Razor's Edge: Old Invitae Short Thesis

“We have been living and illusion that revenue and growth equals success. Even the press goes for it”

-Bill Gurley

1) Invitae: The Amazon of Genetics?

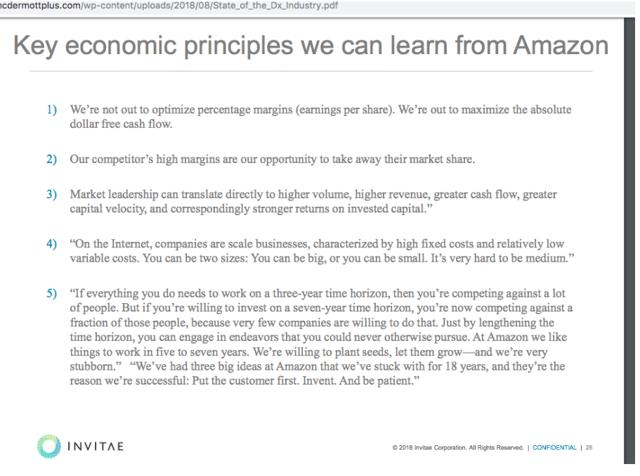

Invitae’s social mission is to provide affordable genetic testing for all. This has somehow earned them an Amazon.com moniker. Basically, near-term losses are a path to market share, economies of scale, and network effects. This will subsequently translate into dominant market share and once in a lifetime returns for shareholders. Management has readily encouraged these comparisons to the Internet giant.

They even include them in their investor presentations…

So, how is Invitae’s financial model like Amazon’s?

The short answer is it’s not!

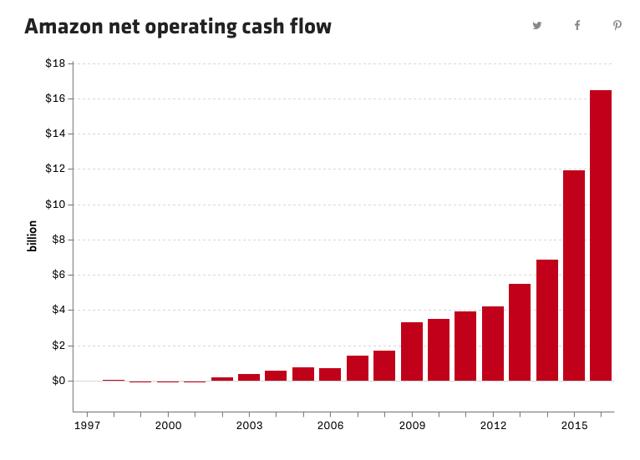

Here is a chart of Amazon’s net operating cash-flows since going public:

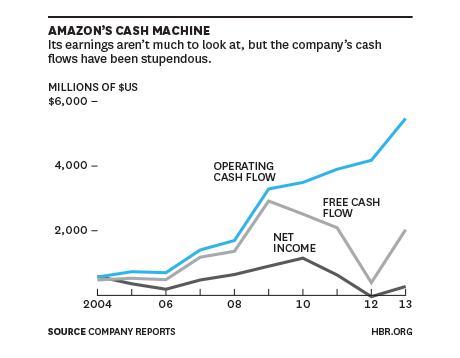

While Amazon’s ho-hum net income has tended to grab the headlines, Amazon’s robust epic cash-flow has been the secret to their success and the envy of all competitors. This HBR article titled,“At Amazon, It’s All About Cash Flow”, does an excellent job of nailing the main economic driver behind the company’s success.

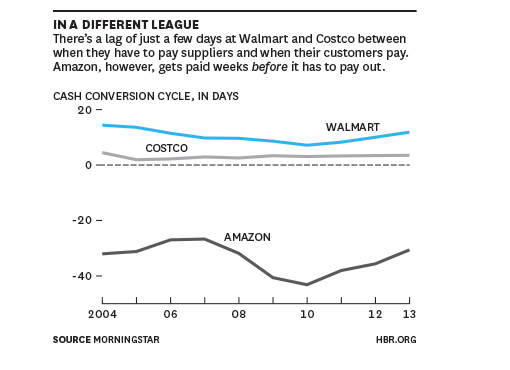

Here is table showing Amazon’s cash conversion cycle (CCC) advantage, only Apple has been better:

Amazon takes a very long time to pay suppliers, and this uniquely negative working capital model has been used to internally fund growth. So, while some companies may try to make Amazon compares based on ‘customer first mantra’s’ justifying near-term investment, these are utterly worthless without the well-oiled financial machine that has been Amazon’s operating cash-flow. Dubbing Invitae “the Amazon of Genetics” is a classic example of this folly. (Other recent notable market follies like this include Jumia as “the Amazon of Africa”.)

