry that you're activating in, you're behind. If you're at a little bit of a disadvantage, I would say, definitely from using Sprout Social versus Sprinklr, just a lot more high- end functionality.

And you can see by the list of companies like when you take the onboard meeting with Sprinklr and they show you how many top 150 companies that are using their platform, it's all the biggest names in the business."

Six months ago I argued that Sprout management was contradicting themselves by talking up their newfound upmarket identity while simultaneously criticizing Sprinklr for their M&A and custom development. I had some evidence then to support this thesis and as you will see throughout the rest of this report; I now have a lot more confirmatory evidence backing it up. Sprout can argue that ease of use is an advantage of having an architected SMB focused product going upmarket, but the reality is for most sophisticated enterprise customers this is not going to be the case.

Pretty clear message right?

This management team is the Avengers of SaaS and not even a Thanos sized Covid hangover is going to slow them down. This is despite the fact they cut their 2023 guidance in a big way, which by the time they were done explaining it they wanted to be clear wasn’t technically a cut. They also abandoned their 2025 guide framework of 30%+ Organic Arr growth for each year and replaced it with a 25% reported revenue CAGR through 2028. Again, somehow not some sort of acknowledgement of decelerating growth as seemingly every slide during their investor day featured the word accelerating. And let’s not forget the surprise $140ML acquisition while it’s still super early days in your core $120bl TAM that was sprinkled in there.

To think I thought the challenge here was going to be that this management team would continue to avoid acknowledging or better quantifying the impending Social Studio cliff. Turns out I was way too optimistic. These guys have instead decided to snap the entire SaaS Covid hangover out of existence. All the minimal “noise” so far really is the fault of a couple thousand $1400 ACV customers responding to their deliberate price changes, end of story.

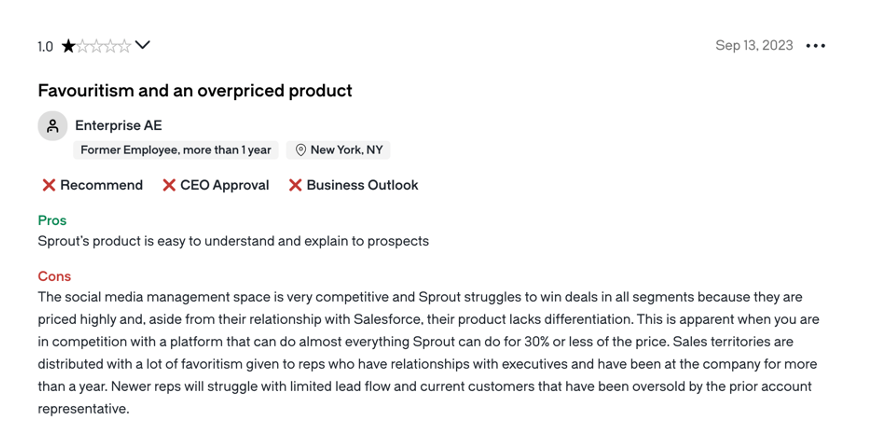

Unfortunately Sprout Employees haven’t gotten this memo…

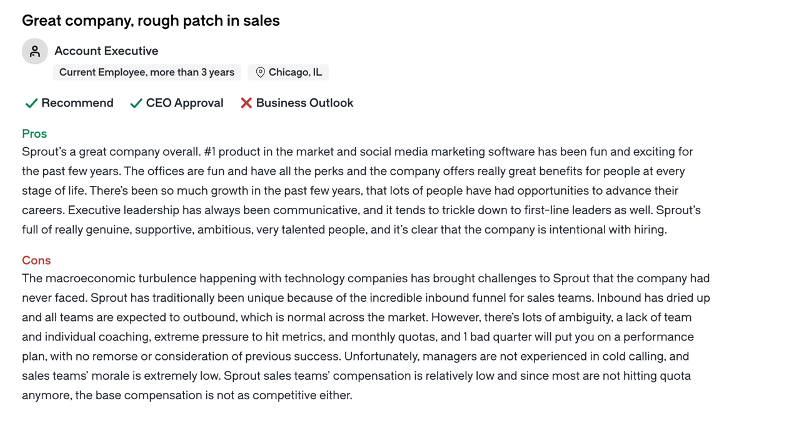

Glassdoor Sep 13:

I really didn’t read much into this breadcrumb initially. The reported financials already have painted a clear picture for me of that organic growth has slowed considerably, but you can’t help but be curious how this is playing out internally when management is painting a very different picture for investors. However, the very next day I saw that Sprout had disclosed that their CMO resigned which you obviously can’t ignore in this environment.

Then ten days later another Glassdoor post…

This post is a lot harder to discount. The sales rep is telling you that inbound has “dried up” and that the macro is in fact having a pronounced impact on their business with most reps missing quota and salesforce morale taking a hit.

So, two posts in 10 days about sales challenges and the CMO resigns, that gets your attention and warrants some further research.

Here is some color from some former Sprout Enterprise Sales Reps.

On the overall macro environment shifting and its impact:

"Anybody that had been there, like started within a couple months before I did or, or since I started, is coming into an environment where you don't really have any inbound business. And I think some of the, for the legacy folks, the people that had been there more than a year, that change was a bit shocking for them because they were used to not having to outbound at all and just having a, a constant flow of demo requests and RFPs and that volume has significantly dropped. So yeah, it's a, it's a much more challenging selling environment across enterprise in the social media space right now."

Good analogy on selling Sprout in this environment:

"The, the sales training, the product training, like it's a very easy product to learn. For a seasoned seller like myself or somebody that's newer to the business, like it, it is pretty easy to wrap your head around the product and the, the competitive differentiators in the space and the actual sales training is very solid. But yeah, it's kind of like trying to, to catch fish, but you're, you're like, hey, this is your lake and there's no fish in the lake, so it doesn't matter how good your, your fishing equipment is or your knowledge of fishing, if there's no fish in the lake, you're, you're in trouble."

More on selling in this environment:

"The product itself is the top three solution. The training is, is great. The onboarding, like generally the culture is pretty solid. So de it, yeah, depending on at what point you are in your sales career, it could be a, a good environment to sell in if you're like a maybe an Smb seller reasons against, I think they've, there's just too much competition in social media management. It's a, it's a very premium priced solution. So you have an uphill battle when you're trying to sell the solution because oftentimes it, you might think it's a, it might be better and the customer right, right. Might even agree with you that yes, it is a better solution, but the cost is just so much greater that you can't get them to pull the trigger. So I would just say it's a very difficult selling environment and because upper management has these incredibly aggressive growth goals that has filtered down to the sales team and it's started to have a, a significantly negative effect on the, the culture there across the sales team. Somebody puts a number in front of you and it's completely unreasonable. You just go like, Hey look, I, there's no way this isn't gonna happen. So you, you, I know this is getting pushed down from upper management, but you can't put a number in front of this, in front of a sales rep like this and expect them to hit it when there's no inbound business."

Some color on Covid overselling and seat-based headwinds:

"I think current customer expansions were a challenge because a lot of the companies that we've traditionally done business with, like retailers had done a lot of layoffs. So I came into a lot of accounts that had shelfware because they bought 50 seats of Sprout and then they laid off half their marketing team. So they're like, well we, you know, we're very happy with Sprout, it's a great platform, but we have 20 extra seats here so there's no reason for us to spend additional money on the platform. And sprout doesn't have a lot of like premium add-on offerings. So if if you're not adding seats and they've kind of already got listening or advanced analytics, you don't really have much more in your bag that you can sell a current customer."

Thoughts on the CMO Resigning:

"The challenge for her was it's the, the selling environment has changed a lot since she joined the business and yeah, the, the inbound has just completely collapsed. So there's probably a lot of the sales side of the business was putting a lot of pressure on marketing to, to get that inbound lead flow going again. But yeah, I don't really blame marketing fully for that. 'cause it's not like it was a, a change that was made on marketing's part that slowed down the lead flow. It, it was the macroeconomic environment and the competitive environment that did that. Not a lack of resources or skill on marketing side."

To be fair, there is nothing shocking here, countless public SaaS management teams have been telling investors the same things for months. And you just need to look at how Sprout’s net new ARR has tracked this year despite a massive increase in new customer pricing and a substantial Social Studio tailwind to fully appreciate how disingenuous Sprout management has been about the macro environment and underlying growth substantially slowing.

Like, what happens when you start lapping new customer pricing and the Social Studio migrations tailwind? What about your enterprise/mid-market expansion rates against seat attrition headwinds? Or maybe what’s your value proposition to Service Cloud customers as Salesforce is rolling out generative AI tools for them? Are you effectively replacing a plugin to be a Social API plugin?

These are the types of questions they should be answering and yet they can’t even be forthcoming about the current macro situation. Instead, they are raising FCF targets just as it appears kind of obvious that they need way more development resources to compete against Sprinklr and that they probably are facing a way higher CAC going forward as they have historically not done any real paid marketing.

It’s all really quite remarkable, and even on the topic of Social Studio every check I’ve done also somehow manages to contradict what management has told investors.

