Razor's Edge: Profitable SaaS Short Pitch

Shorting unprofitable tech on high sales multiples is largely played out. Focusing on SaaS, most names in this category now trade well below 5x sales with many hated names as low 1-2x. Risks in this category have now shifted in direction of potential positive catalysts with respect to cost cutting or even consolidation. Thus, if you are looking for short exposure you are left with a small subset of darling hypergrowth names to pick on which generally are more challenging or the highest quality profitable software companies at somewhat elevated earnings multiples. The latter probably still skew short on macro as ServiceNow demonstrated this week, but I think one can do better.

What I Went Looking for?

- Profitable SaaS names with well established EBITDA margins/FCF that are richly valued vs broader tech and against profitable peer group

- Names that might fall into a category of owner complacency over the long bull cycle due to the stable and consistent nature of their growth and unit economics

- Names that are more levered to macro vs some sort technological transition/spend prioritization

- Names where there might be an angle to sink teeth into that market has largely ignored up until now

What I Found?

Payroll/HR SaaS: Paycom & Paylocity

- Secular and durable 25%-30% growers pre-covid

- Consistently profitable with 30%-40% adj ebitda margins

- US market pure plays directly levered to employment growth in smb/mid market

- High shareholder complacency as result of all the above and likely illusion of safety as unprofitable growth at any cost SaaS has become anathema

- Aggressive accounting dynamics with respect to deferred contract acquisition costs which overstate profitability and make these names actually overvalued compared to other tier 1 profitable SaaS

Paycom & Paylocity Short Thesis

Background

- These are payroll/hr saas companies that recognize revenue based on a per employee payroll processing basis with added upsell around HCM suite adoption

- I estimate that PAYC/PCTY process payroll for roughly 10ml United States employees with the split being 3ml+ for pcty and 6ml+ payc

- I put avg rev per employee at just under $20 a month with full HCM suite adoption at roughly $35+

- Customer wins for both have largely come at expense of service bureaus ADP/Paychex and regional providers or in house solutions

- High end of enterprise market Workday/Ceridian and right below them Ultimate Kronos Group. On lowest end you have Paycor which plays in segment below Paylocity.

- PCTY avg customer size 100+ employees and Paycom at 160+(300+ parent company level)

- Paycom has been a 30% grower with roughly 40% adj ebitda margins throughout the SaaS cycle and Paylocity 25% with close to 30% adj ebitda margins. Both names been quite durable and exceptional performers (both are top five in software returns last 5yrs) thus popular amongst long only SaaS profit sensitive bunch.

Short Thesis

1) Stocks look ok vs profitable peers on adj ebitda basis but are about 2x as expensive on FCF basis which I believe is unwarranted in this tape.

2) Companies were hit by Covid layoffs and have v shaped bounced back on domestic payroll rebound and as payroll adds have notably slowed last few months and likely to get worse going forward they are facing clear and obvious headwinds and consequently slowing top line growth.

3) Despite being categorized as SaaS, these are still more like BPO hybrids with high customer support nature. Sales commissions are significant and so are internal software development costs both of which are capitalized in manners that boost profitability vs SaaS peers. FCF generation captures this difference, but I’d argue that for the shareholder base this has not been a focus, and they have simply been comfortable with the predictable growth and ebitda margin profile throughout the SaaS bull mkt. Thus, I believe the stocks are susceptible to increasing scrutiny which is likely to come into focus as macro headwinds mount.

Valuation

Both Paycom and Paylocity trade at just over 40x adj ttm ebitda and have recently printed 30% recurring rev growth quarters. This would put them in the higher end of range of profitable established software names, but not exactly outliers. However, on a ttm FCF basis, Paylocity trades at 102x and Paycom at 84x.

Compare them to profitable software peers (July 15th):

|

Profitable Software |

EV/ TTM FCF |

|

MSFT |

29X |

|

ADBE |

24X |

|

CRM |

29X |

|

ORCL |

21X(normalized) |

|

INTU |

30x |

|

WDAY |

23x |

|

NOW |

41x |

|

TEAM |

60x |

|

VEEV |

37x |

|

ZM |

15x |

|

Avg |

30x |

Outside of Microsoft and Oracle, everyone on this list had trailing growth of at least 20% vs Payc at 25% and Paylocity rebounding to about 30% for fiscal 2022 ending in June. These are sharp rebound numbers for these names as growth came down to low teens in the 12 month period post covid.