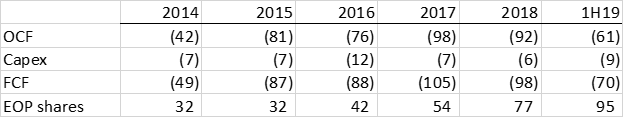

Here are Invitae’s key cash-flow statement metrics as well as shares outstanding since going public:

Source: NVTA 10-k’s

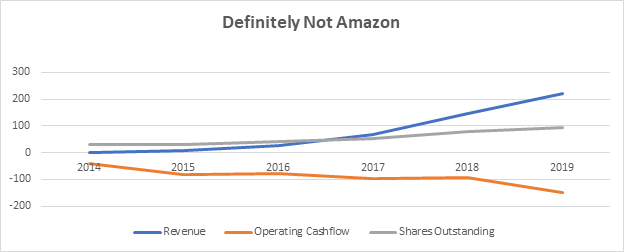

Note that share count has tripled as burn has risen. Visually, Invitae’s financial model looks like this:

Investing long-term in Amazon has been akin to buying 1 cheap ticket for unlimited rides that just keep getting better and better over time. On the other hand, investing in Invitae, is tantamount to having to regularly buy additional and ever more expensive tickets for a ride that just gets worse.

Amazon became the dominant company in its industry by competing against disadvantaged companies (bricks & mortar retailers), exploiting a uniquely negative working capital structure to fund its growth, and benefiting from network effects in its third-party merchant business. Invitae shares none of these characteristics.

To be like Amazon and thus justify investors turning a blind eye to mounting losses, Invitae would need to demonstrate some sort of unique cost advantage over industry peers as well as some sort of financial model akin to Amazon’s highly negative cash conversion cycle vs. brick and mortar competitors.

Where exactly is Invitae’s cost advantage?

Sequencing Machines and microarrays are purchased from Illumina, at the same price as other companies pay, so are reagents/vials and other consumables. Lab personnel salaries are similar, and NVTA’s lab is in a high-cost location (San Francisco). So, arguing that they are disrupting the industry on cost structure is not exactly a compelling evidence backed thesis

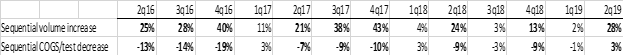

However, as Invitae has achieved test volume over the past two years, they have regularly cited COGS per test as their main operating metric to measure the progress of their model.

Source: NVTA Investor Presentation

We find this somewhat misleading.

When Invitae had virtually no test volume they still had the same fixed cost overhead, so achieving notable fixed cost leverage as volume has notably risen isn’t akin to developing a cost advantage.

This is why COGS have started to drastically level off.

While the company blames stock compensation for the rise in COGS last quarter, the fact is that cost declines have all but disappeared– last quarter showed the LOWEST cost improvement that NVTA has ever recorded for a quarter with robust volume growth, as shown below:

In the past 8 quarters that NVTA has shown a volume increase over 12%, their sequential cost/test DECLINED by an average of 11%. This quarter, with a huge 28% sequential volume growth, their costs INCREASED by 3%. Even ignoring stock compensation, average test cost declined UNDER 2%.

So, while it’s very clear Invitae lacks the critical and unique Amazon financial model needed fund a virtuous cycle of investment. It’s also becoming evident that with respect to genetic laboratory diagnostic test costs, they have no cost advantage over other competing labs. In fact, their leading competitor in the space presently has a COGS that is 38% below theirs. (MYGN FISCAL 2019 COGS per test $157-source 10-k)

While we fully grasp the ‘fool’s gold’ appeal of likening investing in a genetic laboratory diagnostic company to Amazon.com in its early days, we are still surprised at how long this narrative has gone on without drawing some sort of meaningful market scrutiny. We have read nearly a dozen bull pitches on Invitae and have yet to come across one that compares the company to its relevant peers. This is shocking considering the nature of Invitae’s core business, and the fact that their most notable competitor is publicly traded.

