Razor's Edge: The Covid Conundrum

Repost of my Feb 2021 piece...went 5/7 on the predictions...not bad.

The Covid Conundrum

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain

I recently read a nice John Hussman piece on market excess which I think is pretty well timed despite his track record of waxing bearish. The historical references in it are oldies but goodies, and the data he highlights on current markets is worth paying attention to. This article and a recent Grantham interview are your typical late cycle speculative mania bubble warnings from classic value sensitive mean reverting market types, and they will be dismissed as such by thematic growth leaders of the day as well as just about anybody whose enjoying endless up days in markets. So, I am not going to go there right now as this debate is as old as time, but I do think it’s a good excuse to take a break from Twitter and hodling to think about what the post-Covid world looks like for growth investing.

I say this because I am somewhat amazed at how consensual thinking has become with respect to Covid winners and how they will perform post-Covid. And to be perfectly clear, when I say post-Covid, I am talking about two distinct legs. The 1st leg will be the knee jerk it’s over phase which will run the gamut from kids going back to school, live sports with fans in full swing, travel, some degree of hybrid office, dining out etc. leading to a notable economic pie shift. This leg will likely coexist with the current work from home economy that has become the norm for many knowledge workers while also shifting things a bit back into balance for those that have been locked out by the lock down. The second leg though will be about what the world looks like after this transition, and I’m going to go as far to say as that is still debatable. So, while I think the current work from home narrative is likely to dominate, there is enough evidence out there already that supports a potential shift back to a hybrid environment that favors non-remote. Not that I really have any desire to speculate on how this turns out yet, but it’s pretty obvious today this is a discussion people will be having for the next few years once the post-Covid dust settles.

Anyway, I can appreciate the fact that most investors at this point have no desire or reason to think about the 2nd leg, but I am pretty surprised not much thought is given to the first leg.

Instead, what I see regularly is either excitement about an economic boom triggered by the end of Covid with a mix of stuff like this with respect to Covid winners…

“People are so stubborn to think all the pandemic related shifts will go back to old ways- most of these shifts, driven by Tech, are here for the long run, COVID merely accelerated the moves”

“We are not going back to paper”

“E-commerce is here to stay”

“Grocery delivery isn’t going to stop because the pandemic ends as now you are used to it”

Stuff like this combined with your typical tweets on trends and TAMS etc. has essentially picked up as vaccinations have started. It’s almost as if everyone whose enjoyed the Covid market wave is showing signs of anxiety around the inevitable post-Covid 1st leg without really wanting to confront it head on. I say this because it reminds me of what I felt like in late 2000 with respect to the internet, online ordering, online trading, mobile data etc. “We are not uninventing the internet,” was a common rallying cry back then as the 1999 party came to an end. And we obviously didn’t uninvent anything, but our general obsession with these themes as a society quickly cooled off.