I don’t see how these names deserve to trade at 3x the peer avg assuming durable 20% topline growth going fwd, and I definitely don’t think they deserve to trade here with employment headwinds ahead.

You could make the case that Paycom, for example, deserves to trade at 2-3x Zoom’s multiple if its growing almost 3x as fast and has roughly the same adj ebitda margins. However, 6-7x Zoom’s multiple on FCF just seems ridiculous in this tape.

Macro Headwinds On Employment Around the Corner

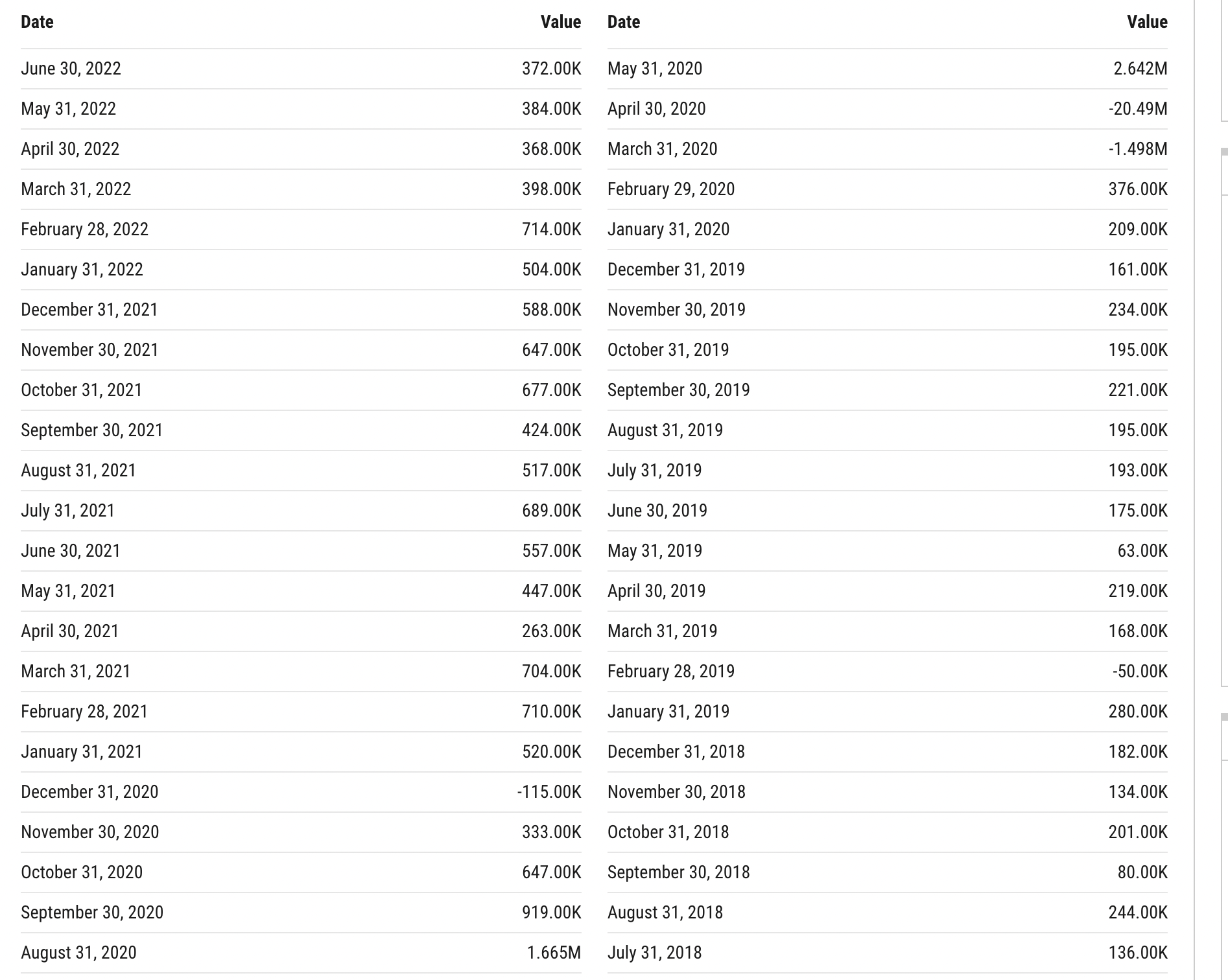

This is non-farm payroll data since covid…

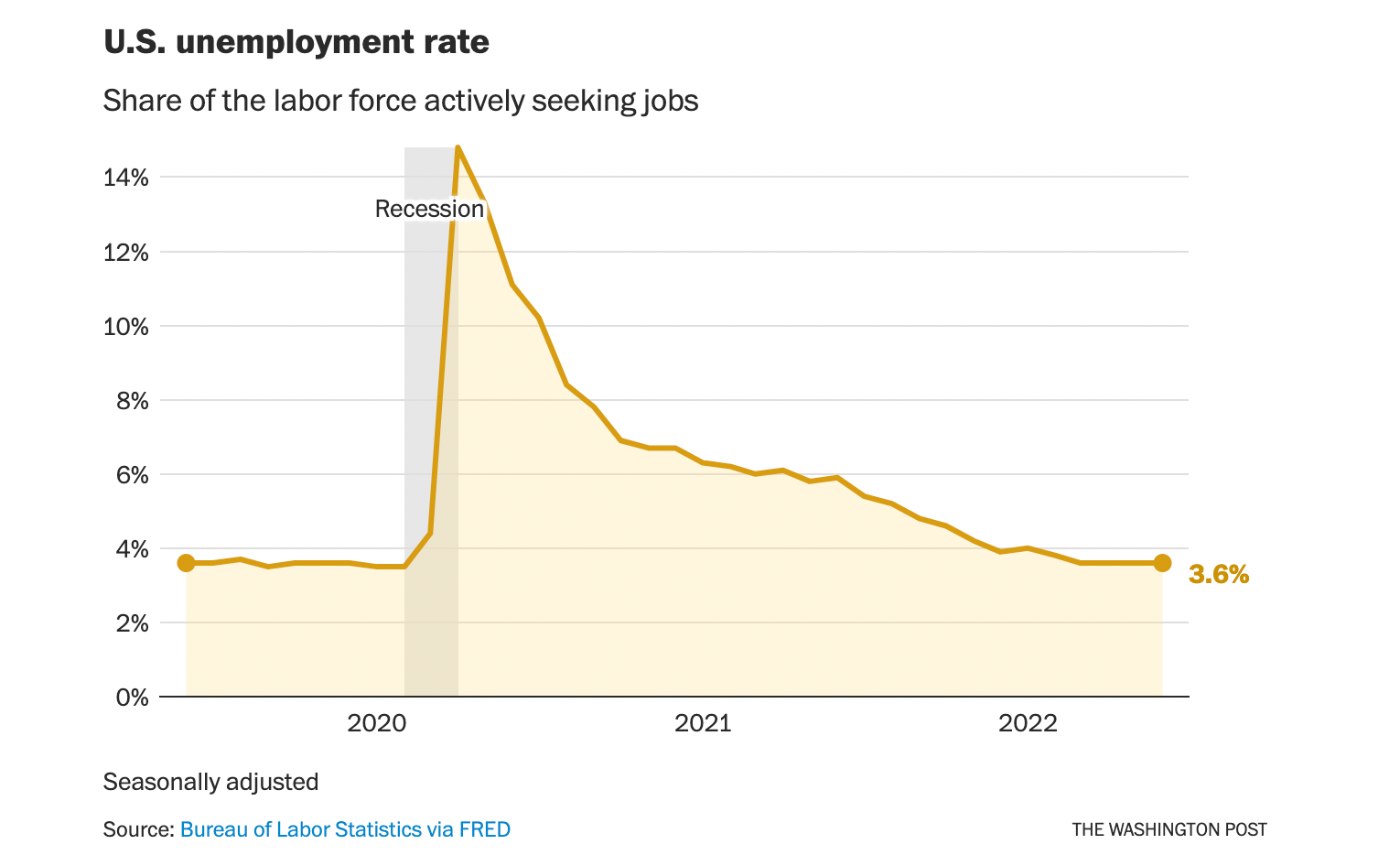

This is the unemployment rate…

The private sector has now recovered all the jobs lost since Covid and added roughly 200k more. Government is still down a little over 600k, so overall payrolls are still shy of pre-covid levels, but that should be done by September.