2) Invitae vs. Myriad Genetics

Myriad (MYGN) scientists discovered the BRCA1 gene associated with hereditary breast and ovarian cancer in 1994. In 1996, they introduced the first molecular diagnostic test for hereditary breast and ovarian cancer. This BRACAnalysis test became the standard of care for determining an individual’s risk of developing these hereditary cancers. Myriad held a nearly two-decade monopoly on these genes until the Supreme Court invalidated their patent in 2013.

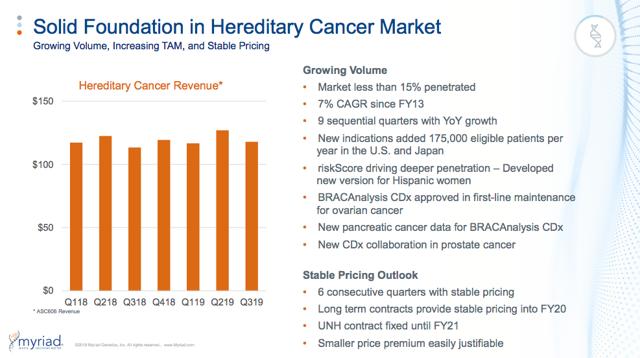

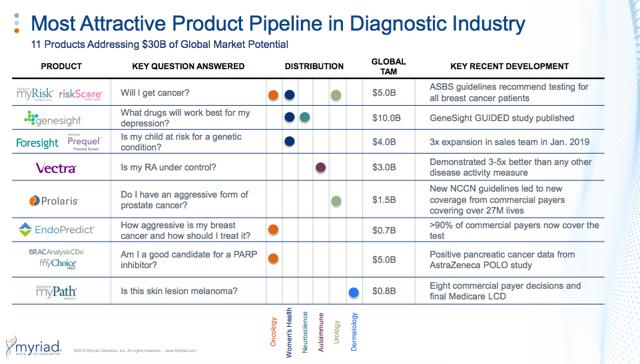

This is a snapshot of Myriad’s business looks like today:

Invitae vs. Myriad- The Business

-While its patent for these genes was overturned by the Supreme Court in 2013, Myriad has a data library of nearly two decades of BRCA tests, allowing it to make superior decisions on less common genetic indicators, known as “variants of unknown significance”

-Myriad has decided NOT to share its library of over 60,000 unique genetic variants, giving them a large repository of unique data that is not open to its competitors. To understand the importance of this database,“in the last year alone, Myriad issued more the 20,000 amended test reports based on this data, and has reported that over a 10-year period 25% of all reported variants of uncertain significance were reclassified.”

-Myriad’s business strategy has been to maintain pricing power in their hereditary cancer business as their test remains the gold standard, and to use operating cash-flow to diversify their genetic testing franchise.

-Invitae’s business model has been dependent on a strategy of underpricing Myriad (despite having higher costs) in order to try and capture volume. Invitae then sells a story of future profitability from having an Amazon-like industry cost advantage and monetizable data to fund these losses while conveniently leaving out that there already exists a company with the volume and data moat in the very market they are chasing.

- Once could easily speculate that if Myriad decided they wanted to adopt the vague yet enticing Amazon/FANGy Invitae investor pitch tomorrow, Invitae would literally have no story to sell to investors.

Invitae Has Been Drafting Off Myriad

Invitae’s business model thus far has been to aggressively undercut pricing on Myriad’s leading Hereditary Cancer franchise. To grasp this one simply needs to look at the large pricing disparity:

-Myriad HCT test volumes for fiscal 2019 were 255,000 which works out to an ASP of roughly $1,900.

