Razor's Edge: SOUNDHOUND IS CHEGG REBORN

I told myself I wouldn't go down a hound hole of stupid, but once you have a position it's easier said then done.

So, as I pointed out in the last post, SOUN revenue was down 50% yr/yr in Q3.

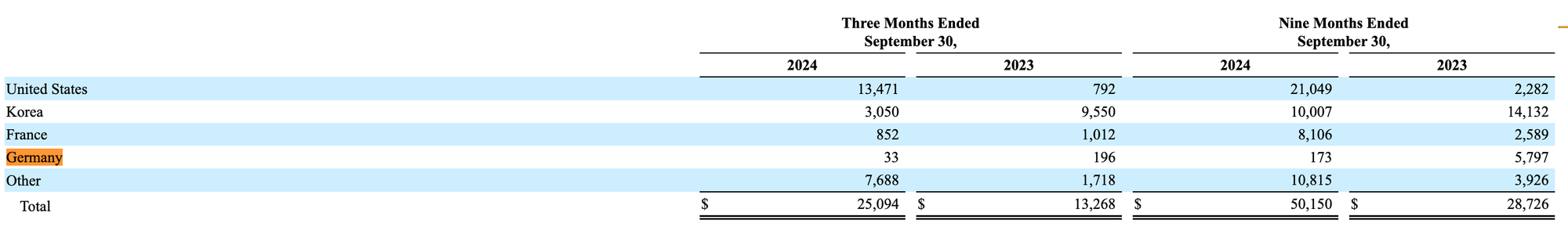

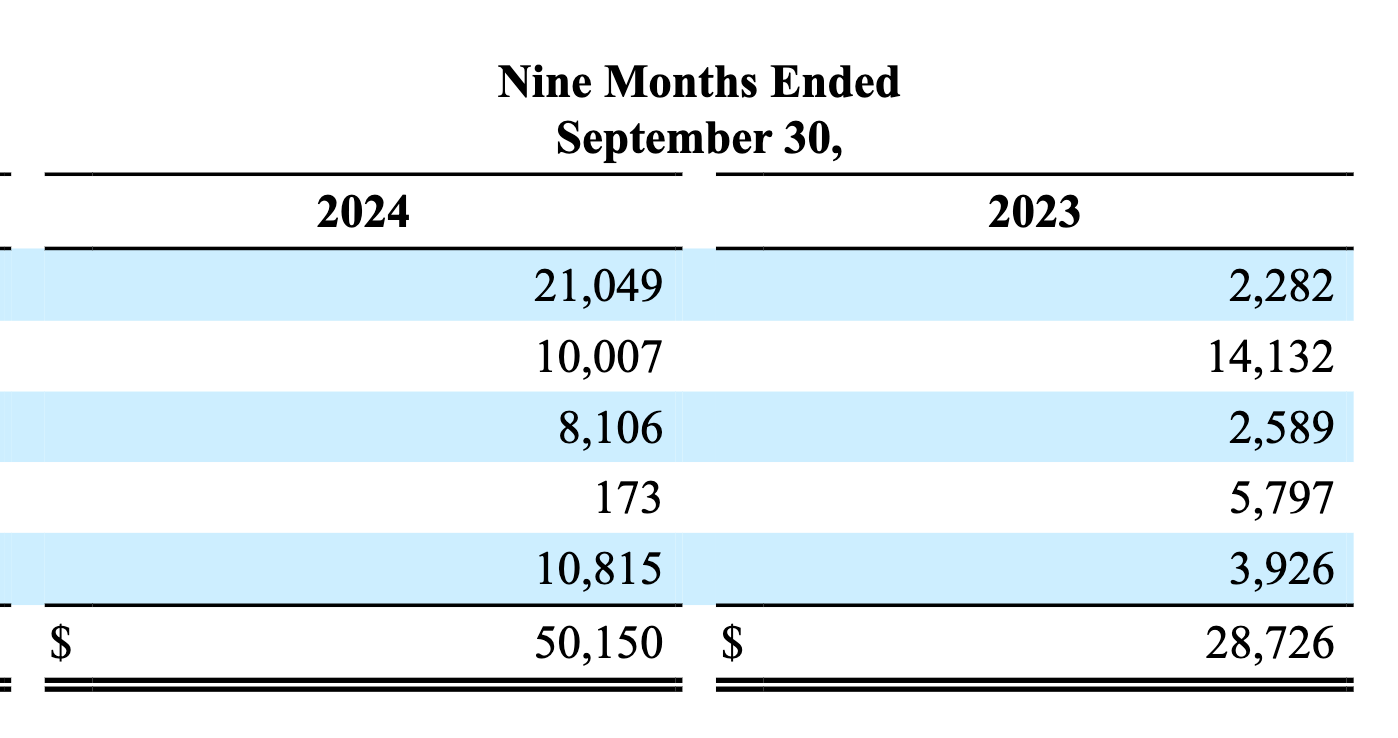

The big hit came from customer A which is clearly Hyundai contributing only $3ml in revenue in the quarter vs $9.5ml a year ago, but Customer B which is clearly Mercedes also didn't help in 2024.

From $5.8ml in revenue in Germany for the 9months ended Sep 30th, 2023 to $173k a for the same period in 2024.

So, what happened with Mercedes?