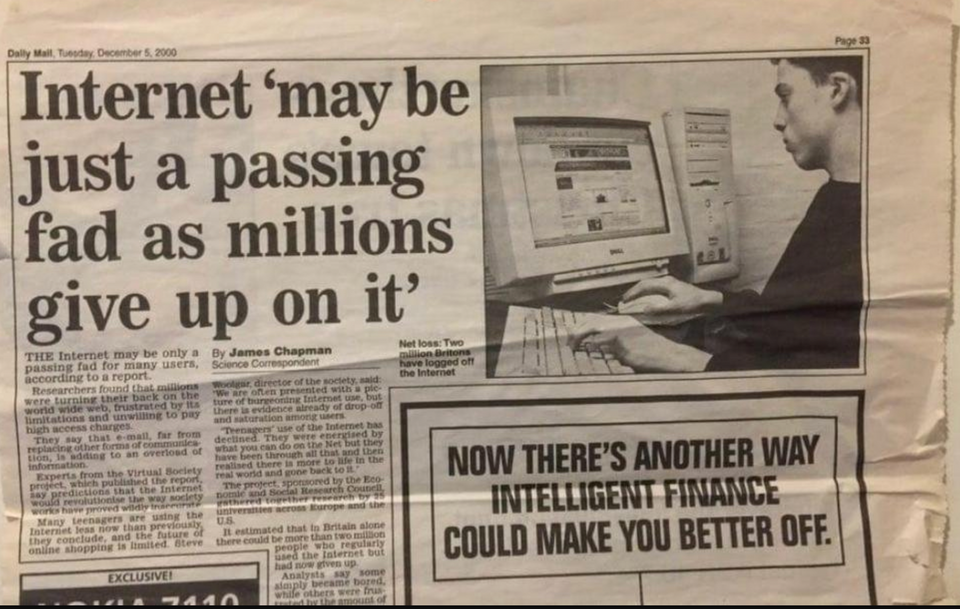

But back then it got so bad in the market for internet companies that you could get away with an article like this…

But Covid raises more serious questions than we faced back then because there is a legitimate case to be made in some areas that it can never be this good again. The pandemic clearly accelerated a lot of digitization and we have spent the past year focusing on all awesome growth it caused for so many well-established companies, but what about the potential downside to it?

Some questions that come to mind…

Will kids ever spend this much time online again? Do we want them too?

Will stock trading volumes ever come back to recent levels once the pandemic is over? (January was up nearly 50% over December and that was on the back of triple digit yr./yr. gains.)

Will screen time for social media and hours spent streaming video/audio etc. ever reach the recent peaks again?

Will notebook and gaming hardware makers have a year this good anytime in the next five?

Will kitchenware makers?

Will home improvement stores?

It’s not unreasonable to assume that the answer for most of the above questions is no. At least in the traditional sense because the next step up would have to be a matrix. But as far as modern global pandemics go even if we had another one we wouldn’t experience the step function pop we went through under Covid again because the shock simply wouldn’t be as severe. Which begs the question…..

Think about e-commerce…

Yes, we are not uninventing shopping online, but if a portion of the population spent 12 months doing all their discretionary shopping online and they then went to making 1 more discretionary purchase a month offline than they did during Covid, that’s a headwind you need to think about. And I say this because it goes against human nature to think this way. I mean to be frank you need to ask yourself at this point if e-com is even a sector anymore in the USA. Every established corporate retailer can be deemed omni-channel capable now, and just about every SMB that did any biz for a year knows how to levg online. So, investing in an E-commerce pure play which has been the best thing ever for past six months is not going to feel very special in a year. Heck, it might even feel dated.

Technology is about progress, but we are to a degree always adopting exciting new technologies. I did a whole thread on Xerox’s breakthrough in collaboration during the 1960’s because the copier really was a massively disruptive and transformative killer app. We don’t think about what it enabled from the original meme culture, to collaborative work, to newsletters, to democratized information etc. today because well it’s obsolete tech now.

Now, what I think is interesting about Covid is that the tech growth narrative and buy best in class company culture kind of bumps up against a hard wall.

Allow me to explain….