Social Studio Checks

Post-Covid software is pretty much the ultimate lesson that a very good SaaS business with significant pull forward growth can actually trade as bad or worse than a slowing or poorly executing SaaS business. In my initial thesis, I laid out a simple argument that Social Studio should be broken out and treated as more of an inorganic growth acquisition since these are very mature customers Sprout is acquiring. That’s more obvious than ever today, but I also pointed out that my early research indicated management had overestimated this opportunity. This is something the street seems to be struggling with as the numbers go up as the migrations accelerate into year end. I think it is fairly obvious at this point that Sprout management overestimated what they would get from this bucket, but at the same time its substantial enough to obscure just how substantial their Covid pull forward was for now. Now, if this was just my opinion it wouldn’t really matter, but it isn’t.

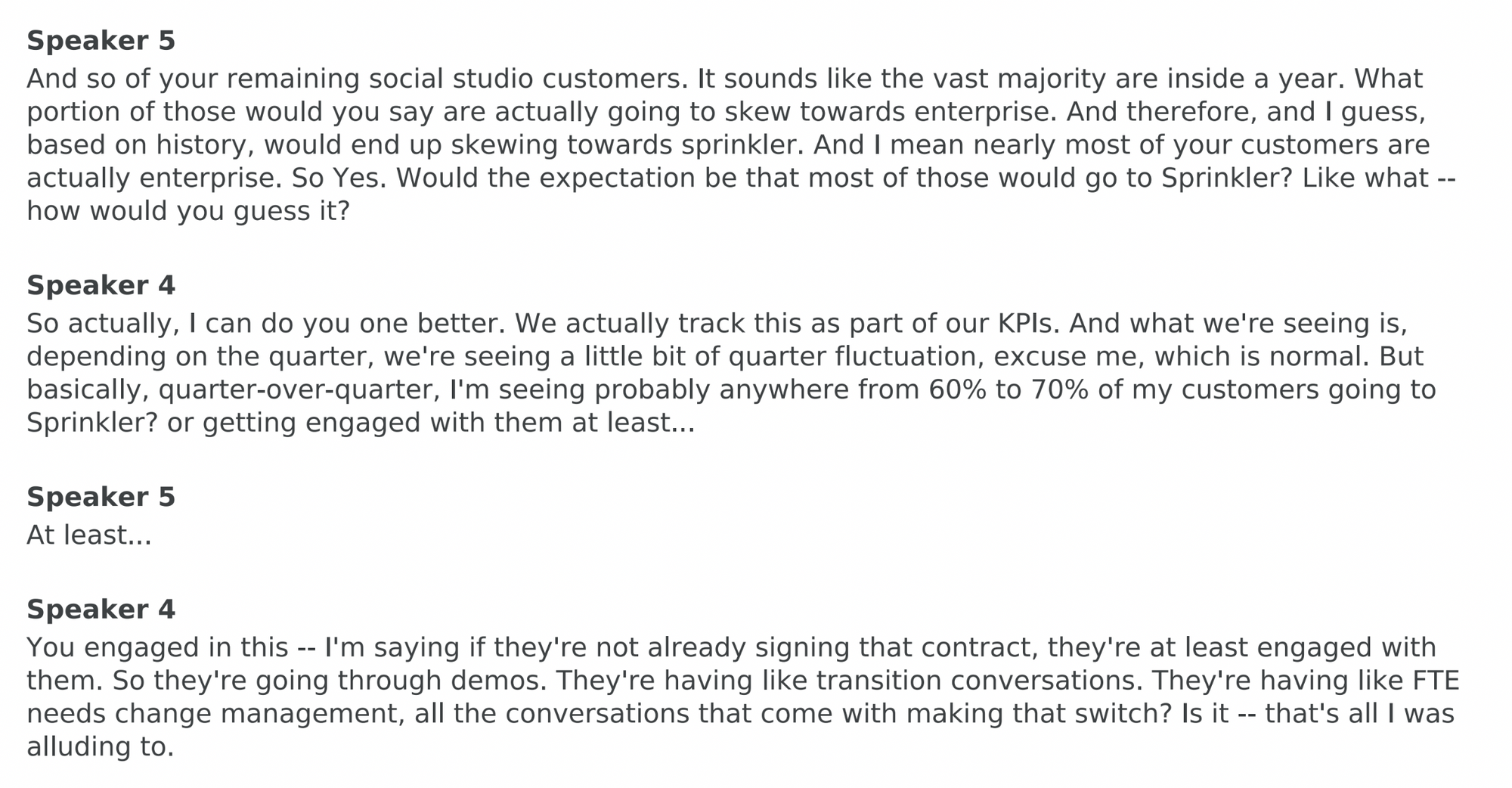

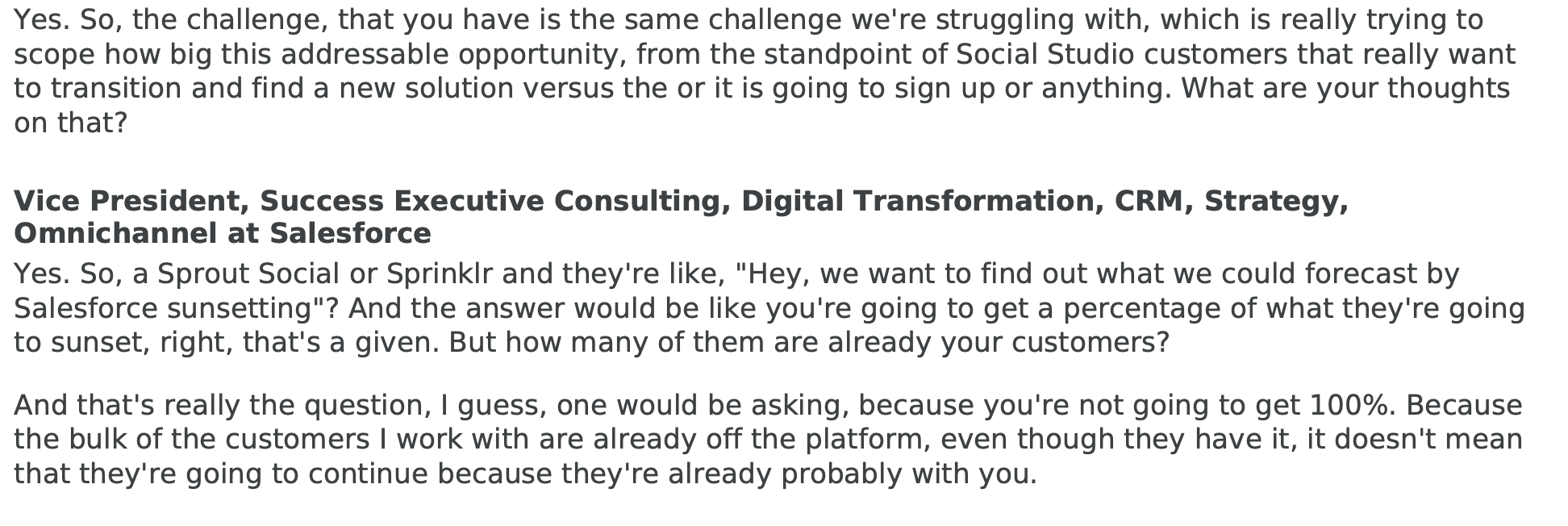

According to multiple checks with SFDC enterprise reps, 60%+ of Social Studio customers are selecting/engaging Sprinklr over Sprout.

I would add that all the SFDC related color has been nothing short of trainwreck since I published my initial report. Not one related call I have done, transcript I have read, or consultant I have talked to has backed up Sprout management’s ultra-bullish position.

What it means to have been a Social Studio customer is something Sprout really should consider explaining at this point as several marketing cloud reps have focused on the fact that a very large percentage enterprise customers had NO CHOICE BUT TO PAY for SS in their marketing cloud bundle package and effectively were dormant users that have long switched to another SMM vendor.

And by the way you don’t need to talk to consultants to figure this all out. I have mapped the entire Fortune 500 by SMM vendors and a large chunk of the Global 2000. While it was quite a time consuming exercise, it turns out this can be done very accurately. I can tell you that there are less than 10 companies in the Fortune 500 that presently use Social Studio in any SMM capacity. That’s less than 2% and not exactly the biggest deal considering Sprout’s historically much more mid-market oriented ARR , but like I now know when it comes to Social Care for consumer facing businesses what exactly is left out there of any note. I also have good visibility into what the expansion opportunities really look like and the types of challenges ahead.

So, if there were 4-5k Social Studio customers before the sunset its quite possible you were only looking at like a 2k top of funnel opportunity of active SS users.

Put this altogether and there is really nothing to say at this point other than the thesis continues to be validated by broad industry checks . The fact that Sprinklr and Sprout have the same enterprise value is a market efficiency that still can be massively exploited. Also, for those that love the sell-side work here, I’d note that Sprout, based on their new long-term targets, is being modeled by the street to organically grow to the SAME SIZE as Sprinklr by 2028 despite Sprinklr being 2.25x as big today.

How do you reconcile that math within the context of the current competitive landscape?

The short answer would be the SMM TAM in large enterprise is still massively underpenatrated and Sprout will win roughly ¾ of that new business going forward, and take notable existing SMM biz from Sprinklr.

Does that fit with what research is showing?

The answer is absolutely not.