So, what does this mean for Payroll SaaS?

Both Paycom and Paylocity saw their growth rates cut in half due to the initial Covid employment blip and then sharp reversal and have reaccelerated to roughly 30% growth with the lag effects and comp dynamics since. With payroll growth now trending about half the avg since their last reports and trending lower, I imagine current forecasts for revenue growth likely face decent risks of coming in below 25% on a fwd 12 month basis. So, if you just want to play the macro here in some expensive SaaS stocks, you are getting good leverage to that theme in this short.

Profitability Overstated By Unique Outlier SaaS Accounting

I’m valuing all profitable software names on actual FCF these days, so adj ebitda isn’t exactly something I care out. But I do recognize that might not be the case for many investors, and thus I think it's important to take a close look at the Payroll HR SaaS names accounting.

One of the main reasons these names have very high ebitda margins is that they capitalize and amortize deferred contract acquisition costs (sales commissions) over a much longer estimated customer life time period than other SaaS companies. Paylocity, for example, uses a 7yr life for their customers. Paycom uses 10 years. The typical profitable Saas company is at 1-5yrs. Veeva is 1-3yrs, Zoom is 3 years, Salesforce 4 years, and Workday and ServiceNow 5 years.

What is being capitalized here is not trivial and thus does have a material impact on profitability. In Paycom’s case, they capitalized deferred contract costs equal to 10.5% of revenue last quarter. Paylocity’s number was a little less clocking in at 8% for the 9 months ended March 30, 2022. Compare that to Zoom which is selling phone aggressively right now at a little over 5% or Workday at 3% or Veeva under 1%. Considering the relative size of these costs the fact that Paycom is using a 10yr amortization period is material to profitability and big reason why Zoom converted nearly 90% of EBITDA to FCF last year vs 47% at Paycom and 49% at Paylocity.

I’d also point out that these companies don’t typically sign long-term contracts with customers. Paycom’s customers can cancel with 30 days notice and the majority of Paylocity’s customers can terminate with 60 days notice.

From Paycom’s 10-k:

The contract period for substantially all contracts associated with these revenues is one month due to the fact that both we and the client have the unilateral right to terminate a wholly unperformed contract without compensating the other party by providing 30 days’ notice of termination. Our payroll application is the foundation of our solution, and all of our clients are required to utilize this application in order to access our other applications. For clients who purchase multiple applications, due to the short-term nature of our contracts, we do not believe it is meaningful to separately assess and identify whether or not each application potentially represents its own, individual, performance obligation as the revenue generated from each application is recognized within the same month as the revenue from the core payroll application. Similarly, we do not believe it is meaningful to individually determine the standalone selling price for each application. We consider the total price charged to a client in a given period to be indicative of the standalone selling price, as the total amount charged is within a reasonable range of prices typically charged for our goods and services for comparable classes of client groups

I do believe that despite not having long-term contracts and customer retention rates in low 90%’s payroll saas companies should be able to use longer term useful lives when amortizing contract costs, but I think anything over five years falls into the category of higher scrutiny as it can overstate true profitability.