-Invitae conveniently stopped disclosing HCT volumes 3 years ago, but there is enough data to estimate the difference. Based on Medicare pricing, Medicare disclosed revenue by code, the fact that reproductive health is their second biggest test volume business after HCT, and their blended average disclosed test ASP’s, we estimate Invitae’s HCT ASP’s are 25%-33% of Myriad’s.( Their current Medicare reimbursement rate is $755 or 40% of Myriad’s while overall disclosed ASP per test is $471 or 24% of Myriad’s)

To be clear, this is a major flaw in Invitae’s business model that doesn’t get much attention, since this approach cannot be extended to other areas of testing. Myriad’s strategy in HCT has been to protect price for as long as possible, and Invitae has been the ONLY company willing to aggressively fund a loss-making volume play in this area.

-HCT, particularly breast cancer, has really been the only segment in hereditary disease genetic diagnostic testing with high volumes and clinically-useful results thanks to Myriad’s development of the space.

We can find no other segments of the genetic diagnostic market that currently have such a price discrepancy, such that Invitae could gain market share simply by pricing at a steep discount to the leading players:

-Genealogy has the consumer giants Ancestry.com and 23andMe and is highly price-competitive

-Companion diagnostics and somatic NGS testing have both diagnostic giants and specialists like Thermo Fisher, Roche, Agilent, Illumina, Qiagen, Foundation Medicine, Molecular MD and even Myriad now as well

-Prenatal, which Invitae has recently entered, has Sequenom (owned by Labcorp), Verinata (Illumina), Ariosa (Roche) Counsyl (Myriad), Natera, Progenity, and countless others

The genetic diagnostic testing space is a highly competitive market. So, volume growth for Invitae beyond what they have achieved in HCT would require significant operational differentiation, as pricing is already quite aggressive. Unfortunately, Invitae lacks this requisite differentiation and simply has chosen to focus on price.

Meanwhile, Myriad has weathered volume and pricing pressures in their hereditary cancer business…

And used this operating cash flow to diversify their business…

- 75% of Myriad’s test volumes and 46% of revenue now come from outside the core hereditary cancer franchise

Invitae vs. Myriad- The Investment Case

To be clear, Myriad is not a very popular stock. The company’s recent aggressive push into psychotropic gene tests for antidepressants is not without controversy and has attracted short-sellers. However, when compared to Invitae, Myriad looks like a seriously mispriced and undervalued asset.

-Invitae’s stated goal is to use low pricing to grow volume and reduce costs to eventually achieve economies of scale. Myriad is already far ahead in this race: Invitae’s cost per sample was $252 in their most recent quarter, while Myriad’s cost per sample was $158.

- Myriad presently has a unique (and controversial) data advantage. Even if Invitae catches up on the cost structure, Myriad will retain its data advantage. This advantage is so obvious and important that Invitae and other competitors/academic labs are publicly sharing hereditary cancer variant data to attempt to close the accuracy gap.

-Myriad has leveraged this competitive edge in hereditary cancer screening and profitability to diversify into prenatal carrier screening, companion diagnostics for cancer, genotyping tests for psychotropic drug selection for depression, RNA expression tests for breast/skin/prostate cancer, and protein quantification tests for rheumatoid arthritis.

When we first opened this position, Invitae’s EV was amazingly $500ml greater than Myriad’s. A remarkable distortion considering we don’t believe Invitae’s entire business warrants even a $500ml EV. But as of this writing here is how the two financially stack up…

-Myriad has $850m of ttm revenues, $125m of adjusted net income, bought back $50m in stock over the past 12 months, and is valued at an Enterprise Value of $2.1B.

-Invitae has $175m of ttm revenues, $150m of net LOSSES, issued $185m in equity and $340m in converts over the past six months, and also has an Enterprise Value of $2.1B

Which Business Would You Rather Own?

3) Medicare Fraud for Hereditary Cancer Testing Has Recently Exploded

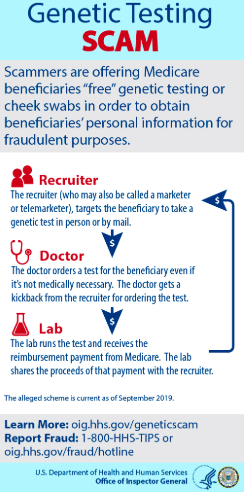

THE DOJ just arrested 35 people in a record $2.1 billion genetic cancer testing fraud of Medicare.