1) SMM in the enterprise is clearly a very mature segment

2) Sophisticated Customers are telling you quite clearly that Sprinklr remains the superior platform from an ROI perspective.

The bottom line is contrary to what Sprout management is telling investors, they don’t have a platform offering for large enterprises yet. And despite providing a guidance that supposedly contemplates no future needed M&A or investment, Sprout in fact will need to aggressively invest/acquire from here on out to try and close the gap vs Sprinklr and that journey is going to become far more challenging as their stock price continues to re-rate lower.

And for all the focus on short reports and quarterly numbers, I actually think Sprout is now more appealing as a structural short than a trading short in SaaS. The stock is not remotely cheap. There are 45 SaaS companies I track with under $4bl EV’s and Sprout has the highest current EV/TTM Sales multiple of all of them. Bump that up to $10bl and they are in the top 5. There is no compounder bargain here. This valuation gap is further underscored by Sprout’s recent financial disclosures, which provide enough breadcrumbs to help reconcile why NDR and new ARR growth will be especially challenging from here.

Sprout's Financial Shenanigans

Sprout Management’s investor messaging approach to 2023 has been a bit chaotic to say the least. If you want to sum it up, management has been unwilling to acknowledge that their seat- based SaaS business benefited from the pandemic and has started to experience the same headwinds every other SaaS company has been facing. Things like drying up inbound funnel, oversold customers, reps missing quota, and broadly speaking a more challenging macro have not come up.

Instead management has largely chosen to present a business with decelerating growth as one that is structurally accelerating by highlighting metrics like ACV, large customer ACV, and introducing metrics like sub-2k customer ARR vs “Core ARR” etc. This is all on the back of massive new customer pricing increases and a Salesforce’ Social Studio tailwind both of which they avoid quantifying.

It’s all been very confusing and management was forced to reset annual guidance lower in their Q2 earnings release and announce a large acquisition.

A close examination of everything they have communicated over the past six months doesn’t paint the prettiest picture.

Sprout’s <$2k Customer ACV metric

This metric was introduced in Q1 with the aim of showing that the >$2k ACV customer part of the business was growing faster. The logic here is their pricing changes were designed to move away from this business, so you should discount the overall slower growth in Q1 to an expected uptick in churn here. They also told you this would not impact their ARR guide for the year and actually took that number up.

From the Q1 2023 Earnings Call:

"We also made meaningful improvement to the quality and health of our customer base with our noncore customers that spend below $2,000 in ARR, now representing 5% of our total ARR, down from 12% of ARR and 50% of logos in 2021.

The healthiest 95% of our business delivered greater than 35% year-over-year ARR growth nearly 600 basis points faster than total ARR growth as we continue to shift our resources away from the very low end of our market. These changes are also accelerating new business and expansion momentum within our highest ACV customers with better baseline pricing and focused energy across the team.

In spite of accelerating $6 million in churn during Q1 from our lowest ACV customers, we're pleased to increase our 2023 ARR growth forecast as we further build on these initiatives. We're looking into Q2 with a healthier customer base, consistent new business and expansion execution, improving competitive dynamics and healthy top of funnel demand."

CFO Answering a question on Sub-$2k impact to overall ARR for 2023:

"As far as how that flows through the rest of the year , I expect, like we talked about this, we think it's going to be a multiyear process where we talked about this in the earnings release or in the prepared remarks where those customers kind of cycle out of the business. So we don't think it has a material impact to this year's ending ARR. I think you'll see it slightly down from the 5%, but it's not going to be a huge impact on 2023."

Basically, focus on the core growth rate excluding sub-$2k customers being notably faster and they are taking numbers up because of that. Also, Sub $2k churn headwinds will have no impact on the overall guide.

From the Q2 2023 Earnings Call:

"While we are seeing everything we want to see from our strategic shift late last year, structural improvements in our business and accelerated momentum up-market, the unpredictability at the very low end of our business has remained difficult to forecast in Q2. So we view this as a positive trade-off and have deliberately deprioritized and removed resources from this part of our business. We are ultimately committed to high competence projections.

For that reason, we have elected to remove non-core ARR from our plan for the remainder of this year and our modeling to have it cycled out fully heading into 2024. We believe this change provides investors with the greatest visibility into our performance and positioned Sprout to execute with the level of consistency that you have come to expect from us."

The message now changed to they are taking guidance down because this sub-2k headwind is proving more substantial than they previously thought.

Now from their Investor Day:

"I think a lot of the times now people get very confused with all the data points we're giving out and I think we've got a lot of feedback from all of you. This is very confusing. And so the way we're thinking about it now is we're a year into that transition. We've updated our guidance to pull out all this low-end noncore business. And so the plan going forward because we're not going to give direct numbers around core, noncore and greater than [ 2k, less than 2k ]. We will give, for example, though qualitative information so you can keep track of how that business is performing.

For example, 1 of the data points that we can share with you is, if you think about how is that noncore business performing – if you look at the way the Q2 net adds number 1 overall was a pretty big negative number, driven by the churn that we saw in the low end of the market, you can expect the Q3 net adds have even worse than that. And so what does that say? You can infer from there that noncore part of the business is performing pretty consistent with what we thought it would do when we pulled it out in our guidance. And so you can expect us to give you those type of updates going forward. We also expect, for example, to continue to be negative in Q4. And then we do expect total customers to start to uptick and accelerate back in 2024."

The messaging now changes to they will stop providing granular color here because it’s too distracting, but directionally its going as expected.

I agree it’s all been very distracting, but the issue is that was by design. This metric was introduced to shift focus away from the fact that despite notable non-recurring tailwinds Sprout net-new ARR for the first six-months of 2023 was -8% vs 2022.

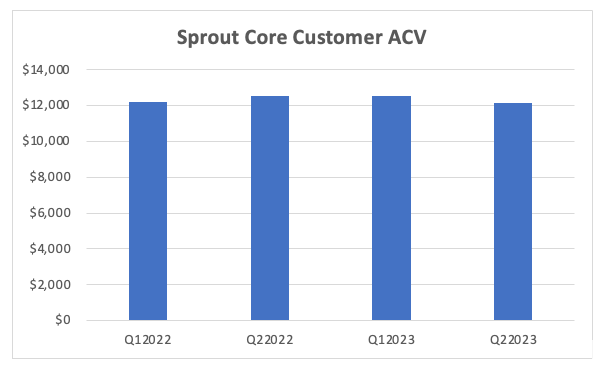

For example, Sprout’s disclosures allow you to build an easy compare of how customer segmentation mix changed after the price hikes and to track their unreported “CORE ACV”.

|

|

Q1 2022 |

Q2 2022 |

Q1 2023 |

Q2 2023 |

|

<$2K Customers |

15000 |

14774 |

10350 |

7387 |

|

<$2k ARR |

21.7 |

20.1 |

14.9 |

13 |

|

Core Customers |

17800 |

18846 |

23511 |

25772 |

|

Core ACV |

$12207 |

$12522 |

$12547 |

$12144 |

|

$2k-$10k Customers |

12451 |

13046 |

16404 |

18381 |

And this is what it all looked like on a year over year basis at the end of Q2 2023:

|

|

Q2 2023 Y/Y Change |

|

<$2k Customers |

-50% |

|

>$2k Customers |

37% |

|

$2k-$10k Customers |

40% |

|

Total Customers |

-1% |

|

Total ACV |

29% |

|

>$2k Customer ACV |

-3% |

You can see that Core ACV is actually slightly down despite the very large increase in new customer pricing.

You don’t need to drill to deep to understand there has been some significant retention of <$2k customers at new pricing over $2k.

How much?

This is hard to say without approximate disclosures on gross adds, but based on color mgmt. has provided the sell-side on gross new customer adds you can conservatively say at least 25% of sub $2k became $2k+ and that is assuming no churn in what is a substantial $2k-$5k cohort pre-price increase. Bottom line, you’re not going to have 40% growth in the $2k-$10k customer cohort when total customers decline 1% without some sizeable price-hike fueled “upwards migration”.

As far as investors are concerned though all that really matters is were they painting an accurate picture by highlighting overall ACV growth or “core” ARR growth versus total ARR growth?

The answer is clearly NO because:

-Your sub $2k cohort can’t grow organically anymore

- It’s also providing an artificial funnel for your $2K+ ARR vs the previous year

So, you introduce a clearly misleading metric to highlight “healthier” growth, and despite that three months later you are forced to reverse course and take your entire guidance down. Then two months later you say this is just distracting and you aren’t going to break it out anymore.

All investors need to know is that the benefit of large Social Studio lands combined with significant pricing hikes on Sprout’s lowest ACV customers has translated into a 3% yr/yr ACV decline in all customers that spend over $2k a year with them. This btw isn’t necessarily a bad thing it’s just a balanced reflection of the impact of the changes they have made. Where investors should fault them for this is that they are choosing to categorically present metrics that are all up and to the right without getting into any of the headwinds or challenges they are facing.

Have they learned their lesson?

The answer again is clearly NO.

At their investor day they shared new slides that continued down the same distracting path. And some of these metrics/slides are even more misleading with actual clear negative read throughs into the underlying fundamental growth of the business which is what investors should care about.