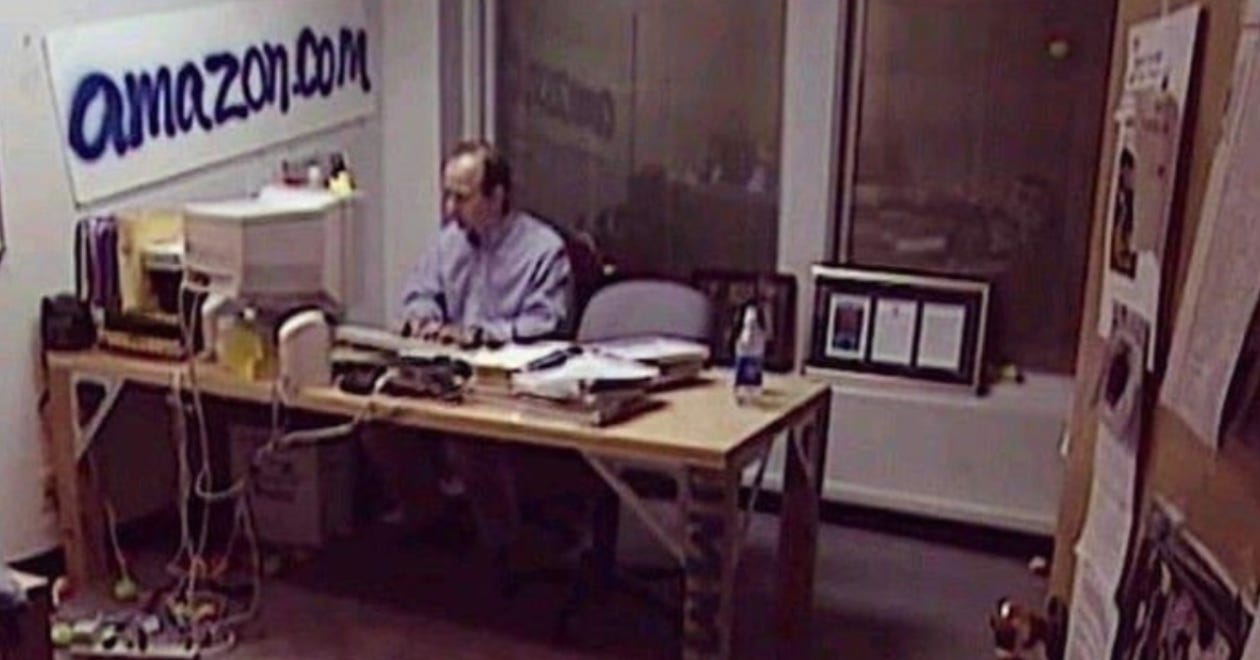

Compounding as a long only is about buying exceptional operator run businesses and holding them for very long times. The main driver behind this very simple approach is that best-in-class operators execute consistently over time and will compound your capital for you better than you or anyone else can. So, if you are smart and lucky enough to spot one, buy and hold if you want exponential returns. Part of the core thesis here is that world class operators over time build moats, disrupt markets, and exploit economic cycles. They by definition execute better than anyone else so patience is rewarded as execution by definition is measured over time. Amazon and Google are your best-in-class examples here.

Amazon is the classic buy and hold and compound away story. Revenues roughly 12x’d between 2009 and 2019 from $24bl to $280bl, and the stock pretty much followed that with a 13.3x over the same time period.

Google just 10x’d over 15 years and revenue has more than 30x’d. Since IPO the stock is 39x and revenue has gone from $3.2bl to $182bl or 56x.

But what is often forgotten is that investment timing with great compounders can be a bit of a big deal, and that massive revenue growth can in fact coincide with periods of subpar returns.

Amazon, for example, generated $2bl in revenue in 1999 and if you bought the stock at its peak that December you would wait a decade to break even. At that point the company would be doing roughly $24bl in revenue or 12x over 10 years. Basically, you gave Jeff Bezos a decade and he executed flawlessly, and you were just breakeven.

Google though is my favorite example because it went from $3.1bl to $6.1bl in revenue in 2005. That 97% growth at scale doubled the stock price. There was no fintwit to celebrate it and no once in 100-year pandemic accelerating their biz. It was just a great growth stock, which by the way also earned $2bl in op income on that top line, doing its thing. But after that the market found more interesting things to focus on in housing, emerging markets and finance, and you’d get a shot to buy it at the same price in the Summer of 2010. By then it was a $30bl in revenue and $10bl or so op income biz. So, from $6bl to $30bl in 4 years with all that profitability and you were break even. WTF?

In case you haven’t figured this out yet, the point I’m trying to make is that investing can be hard even if you own the greatest investments of all time. Buy and hold is essentially a solution to this problem. But what happens when stocks go up 3x or 6x or 10x in a year? Are you supposed to still behave as the patient buy and hold guy? This is the Covid conundrum.

Consider the following names…..