The Office of the Inspector General issued an official warning on the matter

“ But in 2018 we started to get an explosion of complaints [from Medicare beneficiaries],” said Shimon Richmond, assistant inspector general for investigations at Health and Human Services’ Office of Inspector General. He called genetic-testing scams a “pervasive problem all over the map,” prompting the federal agency to start issuing fraud alerts over the summer.Complaints about genetic-testing fraud soared to 50 a week compared to one a week, said Richmond, the former special agent in charge of HHS-OIG’s office in South Florida.

The BBB has done the same. Journalists are starting to look into the fraud in the space.

Here is a nice slide from the OIG that demonstrates how this fraud works:

This news is relevant to Invitae investors because Medicare revenue is a large share of overall revenue and even larger share of gross profit. Invitae’s Medicare financially disclosed revenues were 22% of overall revenue in 2018, and 23% of revenues in Q2 2019. Based on Invitae’s disclosed average revenue per test, PAMA ( The Protecting Access to Medicare Act) set pricing for their HCT test in 2019 of $755, and the assumption that HCT testing is the overwhelming majority of Medicare revenues one can estimate that Medicare accounted for 33.7% of Invitae’s gross profit in their most recent quarter. Invitae’s Medicare revenue grew 86% in their most recent quarter vs. 43% for the overall business.

Compare this to Myriad which derives roughly 7% of total revenues from Medicare, and whose Medicare HCT volumes account for only 1% of total test volumes and 3% of overall revenue and have been declining.

A notable crackdown or policy shift by Medicare is a MAJOR risk to Invitae’s already structurally unprofitable and unsustainable business model.

4) What’s Going On With Medicare Coverage Risks For NGS Hereditary Cancer Testing?

-While PAMA ensures Medicare reimbursement rate declines will step up to 15% in 2020, this is not Invitae’s biggest problem. The bigger risk is that Medicare coverage for a large portion of Invitae’s tests might be removed.

-In January of 2019, Medicare contractor Palmetto GBA revised a local coverage determination (LCD) for BRCA1 and BRCA2 genetic testing to restrict coverage for NGS panels when performed in individuals with early-stage disease. Palmetto's revision came at CMS's direction to align the terms of the LCD with a National Coverage Determination (NCD) it issued a year ago for NGS testing for advanced cancer patients.

-The Center for Medicare & Medicaid Services (CMS) reopened the NCD for public comments in May, and the language used suggests the agency is trying to narrow the terms of its NGS national coverage policy to focus just on somatic and germline testing when done in advanced cancer patients to guide therapeutic decisions, and specify that all other types of NGS assessments, including testing performed on early-stage patients for cancer risk assessment, are not within the scope of the coverage terms. A draft decision is due Oct 29.

While it’s unclear how much of a factor Medicare HCT fraud factored into this January decision, the recent revelation of just how pervasive this genetic testing HCT Medicare fraud has become is difficult to ignore.

Considering the nature and size of Invitae’s Medicare hereditary cancer testing business, a narrowing of terms by CMS would significantly impact their revenue and gross profits going forward.

In NVTA’s own words:

An interpretation of the NCD that results in Medicare non-coverage for our current and future assays would have significant negative impact on our business, financial condition, and results of operations.

5) The Overall Economic Landscape of the Space Is Unappealing and Serious Questions Are Being Raised About the CLINICAL Usefulness of These Tests

Cheap venture and public market capital has created an extremely unappealing investing landscape There are 15 new panel tests introduced each week with over 70,000+ tests on market. There are too many labs chasing too little volume (most rare disease tests have virtually no volume), which has eroded pricing. The scientific validity and usefulness of these tests is highly questionable. In a recent 21 gene test for Brugada Syndrome curated for clinical validity, biocurators classified only one gene (SCN5A) as Definitive evidence, while all other genes were classified as Disputed with regards to any assertions of disease causality for BrS.