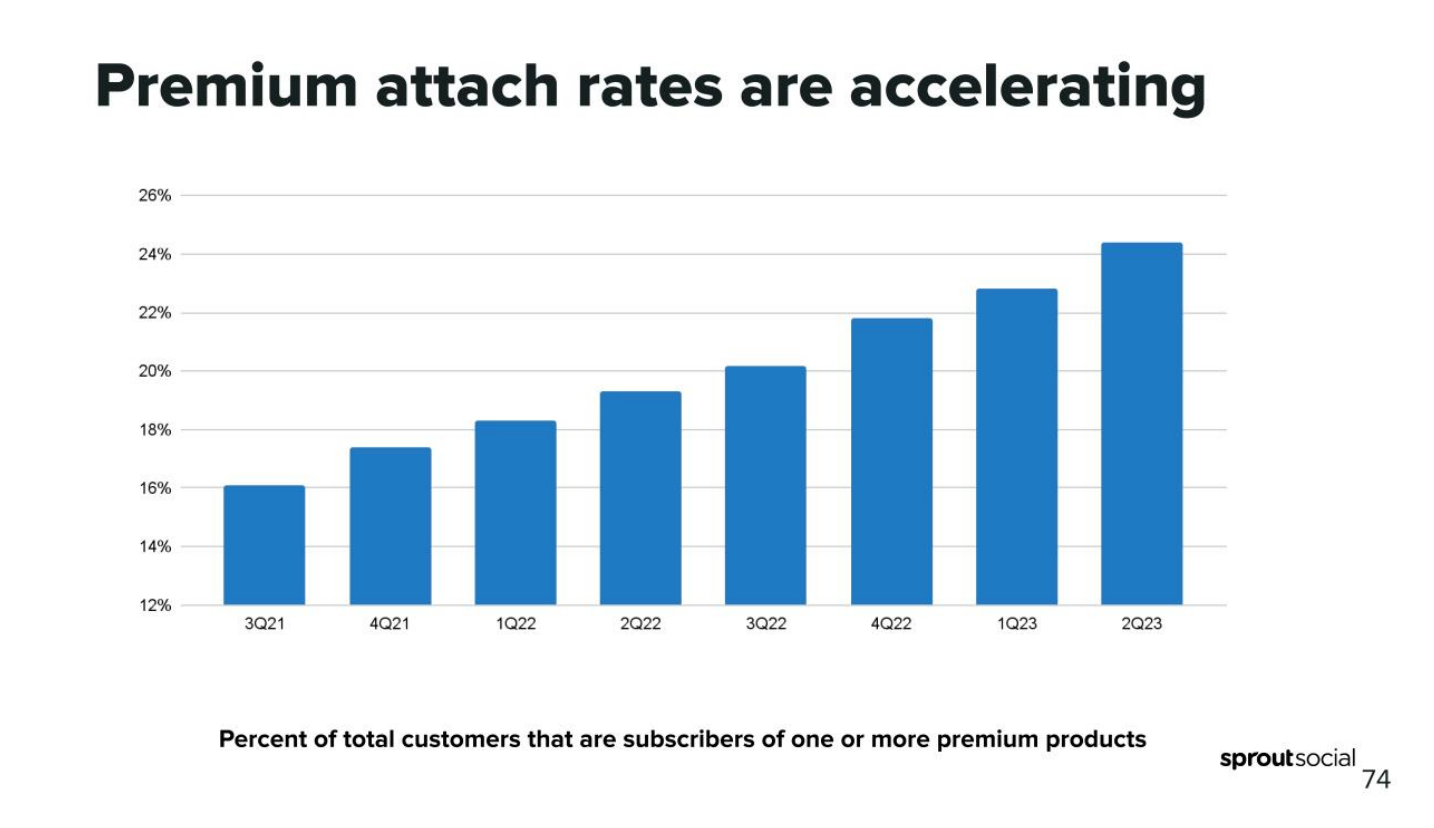

Premium Module Attach Rates Are Accelerating

“Jerry, it’s not a lie if you believe it”-George Costanza, Seinfeld

Seems pretty straightforward, and they did call this out as accelerating by 160bps from Q1 on their Q2 earnings call and by double the 2022 average.

“Multiple factors are contributing to our success and this quarter premium module attach rates were very strong. Total premium module attach rates increased by 160 basis points from Q1 2023, nearly double the uptick we saw on average in 2022.”- Sprout CEO, Q2 2023 Earnings Call

Now, you really couldn’t know when they provided this on the call if they were adjusting for total customer declines, and we remarkably found out on their investor day that they were not. Total customers declined 207bps sequentially from Q1 in Q2. So, if you are in fact just shedding low ACV customers who don’t buy premium modules and adding more high-end premium customers versus historical norms the premium attach rate should have gone up by greater than 207bps (to properly adjust for the net declines in customers in the denominator, with no proportionate benefit to the numerator). 160bps implies premium headwinds. Q1 was even worse at 50bps bump against a 151bps sequential customer decline. That’s a 358bps customer count headwind that should be a premium attach rate tailwind if you are in fact accelerating.

Also, once you plug in the attach rates you can see that the absolute count of net-new premium customers was down over 46% yr/yr in the first half of 2023. This would have been a more accurate investor day slide with respect to premium module customer trends.

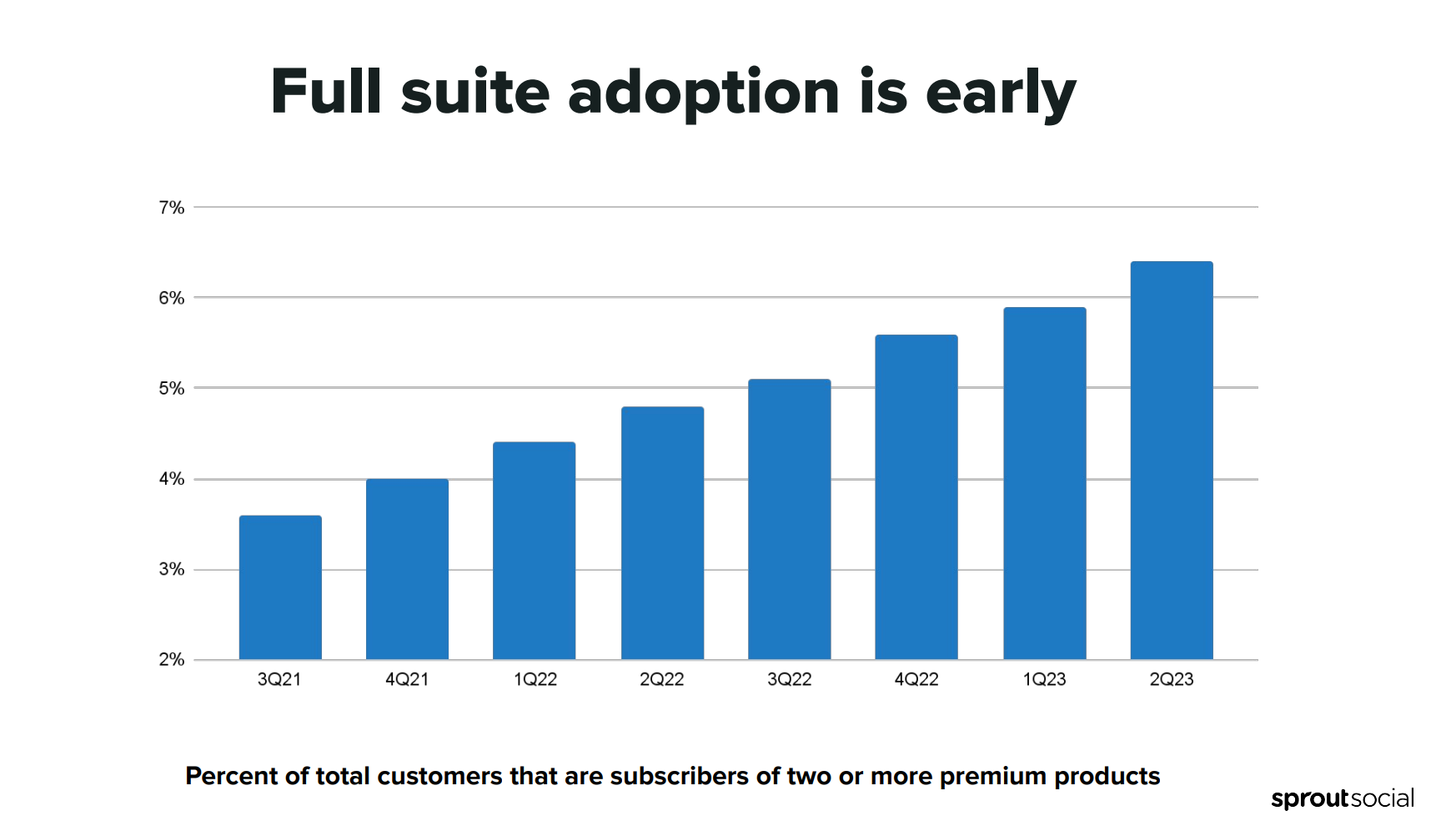

This slide is more of the same..

Net-new 2+ premium product customer adds were down 50% in H1 2023 vs H1 2022.