Shopify went from mid 40’s growth to mid 90’s and the stock 5x’d

Amazon went from low 20’s to low 40’s and the stock 2x’d

Target went from the low single digits to the low 20’s and the stock is up like 70%

Twilio went from low 50’s growth to 60’s growth and the stock more than 4x’d

Zoom, the pandemic darling saw its growth rate go from 80% to 360%, and the stock 5x’d

So, Covid provided step function growth for certain industries there is no doubt about that but returns for the most part have drastically outpaced the annual revenue growth. For example, Shopify didn’t 4x revenue this year and neither did Twilio. So, could the stocks go nowhere for the next five years even if they grow revenue 4x in that time period? I’d argue that 9/10 investors today would tell you no way that’s possible, but you have ample sample data in just the past 20 years that says this is 100% possible. That’s problem one for buy and hold here. Problem two is this growth was sparked by a global pandemic. This means that the ending of the pandemic at minimum is a headwind for investors in these names. At worst it’s a potential major hangover. The rationale behind is really pretty straight forward. Many investors just generated exponential returns in less than a year. I just showed you that some of the best growth stories of all time managed to still hit a performance wall despite no interruptions to their growth. Covid investors don’t have that luxury. They also have way more unknowns to contend with once the transition phase is over.

Basically, if the greatest compounders of the last 50 years can test your mettle like this and could grow and execute for years and be valued as they were; what about everyone else?

You can try and find exceptions, but for the most part they really don’t lend themselves to a buy and hold narrative either after periods of exponential returns in a short time frame.

Tesla revenue increased 30x between 2010 and 2014 from $100ml to $3.2bl and the stock returned 10x over that window. It then went nowhere over a verry volatile 5 years while revenues increased 8x from 3bl to 24bl. Under Covid it has 10xd in a year with an acceleration back to 40% growth.

Nokia saw a run similar to this in 1999 and so did Qualcomm. Cisco was close too, and Siebel systems as well. Of course, all these stocks experienced major crashes after that despite quite durable businesses. In fact, I have not been able to find a 10x run that occurred in a 2yr period or less in anything non micro-cap that was not followed by a minimum 50% drawdown. In fact, even Apple has had 50% drawdowns after two multi-year 10x runs in the post tech bubble era.

So, buying the best businesses ever after huge runs in short times has for the most part been a very bad idea. This is usually lost on investors. Like if I bought Cisco versus the most speculative networking companies in 2000 I would be down 95% or so at the sector lows vs. 80% in the sector leader. Not exactly comforting at that point in time. And while Cisco or something like Amazon may go onto recover vs the spec name; I’m still required to hold it for 15+ years for that to pan out. Meanwhile assume the sector doesn’t experience a bust, well then, the speculative asset might in fact be worth the risk then vs the leader at that point in time.

This means that there are points in time for many names where macro variables seem to be driving returns, and thus rendering stock picking skills almost useless as a measurable driver of performance.

Are we in such an environment today? Where we in such an environment before Covid even started?

Taking a look at Apple shares over the last two years definitely makes one wonder….

Apple ended 2018 at a market cap of $745bl, and the stock bottomed in early 2019 at 1/4th it recent high. What did the business do in those two years as far as top line growth? Not much. Revenues declined by 2% in 2019 and grew 5% in 2020. The company is now worth $2.2trillion. Macro aside, arguments can be made about durability and profitability views shifting with respect to services and what not, but it’s definitely an interesting example of an extreme rerate without much change in topline. Which brings me back to the Covid conundrum….