“The cost of indiscriminate expanded panel testing, aside from the financial implications, lies in the return of variants of uncertain significance (VUSs) to health care providers with limited understanding of their meaning. In the study by Beitsch et al,1 the 54% of patients who were found to have VUSs is unacceptably high. These results take time to interpret and explain to patients and may require follow up, additional testing, or review in case of reclassification.6 Of even greater concern, results are frequently misinterpreted, leading to inappropriate clinical management. Kurian et al7 found that many surgeons managed patients with BRCA1/BRCA2 VUSs in the same manner as patients with BRCA1/BRCA2 pathogenic mutations, and one half of average-risk patients with VUSs underwent bilateral mastectomy, which suggests a limited understanding of results among both surgeons and patients.”- Journal of Clinical Oncology 37, no. 24 (August 20, 2019)

In other words, finding a historical correlation of a genetic sequence with a disease state is only useful if it is accurate and changes the diagnostic and treatment action plans. Otherwise, it is just cost with no benefit! Many tests have false positive rates in 20%-30% range yet there are no mechanisms in place for accountability. Signs that managed care providers have had enough. Laboratory benefit management programs have been cracking down on carrier screening tests reimbursements. Germline testing and CMS crackdown indicate coverage may narrow and reimbursements continue to fall. After making it easier for genetic test providers to get tests approved a few years ago, the FDA has been getting more vigilant and is cracking down on marketing for pharmacogenetic tests without robust clinical evidence.

Also clear financial evidence of a deflating bubble is mounting……

Gene sequencing giant Illumina recently warned on sales and cut its revenue growth projections in half. Qiagen also recently warned on demand and has decided to cease development of their Genereader sequencing instrument, and instead entered into a 15-year partnership with Illumina to develops NGS in vitro diagnostic kits. Color Genomics recently pivoted. It began by offering doctor-prescribed tests to consumers, but in January it said it would shift focus to partnerships that incorporate genetic testing into primary care for large numbers of patients. Helix, which launched in 2015 with $100 million from Illumina, had planned to sell tests directly through an “app store’’ for DNA. Instead, it’s now looking to partner with health-care providers. Illumina recently ended their partnership. In the largest junk bond deal of the year, Ancestry.com’s private owners are seeking approval for a $900m one-time dividend. This is a standard pre-ipo move which means 23andMe can’t be far behind either. These giants are going public at a time when their core market is slowing and will likely enter the commodity genetic diagnostic space aggressively.

6) Against This Difficult Backdrop Invitae Has Decided to Aggressively Push Into DTC and Pre-Natal Tests

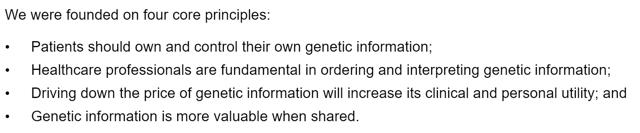

Invitae used to list these four core principles in their 10-k:

More recently, they removed this from their financial filings, perhaps because they are contradicting one of their founding principles with their new DTC offering, announced this June:

Invitae introduces new service to make it easier for consumers to receive the medical genetic testing that experts trust

- "The new service allows consumers to initiate and order themselves..."

- We believe this step was necessary in order to keep growing revenues, especially after 1Q19’s large shortfall. But, is this truly in patients’ best interests, allowing them to choose from a menu of genetic tests that a physician likely has deemed unnecessary? Or is this actually in the interest of keeping revenue growth strong enough to justify the demands of its shareholders? Equally as important, by entering DTC, Invitae is competing with the highest volume players in the industry, by far: 23&Me and Ancestry.com. Both have recently signaled that they plan to diversify aggressively into health side of the market in order to offset slowing growth in the ancestry space. This strategically indefensible DTC battle will likely be a prohibitively expensive one for Invitae investors.

Their timing is also not very good as the DTC space is both slowing and getting a lot more crowded….

Orasure, the leading test vial provider, recently reported that its Q2 genomic products revenues dropped 7%. As ancestry is falling off, a slew of new companies are addressing DTC genetic panels, per OSUR commentary:

The human genomics markets continue to moderate since our last earnings call.

Historically, ancestry testing has been the largest part of the human genomic market and a key driver of our business. Some of the larger players in this area have reduced the promotional support and change their business models to focus either on health offerings or therapeutic discovery and development.