These are huge declines and not only was there zero management color as to why these slowed down so much versus 2022, but in bizarro world Sprout fashion they are in fact calling them out as accelerating. And this disclosure gets worse if you assume high premium attach rates for Social Studio. For example, if all SS customers buy at least one premium module at signing, then your x-Social Studio premium module net new customers declined by 80% in the first six months of 2023. This all kind of does a good job of explaining the timing of the Tagger acquisition. If your sales organization has seen inbound collapse and existing customers have been oversold during the Covid boom, you definitely needed to buy something new to cross-sell immediately. But again what stands out here is Sprout management actually chose to highlight this slide and metric repeatedly as evidence of ACCLERATING momentum in their premium module biz because the chart is up and to the right without giving any thought to the fact it actually clearly demonstrates a pronounced and SUDDEN GROWTH DECELERATION in this segment of their business.

I can’t emphasize enough how bad the optics are on this. Either Sprout management thinks their investors and the sell-side are total lemmings or they actually didn’t understand what they were disclosing was in fact quite negative. Wherever you land on this doesn’t matter as either outcome is very bad.

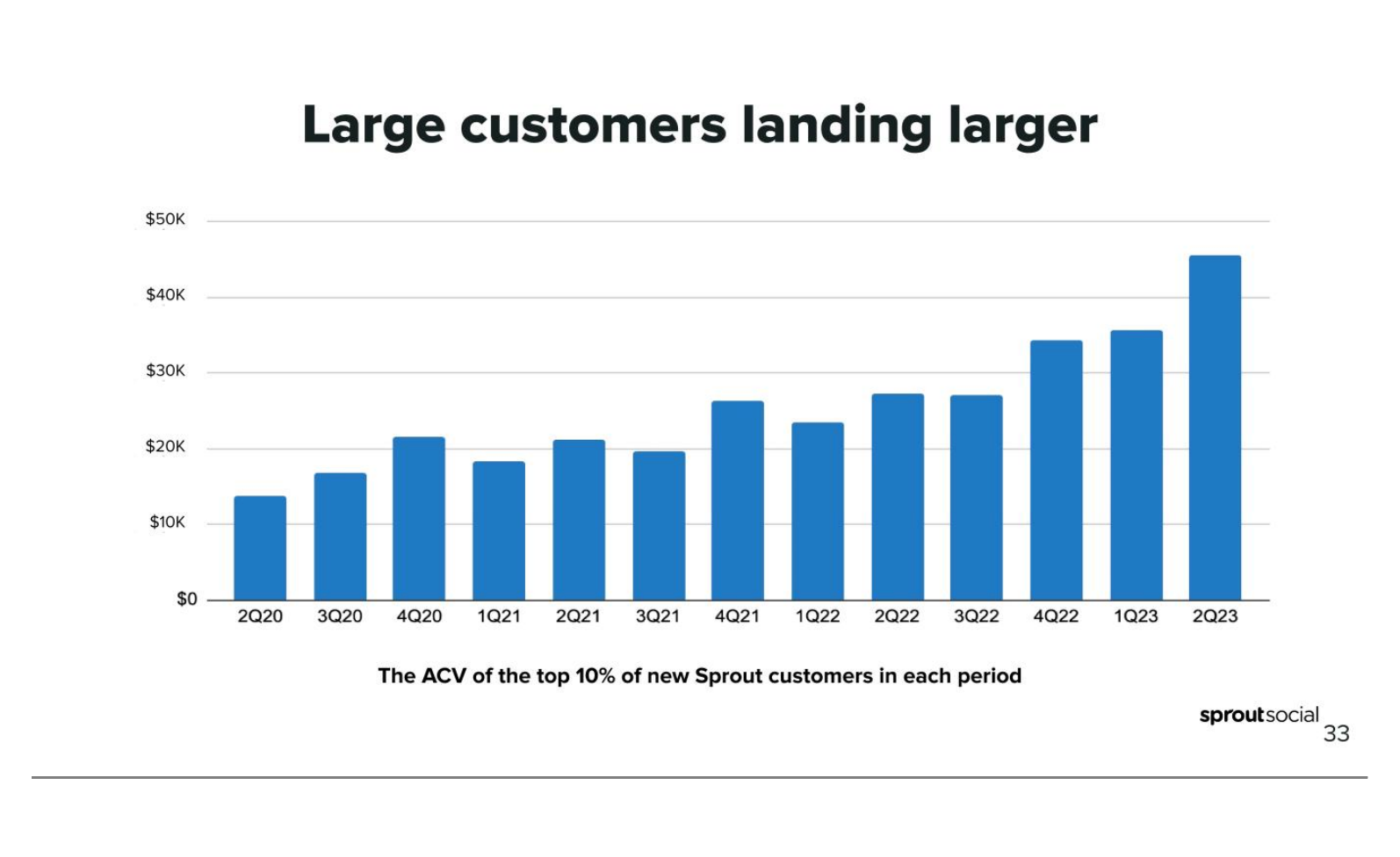

Large Customers Are Landing Larger

Large customers should presumably land larger if you just raised seat pricing 2.5x and premium module pricing 50%, but again an odd slide to choose to highlight. Because if your gross adds are declining notably then top decile new can be misleading as a metric. And a comparison versus Q4 2022 is a great way to illustrate this point because on that earnings call they told you….

$63k is nearly double the $34k top decile number disclosed for that quarter which begs the question how big was the top decile in Q4 2022? 200 would presumably be too small as the next 100 would avg just 5k and it looks like they conservatively had 200+ $10k+ gross new in that quarter even allowing for generous existing customer expansion. So, 250 or 300, or basically 2.5k-3k gross new customers in Q4 vs 1.75k avg Q1/Q2 2023 they are telling the street they averaged for H1 2023. That’s a 40% smaller top decile in Q2 which just makes this slide totally misleading.

These selective disclosures really make your head spin because simply put roughly 80% of Sprout’s ARR over the past two years has come from $10k+ customers. They did get a notable uplift in the sub $10k ACV due to pricing changes, but it’s not exactly a needle mover as that customer base is more like a sub $4k cohort. So, growth really was coming from ~ $35k ACV customers in aggregate and landing roughly 2k of those a year during the Covid boom times. This part of the business is trending around 20% slower now and would be more than 50-60% slower if it was not for the timing of the Social Studio sunset. It’s really that simple if management wanted to communicate clearly and honestly with their investors.

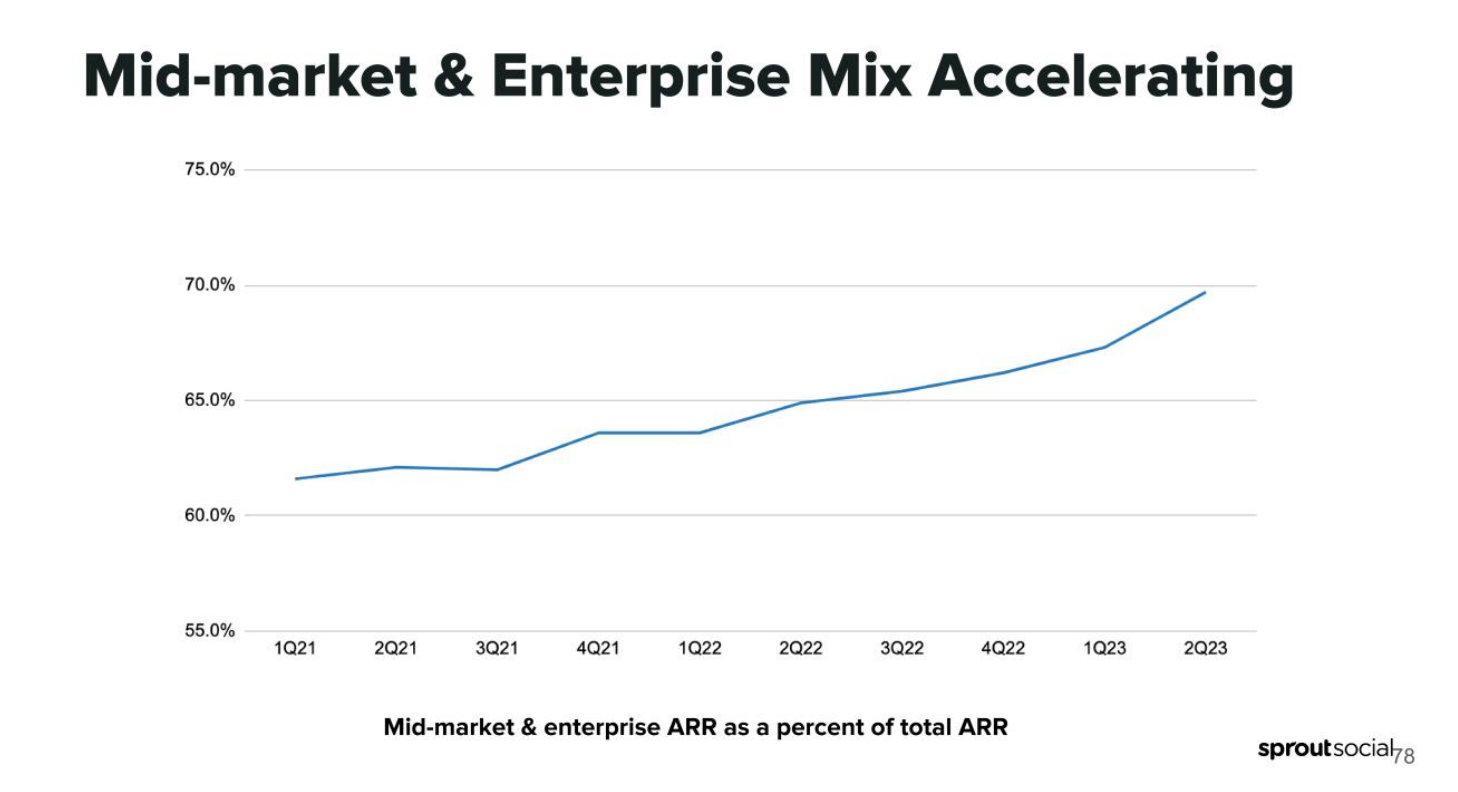

Enterprise/Mid-Market Mix Accelerating

“We believe that you're going to continue to see momentum in these areas. It's a reflection of our move upmarket into the mid-market enterprise. You're also going to see us continue to scale that part of our business. This is a graph of our ARR mix. And you can see the recent acceleration of our mid-market enterprise over the last 3 or 4 quarters and that's been the result of investments we made 3, 4, 5 years ago.” Sprout CFO, September 2023 Investor Day