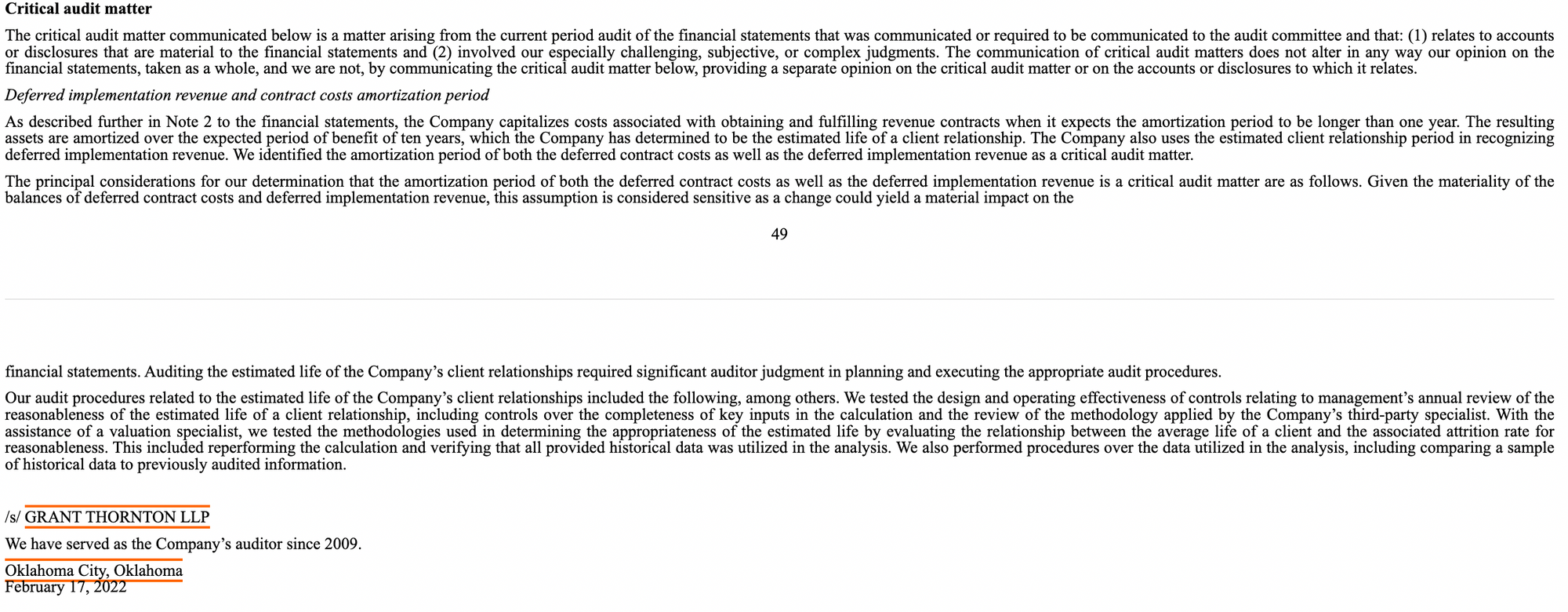

It would appear Paycom’s auditor would agree here as the customer life of 10yrs has been flagged as a critical audit matter.

So, that’s one reason these companies report optically appealing ebitda margins despite far lower fcf conversion. The other reason is they capitalize a disproportionate amount of software development costs relative to r&d expenses.