They clearly have decided to go in a different direction

The same story is playing out at Hyundia

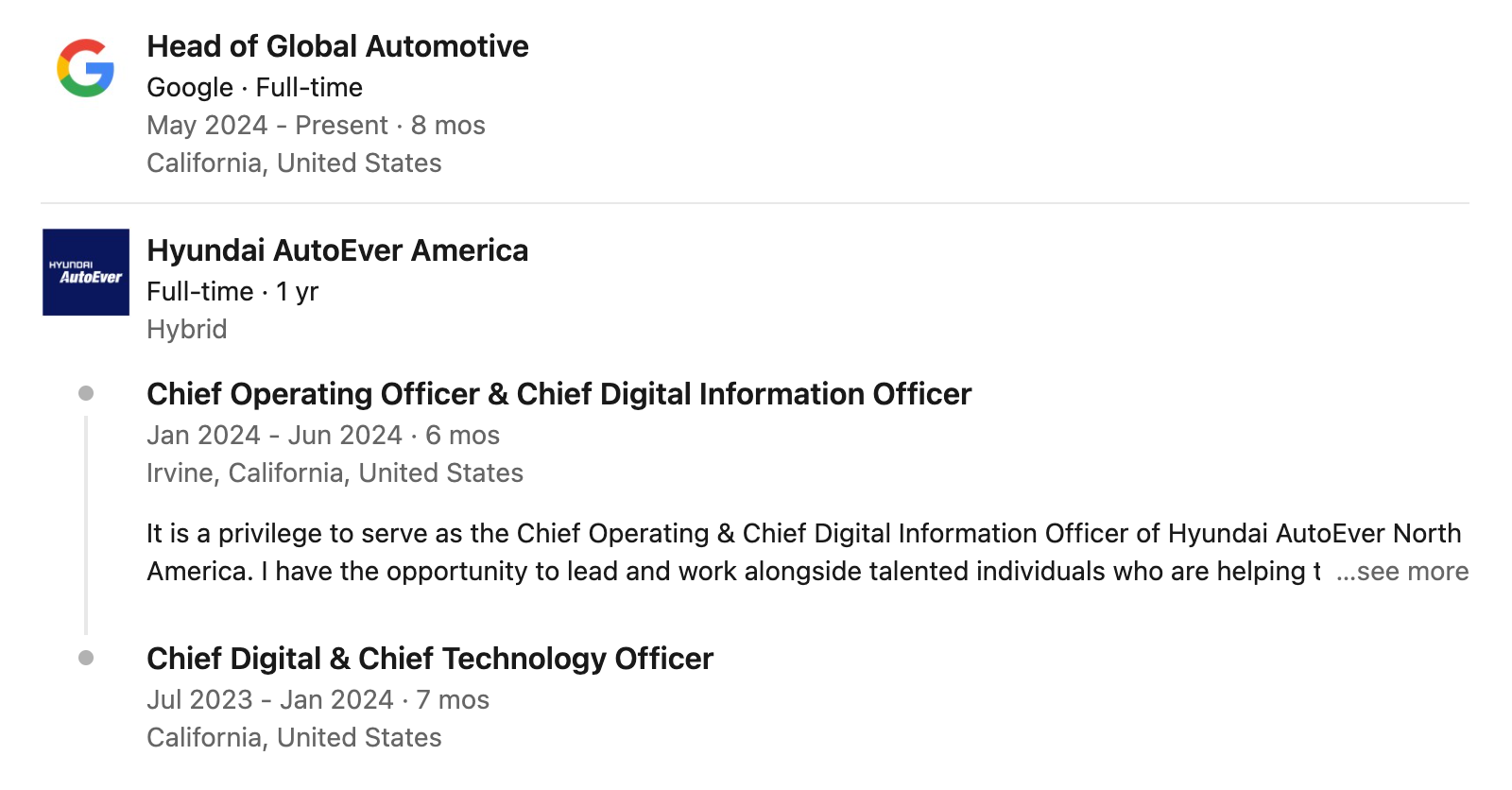

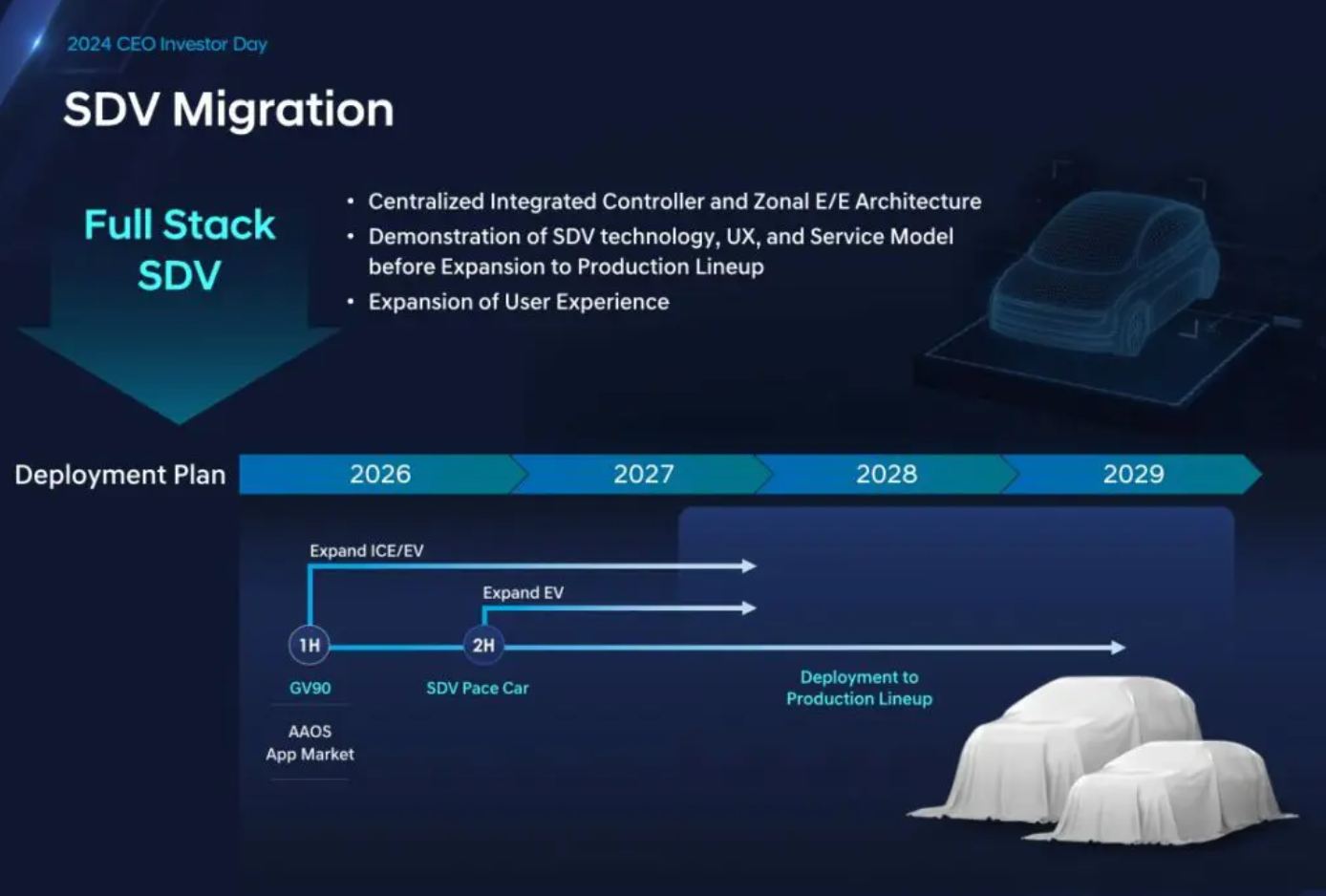

At their investor day in August of 2024, they shared their vision and roadmap for their new infotainment OS powered with their own customized llm.. I’d also point out the former head of Hyundai’s digital information is now global head of automotive at Google. And Google and Hyundai just cut a deal over next gen infotainment..

https://en.yna.co.kr/view/AEN20241212005200320

I find it quite interesting that as this is playing out the Soundhound CEO keeps quoting ever increasing backlog numbers.