The high cost to compete in this consumer market has also in our view, negatively impacted the submarket. Although our business was specifically impacted by lower revenues from a large consumer genomics customer changing its promotional strategy and ordering patterns, we are now seeing additional consumer genomics customers reevaluating their business models in an effort to be more competitive. We see these ancestry submarket trends continuing for the foreseeable future.

Nevertheless, other subsets of the genomics market are more robust with higher growth prospects, mainly in the area of disease risk management and companion animal in lifestyle testing. Disease risk management encompasses genetic tests that provide information about an individual's health risk, including an individual's predisposition to diseases such as cancer and carrier status.

We continue to see a steady increase in the number of consumers in this area and expect the growth potential in future periods will be significant. In fact, during the second quarter, 15 of our top 20 customers based on a trailing 12-month revenues were in disease risk management submarket.

And more than half of the 45 new commercial genomics customers added during the second quarter were in this category. We are now seeing more customers in the disease risk space moving to patient-initiated model where the test results are given back to the patient through a medical practitioner.

For example, one customer recently announced a patient-initiated service to provide consumers with genetic testing along with telemedicine enabled clinical guidance and the ability to share the results with the consumers' personal physician. We expect other companies to pursue similar patient-initiated offerings.

Invitae’s Entrance Into The Pre-Natal Market Is Risky

The pre-natal genetic testing space has IP cost barriers. In the landmark Myriad decision, the Supreme Court held that “A naturally occurring DNA segment is a product of nature and not patent eligible merely because it has been isolated, but cDNA is patent eligible because it is not naturally occurring.” Non-invasive pre-natal testing (NIPT) is predicated on cDNA analysis. The critical IP in this space is controlled by Illumina (Verinata) and Labcorp (Sequenom).

In December 2014, Sequenom and Illumina—arguably the two most prominent companies involved in the development and delivery of NIPT globally—settled their patent disputes by cross‐licensing their patents. Through the agreement, Illumina obtained worldwide rights to use the pooled patents for kit tests for NIPT and to license third‐party laboratories to develop and deliver their own laboratory‐developed NIPT. Sequenom and Illumina also retained the right to develop and deliver their own laboratory‐developed NIPT.

At present the five leading players in the space are Illumina (Verinata), Labcorp (Sequenom), Roche (Ariosa), Natera, and Myriad (Counsyl). How is Invitae ‘disrupting’ this crowded space?

According to Invitae Chief Medical Officer Bob Nussbaum, the company is initially outsourcing the testing to Illumina, which will run its Verifi test for Invitae, but has plans to bring the test in house eventually, though there is no timeline yet.

So, if Invitae is outsourcing this test to Illumina what exactly is their differentiation strategy?

“So, as Sean mentioned, last week, we announced that we are going to start providing NIPS to OBGYN customer segment and that is utilizing luminous verify, which is a standard market leading technology. I think the big difference here is twofold. One, what we intend to do in the OB space is what we've done in the oncology space. And that is make it easier to access, easier to use, more affordable and more accessible for more people. And so that is one of the big differentiators that we know, we've proven we can deploy that strategy and open up a market so that's first.”- NVTA Q4 2018, CC

“Second, being able to offer a comprehensive suite of products to an OBGYN office is critical. So, being able to build on our carrier offering to pair that with NIPS is something that we've heard from OBs. They would like to be able to utilize. And then going beyond that, we know that there's quite a bit of cancer testing that does occur in that OBGYN setting, so being able to offer both our diagnostic as well as our proactive cancer screen is something that we believe is going to help us further differentiate. So those are the two ways that we intend to be providing what we believe is a better approach to genetic testing and screening in the OB setting.”- NVTA Q4 2018, CC

How can Invitae make an outsourced test more affordable and accessible than what the proprietary test providers are already providing? And if Myriad is already offering cancer testing and pre-natal testing how exactly is NVTA ‘further differentiating’? They are not, which is perhaps why they made a recent acquisition, Singular Bio. This is how Invitae’s CEO described the acquisition:

“Singular Bio is building an approach to non-invasive prenatal screening with the potential to achieve the cost savings necessary to provide more women with genetic information to support a healthy pregnancy. We believe this approach could eventually be applied to other areas of genetic testing. The addition of Singular Bio's technology will further strengthen our ability to bring genetic information into mainstream medical care.”