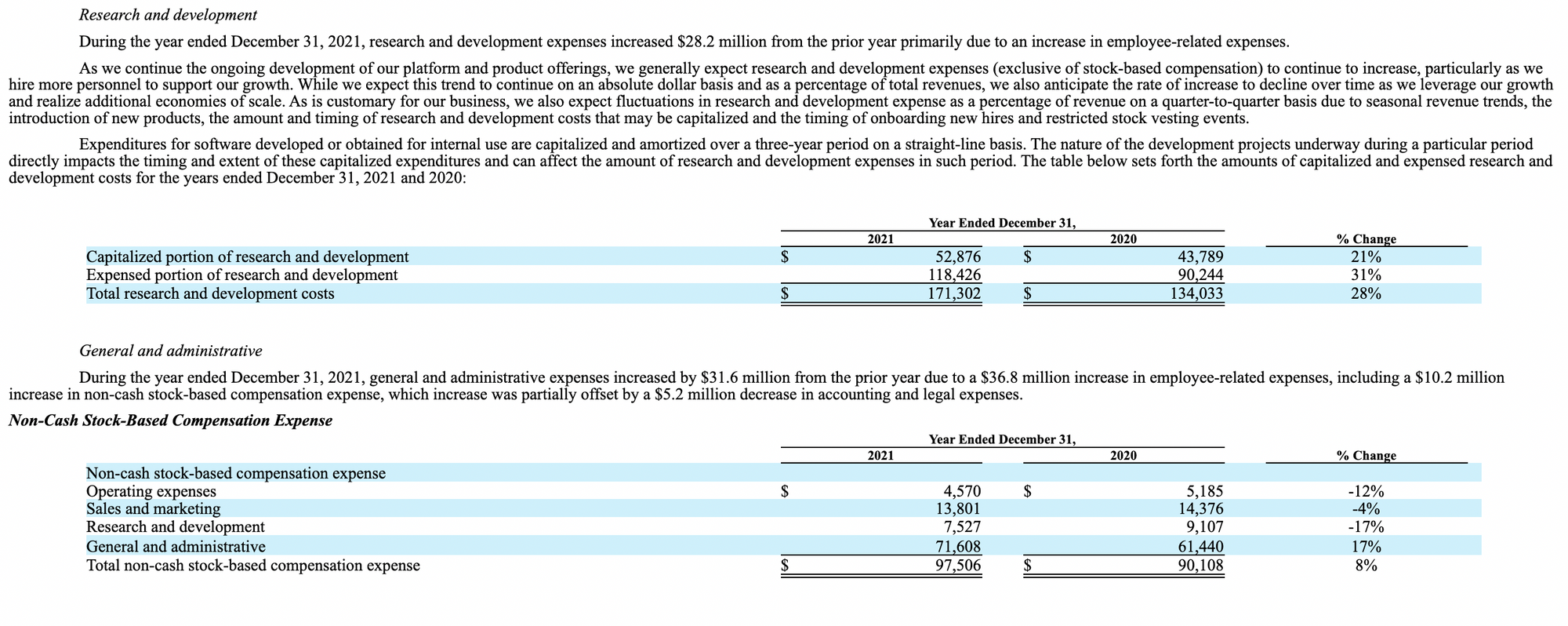

Paycom, for example, capitalized $52.8ml worth of software “developed or obtained for internal use” last year. That worked out to 30% of their total r&d expenses or roughly half what was actually expensed. These costs are amortized over 3 years. Paylocity also is capitalizing 30% of r&d total costs as well as some internal software development costs to cost of goods sold. You can compare this to a Zoom that capitalized just over 5% of r&d spend on internal use software last year.

To be clear there is nothing wrong with this. I am not going the activist short route here and asserting that this is some sort of shady action by management, but rather just pointing out the obvious. These stocks are very expensive on a FCF basis vs an earnings/ebitda basis when compared to peers because they clearly have running operational costs unique to their more BPO SaaS nature which they choose to capitalize in what some could argue is a quite aggressive manner. In this target rich appealing valuation environment in tech and honestly the broader market at this point, that makes them clear short candidates.

Conclusion

Obviously shorting shitco’s or structurally challenged businesses is more appealing to most investors, but the reality of this tape is that has become far more challenging. If you are in the camp that was has transpired over the past 9 months is more akin to a bubble popping and a wholesale rerate of how certain thematic tech businesses have been valued for more than 5 years, then I think you need to consider these names as appealing shorts. They are likely 25% over valued if they remain steady 20%+ growers, and possibly up to 50% overvalued near term if you believe growth could modestly decelerate due to slowing job growth in the overall U.S. economy. As far as risks to the thesis, I don’t see that many here. They will benefit from higher rates on their float balances, but at these valuations that is not going to be needle moving. They also likely facing 5yr fwd growth cagr headwinds that are under-appreciated right now with respect to market penetration/competitive landscape if you want to dive deeper. And I think anyone familiar with this sector can make a compelling over earning argument based on how costs are managed in this space. I also think if you consider these have been passive mutual fund favorites that you have I nice set up on your side if you believe we are not far (my guess is September) from a negative jobs print.

Anyway, I've kept the thesis simple as I think that's what matter most here, and simply believe that you want to be short these names over the next 6-9 months.

(note: I left paycor out of this pitch cause its the smallest and least liquid)