On the Q1 2024 call he had this to say about backlog..

In Q3, I mentioned our cumulative bookings backlog was $341 million with automotive being the largest constituent. I also mentioned that separately, in the restaurant vertical, that at full scale out, we would have 4,500 locations signed up and roughly $25 million in ARR. When we look at the combined potential of our signed up customers at the end of 2023 across both Pillars 1 and 2, our cumulative subscriptions and bookings backlog was $661 million, up nearly 100% year-over-year on an apples-to-apples basis, thanks to growth in Pillar 1 and the incredible list of customers we have added in Pillar 2.

That number went up to $723ML on the Q2 call.

Here is their RPO disclosure from the Q2 2024 10-Q:

As of June 30, 2024, the aggregate amount of the transaction price allocated to the remaining performance obligations related to customer contracts that were unsatisfied or partially unsatisfied was $10.6 million. Given the applicable contract terms, $5.5 million is expected to be recognized as revenue within one year, $3.1 million is expected to be recognized between 2 to 5 years and the remainder of $2.0 million is expected to be recognized after 5 years.

The greater than 1yr RPO number is $5.1ML or not even 1% of quoted backlog.

Now look at how Cerence reports RPO/Variable Backlog in voice automotive..

As of September 30, 2024, we had five-year remaining performance obligations of $172.7 million. As of September 30, 2024, we had variable five-year backlog of $780.0 million, which includes estimated future revenue from variable forecasted royalties related to our embedded, connected, and professional service businesses. Our estimate of forecasted royalties is based on our royalty rates for embedded and connected technologies from expected car shipments under our existing contracts over the term of the programs. Expected shipments are based on historical shipping experience, customer projections, and other information that management believes, taken collectively, provide a reasonable basis for estimating future shipments as of the date of this Form 10-K. Both our embedded and connected technologies are largely priced and sold on a per-vehicle or device basis, where we receive a single fee for either or both the embedded license and the connected service term. However, our five-year remaining performance obligations and variable five-year backlog may not be indicative of our actual future revenue. The revenue we actually recognize is uncertain and subject to numerous factors, including the number and timing of vehicles our customers ship, POTENTIAL TERMINATIONS or changes in scope of customer contracts, and currency fluctuations, as well as the other risks discussed below in Item IA, “Risk Factors.” As of September 30, 2024, we estimate our five-year backlog to be $952.7 million, including $172.7 million of five-year remaining performance obligations and $780.0 million of five-year variable backlog. As of September 30, 2023, the estimated five-year backlog was $1.2 billion.

Cerence has a 1+ yr RPO of $124ML or 24x SOUN and its cashflow positive yet has about 4$ of the EV.

So, we have a CEO who doesn''t even bother pointing out his non- acquired 5mn biz was down 50% and instead highlights the inorganic growth. Basically, he does not give a damn about being misleading on a call even if the numbers are plain as day. And not surprisingly he doesn't seem to have any interest in providing color on massive automotive customers showing off their new voice tech or roadmaps.

Like ok technically you might still have a contract in place, but these customers have told the whole world they are going in another direction. So, quoting variable backlog "potential" for a decade that will be 100% wiped out by guaranteed termination is not great bob.

And if this wasn't bad enough you have this Amelia acquisition...