Again they love the word accelerated, but if you churned off 2-3% of your low-end customer ARR and you are migrating Social Studio customers and you raised your premium pricing; how does a 2% shift in in last three quarters get attributed to investments from five years ago?

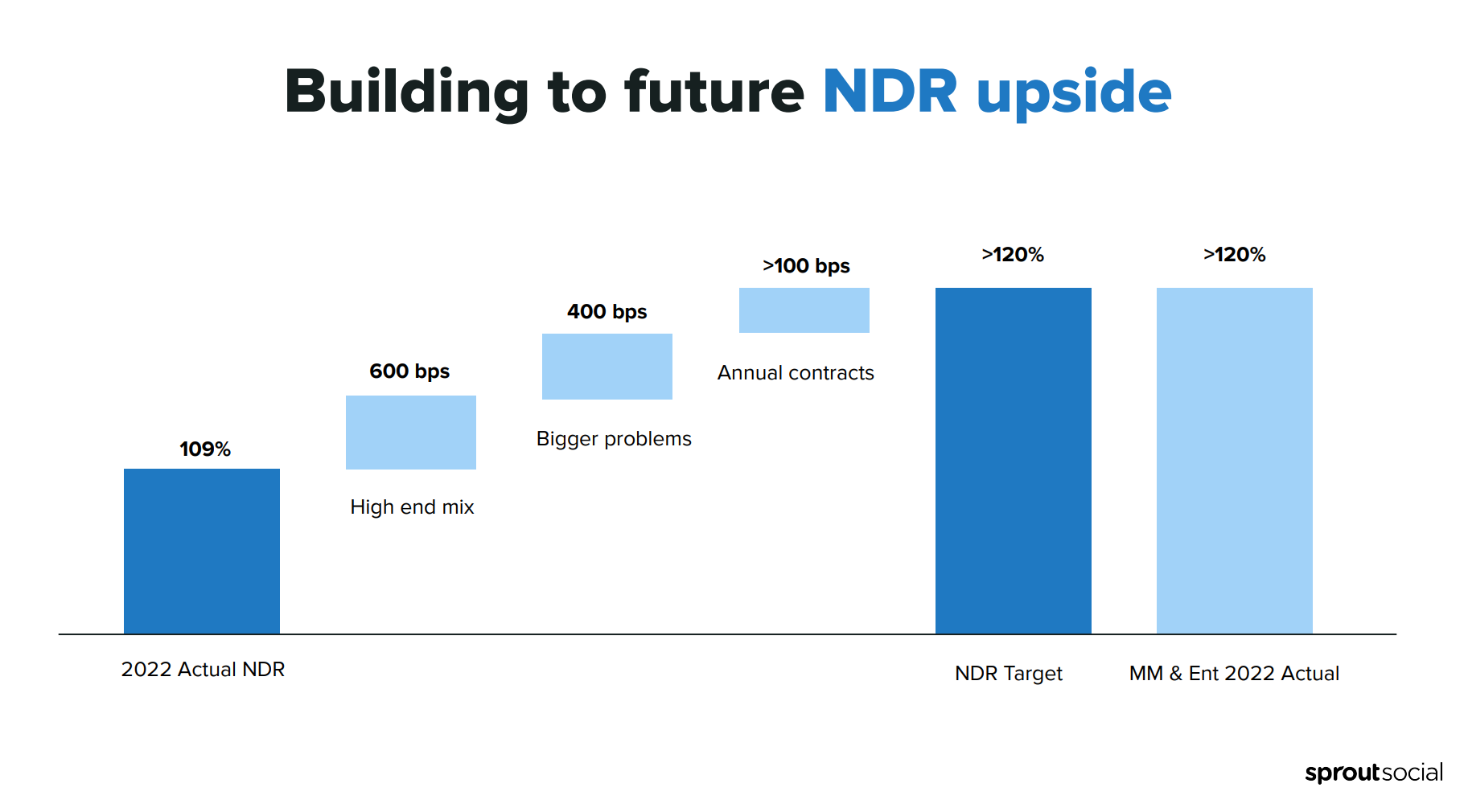

Sprout’s Long-Term Goal of 120%+ NDR

This is an interesting slide because they are showing you how they plan to bridge the gap between their > 120% Mid-Market/Enterprise NDR in 2022 and their 109% overall NDR.

The problem with this slide is Mid/Entp is already 70% of ARR and its NDR outperformance clearly benefited from Covid tailwinds on seat-based growth. You also are coming off a premium module customer attach rate that was low single digits at the start of Covid vs ~25% today. Assuming that your NDR’s for the 70% of your current ARR sustain at those trailing levels is a very aggressive assumption. And the signs that Sprout is presently experiencing the very same expansion headwinds that everyone else in software are facing are already there. Also, if your selling motion is mature and your growth is coming more and more because large customers are landing bigger, then your expansion rate is going to naturally contract anyways.

If I was to think about the next 12 months, I’d say there are way more substantial NDR headwinds ahead then they have let on. I’d be less focused about getting to 120% for the whole business and more preoccupied with precisely where NDR is trending at today and what seat- based renewal headwinds will look like from here.

They Also Provided A TAM Update Which Was Very SaaS Pre-2022

“One, we believe it's a $120 billion opportunity now growing over 25%, and there's a couple of changes to call out. One is on the SMB side. Obviously, with the focus we've had in taking advantage of the most successful parts of our market, there's probably a little bit less emphasis or business coming from the SMB side. So that number is a little bit less than we thought a couple of years ago. We still want to catch those social first, those digital-first companies, and so it's still going to be part of our strategy, but that market opportunity is a little bit less. Mid-market is very consistent. This continues to be our sweet spot, right? We have no competitors in the space, really high win rates, been really strong for us. And that will continue to be a huge growth driver going forward and feel like we're probably the best position of all the segments to succeed in the mid-market. And then probably the biggest update from the last time is the enterprise, right?The enterprise now, 2 years later, is growing much faster than what we thought 2 years ago, right? The ACVs of those deals are much larger. Justyn talked through some of the bigger wins. And so we now believe that the enterprise opportunity is a larger 1 than 2 years ago, when you roll that up, you get into this $120 billion TAM forecast.

And then just to flow that down very quickly to what we call our served addressable market, the more immediate term. That's just a slight increase from the $44 billion that we talked about 2 years ago to $55 billion, and that's really just flowing through that enterprise acceleration and how we view that market. And that's kind of the update you see here on the SAM.” -Sprout CFO, September 2023 Investor Day

TAM went up $20bl TO $120bl with just a tiny tempering on their part on the SMB side. SAM went up to $55bl. All of this is on the back of Enterprise ARR growth which is being boosted by a competitor’s product sunset. The whole TAM thing isn’t something you hear too much about today in software. I’ve actually noticed more management teams eschewing large useless TAM numbers for more quantifiable near-term opportunities.