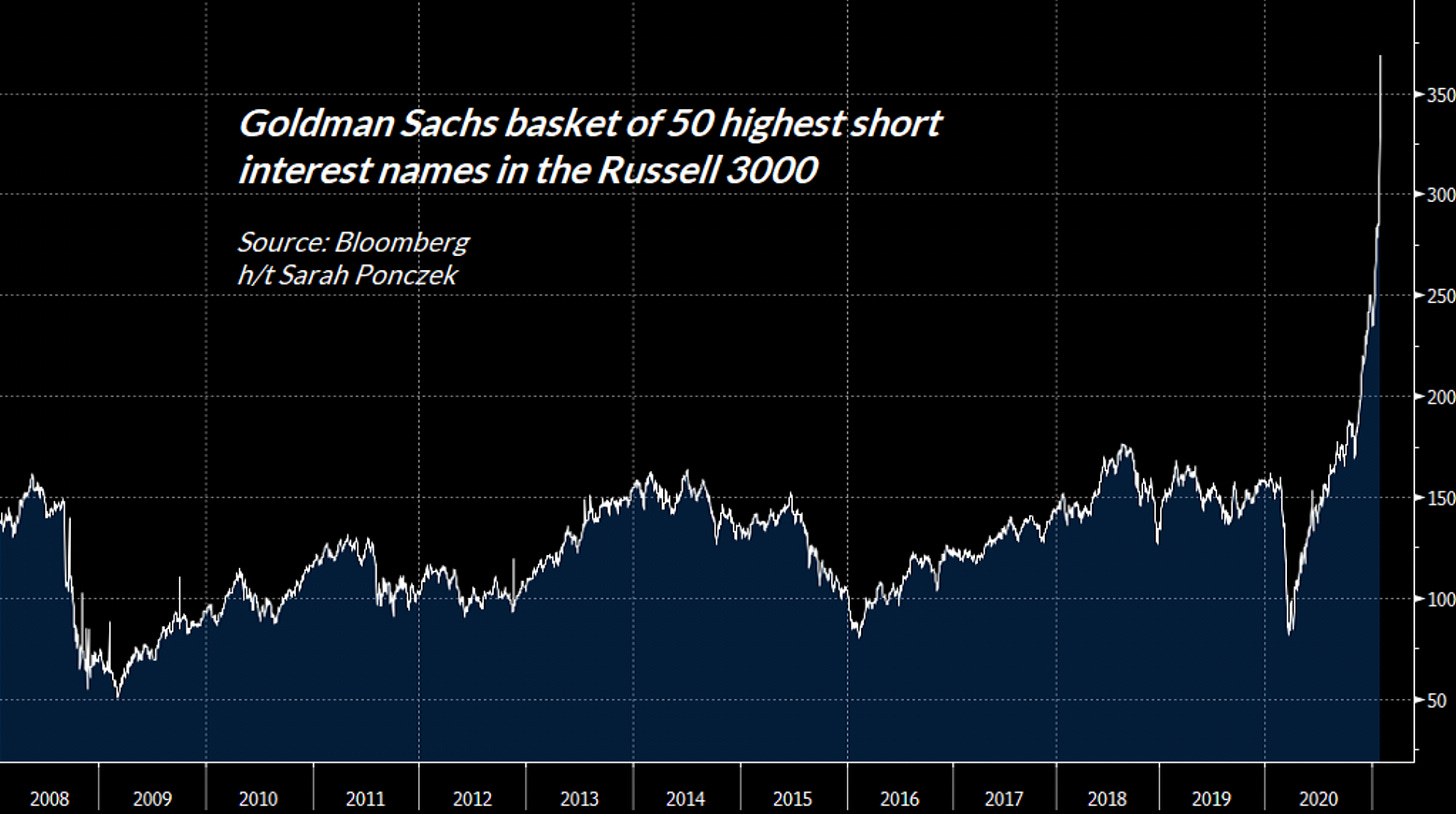

If macro variables have been the dominant driver of performance, odds are that picking best in class operators hasn’t really added the alpha you thought it was adding. It’s no coincidence that despite the impressive nominal gains for many consensus darlings over the past year; the consensus dogs have done even better.

Which means you should think very carefully about what things might look like in a year from a comp standpoint because slowdowns from step function moves typically don’t lead to rationale and smooth pullbacks in stocks that had exponential moves in less than year. And deflating manias or macro turns are a lot more challenging for investors to deal with than financial crises.