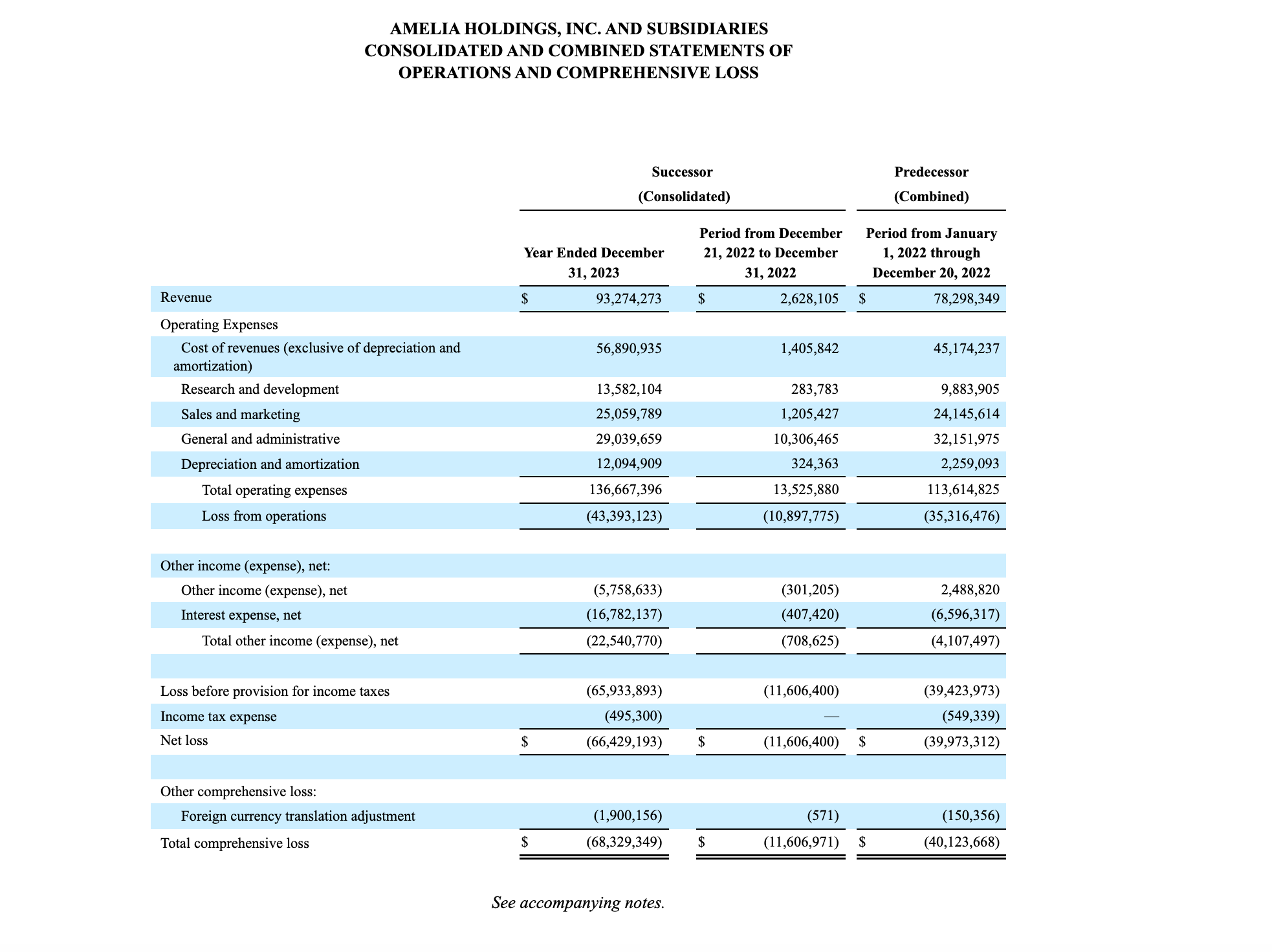

Here are the audited income statement financials for 2023:

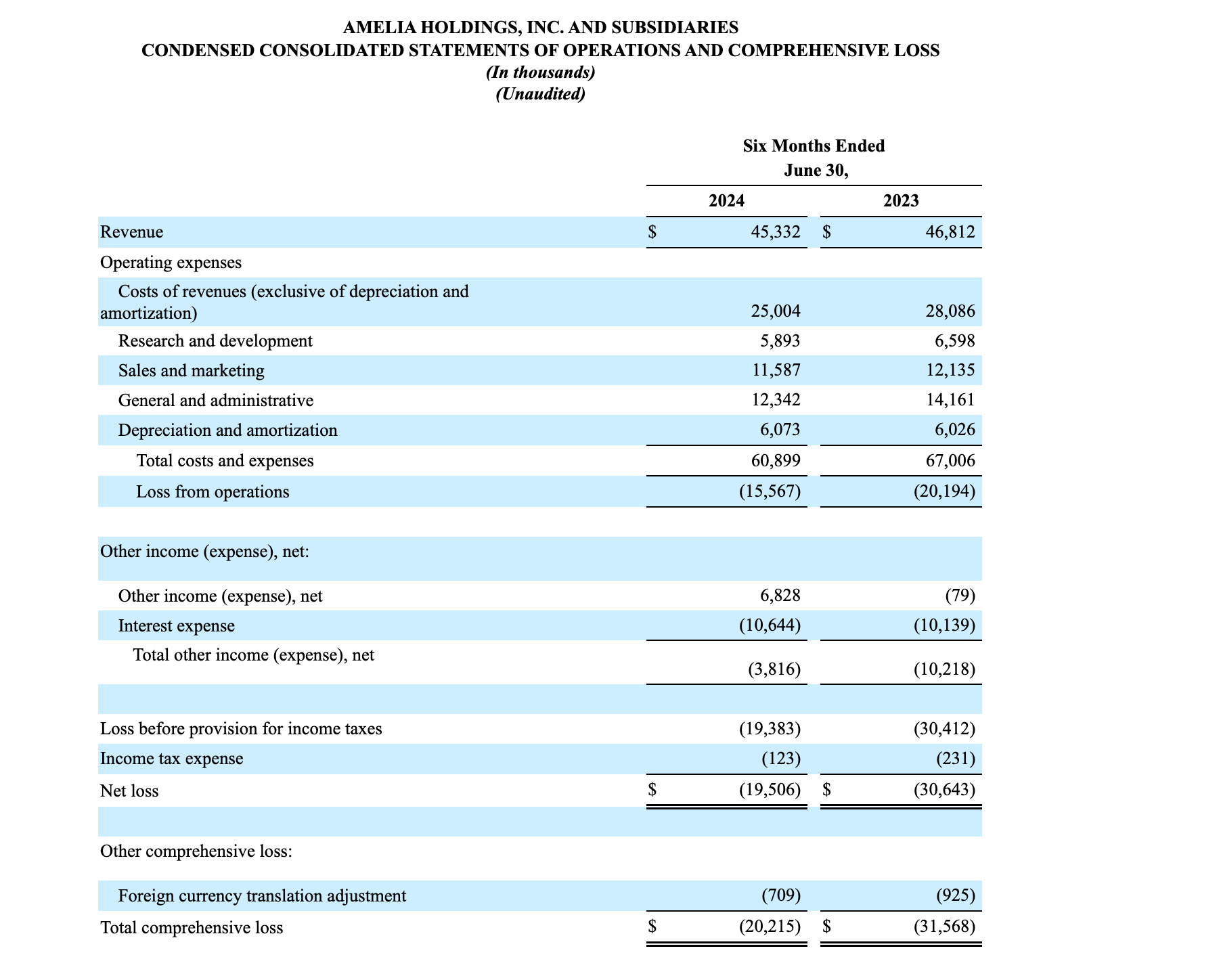

Now the unaudited H1 2024 numbers:

This is legit a 25%-30% GM biz that is not growing. I don't know how you can call this SaaS. Taking account for the current SOUN share price the contingent consideration makes this like a 7x EV/Sales transaction for a negative growth biz with real GM% that is sub 30%. That's like paying 21x EV/Sales or basically buying a top 2 rev multiple public SaaS darling today.

I’d also note the SYNQ3 acquisition generated $2.8ml in q3 down 20%+ yr/yr.

This is what is going to take on Brett Taylor and the hot competition in this space?

Get real!

IT'S A SARDINE

Yea, I get it, but two things stand out on this one.

1) THE DISCLOSURES BY CEO ARE JUST SO UNECESSARILY MISLEADING.

YOU ARE A SARDINE JUST EMBRACE IT.

2) DAN IVES RECOMMEDNING IT AS AN AI SLEEPER.

YOU THRIVE OFF COVERING THE REAL AI MARKET DARLINGS AND LOOK SUPER STUPID RECOMMENDING SOMETHING THAT IS LEGIT A WORSE AI LOSER THAN CHEGG AT $8BL.

Sardines are almost totally arbitrary these days, but when mgmt and a sell-side celebrity choose disclosures/analysis over meme behavior you can legit call it out.

The way I see it; Ives is drafting his coverage of AI darlings to generate fees off this name. There is no way he can honestly defend this thesis. And if he was some analyst who nothing else to cover but businesses like this that would be no big deal, but when you cover the MAG darlings picking the most obvious AI loser and calling it a sleeper winner is unacceptable.

SOUNDHOUND was a bespoke voice recognition tech player when AI Voice needed that, but LLM's have introduced tech that is 10000x better for everyone at a fraction of the cost. This is why they are losing big clients and even their diminished music recognition app has experienced a total collapse (-52% Q3) in monetization. They have been totally commoditized and thus are the exact opposite of a sleeper.

Anyway, Sardines are going to do their thing, but this is obvious as hell.

`