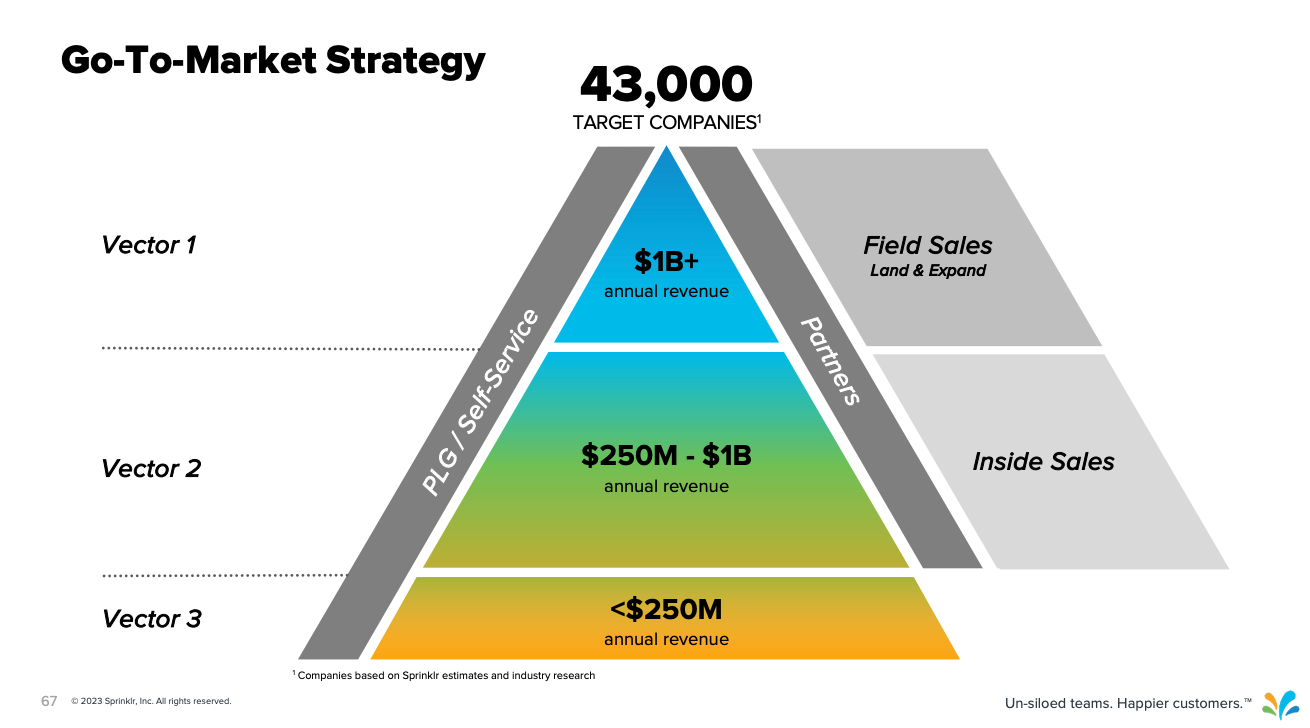

Here is a target market slide from Sprinklr’s July 2023 Investor Day:

At Sprinklr’s current ACV of $380K this is a $16BL TAM or 13% of Sprout’s number. I’d also add Sprinklr is very penetrated in the highest end of the market and has essentially three flushed out product verticals. This number is basically fine by me, but I can easily segment this down to a $8bl TAM with different ACV mix assumptions across the vectors. Not that tells you much as Sprout’s number is bigger than the current global server market and multiples of the CRM market. Bottom line, Sprout management is still going with the very lazy big number approach that you simply cannot take seriously.

For example, Sprout’s been around for 13 years, and their SMB ARR is a little over $40ML. How do they think there is a $40bl market here? You have the same amount of sub $10k customers as you did two years ago and you already told investors your sub $2k segment was declining for nearly the two full years before you changed pricing. And according to some recent expert calls, the customers who are spending with you in this category are not exactly providing the most encouraging TAM signals…

Here is an excerpt from a recent call with a Digital Marketing Manger at a previously featured Sprout SMB customer that is presently well below Sprout’s current pricing for listening saying they don’t intend to renew listening:

Question:

And did they try to raise the price over the last year because I know they've been raising prices. When did you negotiate the contract and when is it going to come up for renewal?

Answer:

We negotiated the contract two years ago. I believe we started in February of 2021. And then it just renewed this year. They did not raise the price on us, but we will not be renewing with social listening come this next year just because while it's been valuable. We can find that tool elsewhere for a little bit better price. So if they try and raise it on us we would not continue.

Question:

Where are you looking or where do you know that you can get it more cheaply and something equivalent?

Answer:

I don't know for certain, but GRIN is looking at adding social listening. And then I'm interested to see what Meta and TikTok do to allow trends to become more at the forefront because that is really where the industry is going. If something happens in app that allows us to not have to pay a dime then why would I spend thousands of dollars when the app is going to tell me itself what it will push.

And here is an excerpt from a call with a Social Media Manager at a Sprout mid-market customer commenting on the recent price increases.

Question:

Are you paying the fees listed on the website? Or is that negotiated separately on an annual basis or something like that?

Answer:

Yes, that was negotiated separately. So when they raised their prices in August, I believe that's like $300 a month, but then we got a notification that because we've been customers of Sprout for so long, it would be less, and that was still a little bit out of our budget. We were able to negotiate even lower. So yes, we don't pay what's reflected on the website. I think we pay about half or less than half.

And these are just the surface level TAM questions.

If I look closely at the enterprise market, I can see that 70% of the Global 100 top brands are on Sprinklr and another 15% on Khoros. This market is 100% penetrated for SMM. Sprinklr’s domination across Tech Consumer, Financials, CPG, and Retail & Apparel is undeniable. There is no greenfield opportunity here. And in this market the meat for SMM vendors really is in hybrid Service Desk/Contact Center solutions. Where Sprout has been having some upmarket success is with existing Salesforce Service Cloud customers who have depended on Social Studio to connect their service center to social channels. That’s great but you really are coming in as two-way communication provider and essentially API support and not much more as the service desk software manages everything else. And that’s going to get worse…

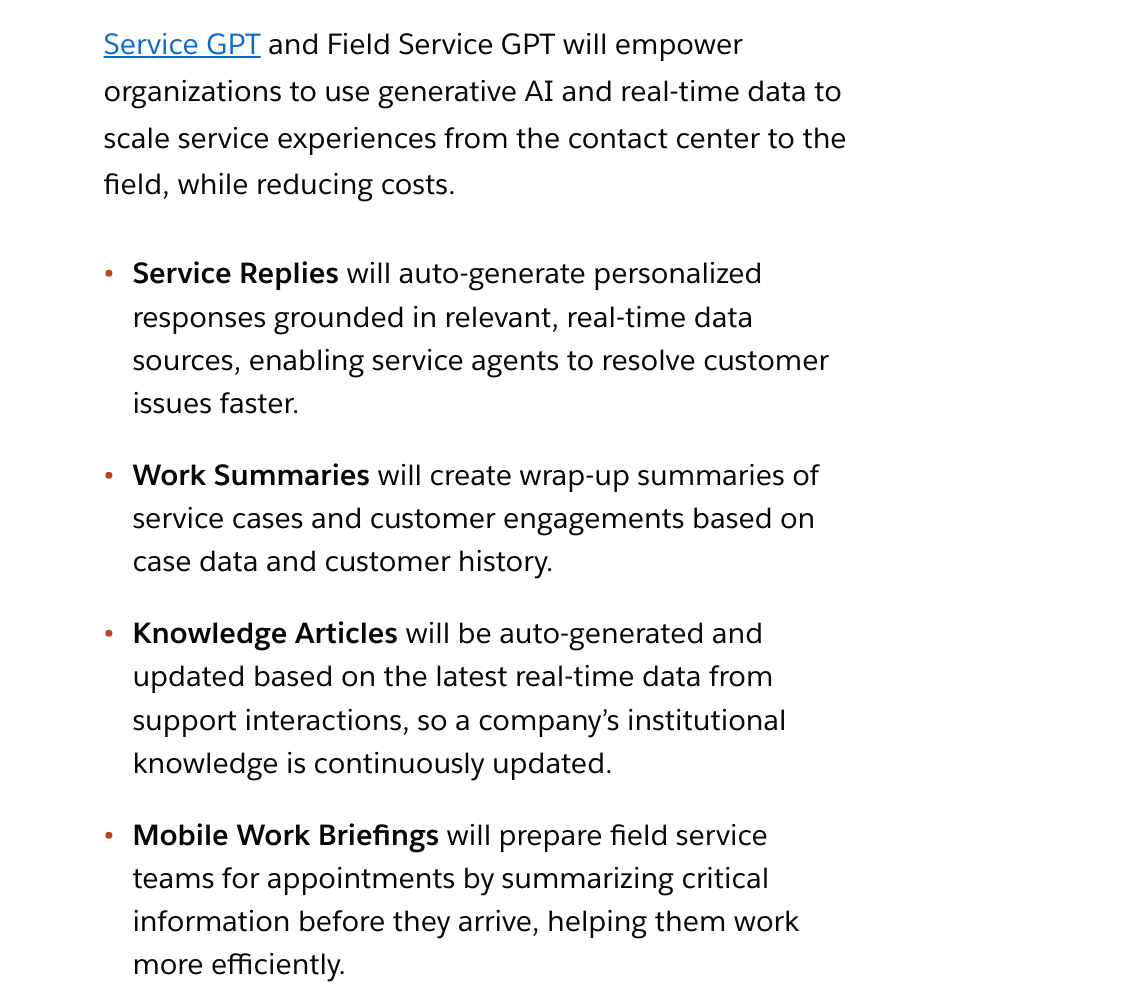

Salesforce has introduced Service GPT:

If I’m an investor assessing the SMM TAM in the era of generative AI and the company I’m long is the social plugin provider for a Salesforce Service Cloud customer, I do need to be asking myself what exactly is their future $ content opportunity with this customer. Salesforce is going to provide them their generative AI tools to increase contact center efficiency and presumably reduce the number of human seats needed here. What’s left after that? That’s not a platform.