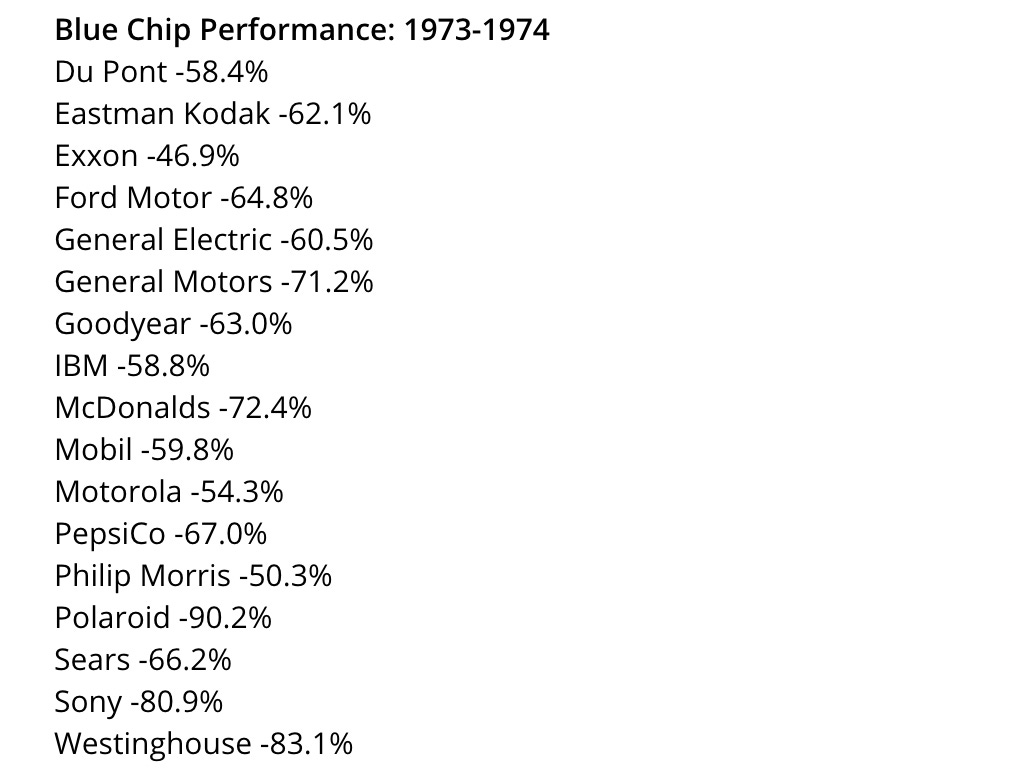

I liked Hussman’s citing of the Nifty 50 bear market that came a few years after the collapse of Bretton Woods, and the sudden pickup in inflation. In many respects it’s an excellent reminder of what can happen to a basket of great companies if a currency debasement triggers real inflation.

Anyway, enough beating around the bush, here is what I am confident of over the next year…..

1) Screen time 12 months from now will be down

2) Trading volumes 12 months from now will be down

3) E-commerce stocks 12 months from will be the biggest underperformers on a trailing basis. I don’t know when it will start or how fast it will happen, but I do know in a year it will be a DUH type of thing in the market.

4) SPAC targets bring notable supply as a boat load of unlocks occur same time. This will tip the scale to net-selling and end that party as the appeal in cashbox arb trades diminishes when the marginal retail buyer and promoter chaser stops playing the pump game. Consequently, many SPACs with no targets yet will start to trade below issue as investors lose interest but the shot clock time is still a long way from expiry.

5) Inflation readings should run way hotter into the summer before subsiding as the economy goes through another notable dislocation due to Covid’s demise.

6) Semiconductor end market demand remains strong as supply constraints continue to be worked through but by year end an inventory correction begins and h1 2022 in the space is not pretty.

7) CASH proves to be a solid overweight as some reopening names have run notably and volatility causes aggravation.

Anyway, for those that want this all summed up neatly, here it is.

Investors pay high multiples in an effort to discount extended periods of above avg future growth today. Covid accelerated the future for many industries by pulling certain digital growth forward. In many respects, that makes the future the present. Eventually the present becomes the past. All along the way multiples step down notably. A year from today simply being awed by cloud adoption or new slide decks for disruptive business isn’t going to suffice as an investment thesis. Be prepared for the hangover.