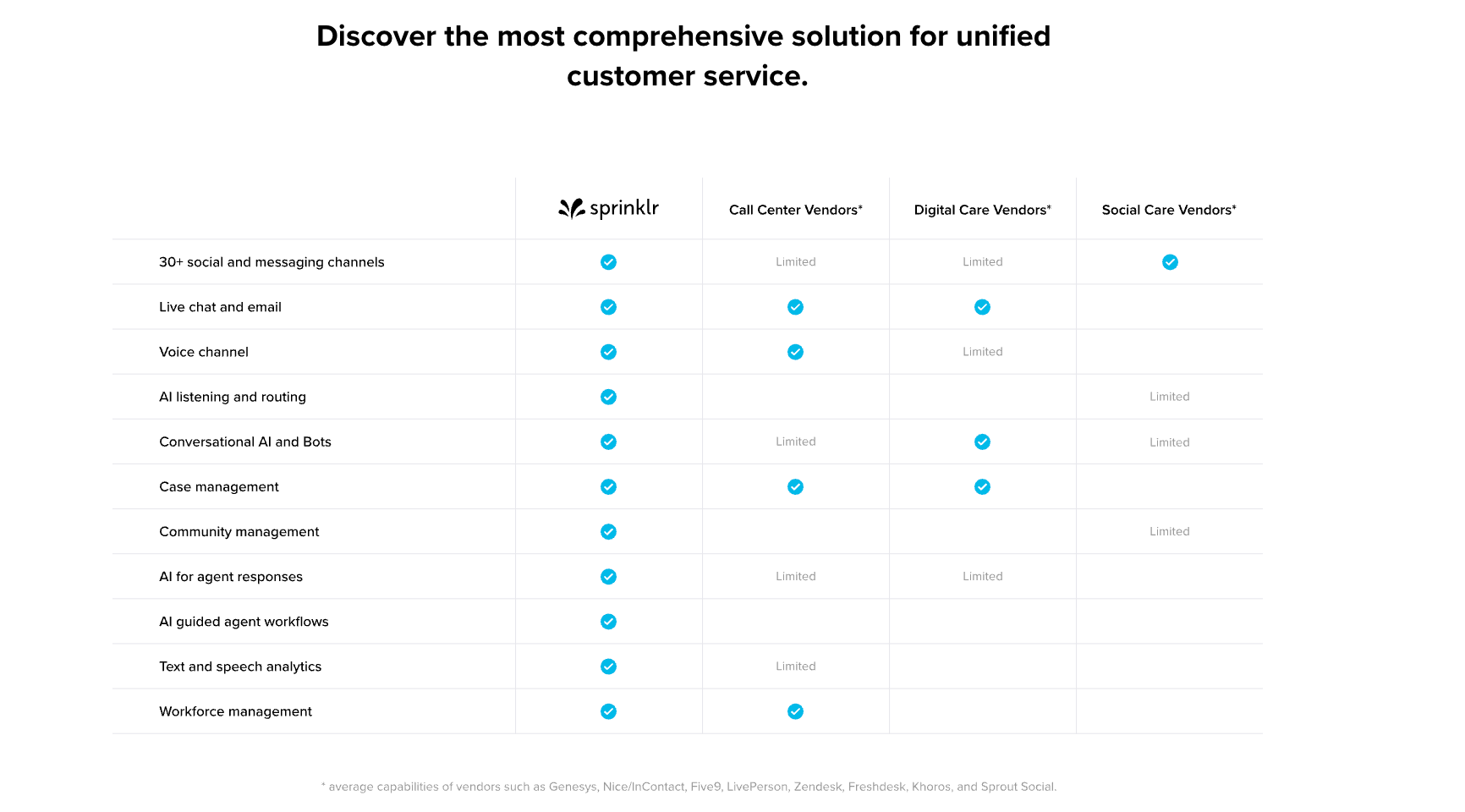

You can kind of understand this challenge from how Sprinklr positions their service offering:

Can you really even view SMM as a standalone market in the enterprise independent of contact center and service desks? I think the answer is obviously not. The seats are in customer support and not on the marketing side of SMM. And when it comes to marketing your competition is a totally different set of marketing automation focused companies. This is the challenge of the SMM TAM especially in an era of vendor consolidation at the customer level.

The reality is Sprout got a huge boost from Covid in the education, government, and non-profit verticals. This is where the mid-market/upmarket sweet spot is for them and where they experienced the most expansion during the pandemic. They also performed well from a raw social scheduling functionality standpoint with B2B businesses, but this was literally more of an IR/PR point sale during the pandemic.

Going forward their growth is going to be dependent on displacing full blown software providers for Global 2000 B2C businesses. There is no greenfield here and this is really a pure ROI and TCO game across multiple vendors. As I argued before, Sprout effectively needs to kill a business like Sprinklr to grow meaningfully from here because that’s where the next $300ml in SMM revenue exists. And by the way when you try to do that going up against a more robust suite you will notably shrink the TAM in the process if you manage to be successful. At the same time vendors like Sprinklr now need new customer growth and view Sprout’s core market as kind of a Covid windfall that is suddenly on the table as these customers become smarter about their SaaS spend and look to implement more sophisticated solutions to drive their ROIs.

This is pretty much the story of most of SaaS today and if Sprout traded at 3x-4x ARR maybe the risk would be worth seeing how it plays out, but unfortunately it doesn’t.

Conclusion

I’ll keep it brief and simple…..

1) Their net-new ARR was down 8% in H1 2023 despite a 150%+ increase in new customer seat pricing and the accelerated Social Studio sunset tailwind.

2) Their net-new $10K+ customers were down 17% H1 2023.

3) Their net-new premium module customers were down 46% H1 2023.

4) Their net-new premium module 2+ attach customers were down 50% in H1 2023.

5) Despite these substantial declines, Sprout management highlighted their premium module customer growth as accelerating in 2023 during their Q2 earnings call and subsequent investor day because they somehow didn’t account for the impact of overall customer declines distorting their attach rate metrics.

6) On the back of all of the above, they cut their annual guidance, redefined their long-term guidance, and acquired a new premium module for $140ML.

7) They attributed their guide cut to removing what were roughly $1400 ACV customers ARR from their forecast. They cited churn unpredictability due to new pricing and provided ZERO color on premium/$10k+ customer adds massive deceleration despite the fact that 90%+ of net-new ARR was already coming from the upmarket before their pricing changes.

8) Their sales reps are saying that “inbound funnel has collapsed”, customers are “oversold”, they are “fishing in a pond with no fish”, and that customers have seat “shelfware”.

9) Their CMO resigned last month.

10) A very sophisticated 6+ year Sprout enterprise customer that recently left for Sprinklr highlighted ROI deficiencies with the Sprout platform attributable to limited internal development resources and technological capabilities as the reason for their migration.

11) Countless Salesforce.com expert calls all contradict multiple claims management has made regarding competition and the size of the opportunity there.

12) The Social Studio cliff looks bigger than ever at roughly 40% of net-new ARR YTD.

13) At their investor day, they raised their TAM numbers and provided a bunch of selective and often self-contradicting slides saying everything is accelerating without even the slightest hint of any of the above confirmed issues or macro challenges in software. Instead, they are describing themselves as an “Iconic Software Company”.

14) The stock is still incredibly expensive at nearly 10x EV/TTM Revenue

If I was long a SaaS company and someone highlighted all this, I would sell it the next day and not even think twice about it even at potential attractive valuation. Sprout longs don’t have that luxury. The shares trade at the highest EV/Sales multiple of 50 public SaaS companies with an Enterprise of $4bl or less, and in the top 5 of nearly 75 listed SaaS names under $10bl.

Consensus estimates for 2024 have come down by $40ml or are now roughly where I argued they should be in a ultra-bull scenario at the start of the year. Sprout has done a very good job of selling the street on their strategic pricing changes causing this which one can judge as they see fit in the face of such overwhelming evidence to the contrary.

There is no need to pull punches at this point. Management has been kicking the can down the road despite knowing full well organic growth is trending well-below the financial targets they have set. It’s kind of undeniable at this point that they are not interested in being transparent with investors. They had some breathing room for this thanks to new pricing and accelerating Social Studio migrations in 2023, they don’t have that same luxury in 2024. This is a stock whose underlying SaaS fundamentals translate into a share price that should be 30%-50% lower. From here I expect the 30%+ sustained ARR growth and the “Rule of 40” narrative that has sustained the current valuation to collapse .

DISCLAIMER

As of the publication date of Akram’s Razor report, Akram’s Razor Related Persons (along with or through its members, partners, affiliates, employees, and/or consultants), clients, and investors, and/or their clients and investors have a short position in the securities of a Covered Issuer (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Akram’s Razor and Akram’s Razor Related Persons are likely to continue to transact in Covered Issuers’ securities for an indefinite period after an initial report on a Covered Issuer, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in the Akram’s Razor research.

Akram’s Razor Related Person is defined as: Akram’s Razor and its affiliates and related parties, including, but not limited to, any principals, officers, directors, employees, members, clients, investors, consultants, and agents. One or more Akram’s Razor Related Persons have provided Akram’s Razor with publicly available information that Akram’s Razor has included in this report, following Akram’s Razor independent due diligence.