This acquisition demands a high-level of scrutiny. The pre-natal space is crowded, highly litigious, and has two IP giants sitting at the top of the food chain. Basically, any remotely differentiating technology in this space has a vast competitive market of interested buyers. Thus, if Singular Bio ended up with Invitae as their suitor, this means Illumina, Sequenom, Roche, Natera, Myriad, and just about any Bio-tech/Diagnostic Testing resource-rich giant on the planet evaluated and passed on their technology. If Singular Bio’s tech offered even a 5% chance of differentiation, Illumina could spend $50-100ml on it and simply write it off no problem if it did not pan out. For Invitae, who can seemingly burn money on just about anything without being scrutinized by investors, this acquisition is nice ‘narrative window dressing’.

Invitae’s pre-natal business strategy is a poorer version of their Oncology strategy. It’s undifferentiated in a far more crowded market than oncology, going to be very expensive, and makes zero economic or strategic sense. In fact, we believe that their decision to commence aggressively on this path now is a sign of immediate concern and evidence that their growth in other markets has DRASTICALLY slowed. This is rather alarming considering how much cash they have been willing to burn getting there.

7) What’s Invitae’s Data Strategy? Who Owns the Data?

Importantly, the test data created by the company is immediately shared with a public database

- This is a core promise of NVTA and its CMO

- In fact, its CMO was a founder of the SRCP project, whose purpose was to “free the data” that Myriad has refused to release about its patient population

- Moreover, NVTA promises to let customers own their own data, and even profit from it, so it is difficult to imagine that NVTA would sequester this data in order to profit from it

- Thus, the genetic database, by definition, cannot be a competitive “moat” While we applaud this approach for the benefit of science and humanity, we note that it makes the business model weak and indefensible

“Patients are empowered by having better access to their own health information, and then by owning their own data.”

-Elizabeth Holmes

8) Invitae Management Preaches Transparency But Provides Very Little By Way Of Financial Disclosures To Their Investors

FROM NVTA’S S1 ‘CORE VALUES’- Transparency. We strive to be transparent with our clients, employees and shareholders. We believe the best execution happens where information is broadly shared. We view a state of heightened transparency within companies and with the public as a growing trend that will only accelerate in the future.

NVTA provides scant data for investors to evaluate their business. The only ‘relevant’ operating metrics they disclose are aggregate billable test volumes and covered lives. Compare this to publicly listed genetic diagnostic ‘peers’ Myriad and Natera which disclose revenue and volumes by clinical segment/product and regularly update investors on specific diagnostic test insurance coverage. This is somewhat concerning considering how often NVTA likes to reference their broad test menu. What percentage of their test menu is actually covered by insurance as medically necessary? For example this type of panel test for Cardiomyopathy: Test | Invitae Cardiomyopathy Comprehensive Panel, is described this way by Aetna:

“Furthermore, the results of the genetic test, whether positive or negative, does not help an individual affected with hypertrophic cardiomyopathy (HCM). Given that phenotypic expression of familial HCM is heterogenous, a positive genetic test does not determine prognosis of HCM and it does not determine treatment of HCM. A negative test in a person with HCM with a family history does not rule out the possibility of a genetic etiology because many of the genes involved in familial HCM are not known.”

Citing a large covered lives number is not very useful if only BRCA1/BRCA2 testing is covered. However, not providing clinical volumes or coverage disclosures does prevent investors from accurately and directly comparing NVTA to established publicly listed competitors.

Their disclosure track record as far as their path to profitability and capital needs is also very concerning….

Here Invitae’s management team has consistently overpromised and underdelivered:

The company is currently losing money on each of the tests it offers. But by the end of 2016, Scott expects that the company will start making money. “Genetics is a volume-dependent business,” he says. “We hope to flip to being profitable.” - NVTA CEO INTERVIEW MARCH 2016

Note: Company reported a $100ml loss in 2016

“We expect the cash used in Q1 and Q2 of this year will be roughly consistent, followed by an accelerating reduction in the back half of the year as payer contracts operationalized with the expectation that we will reach positive cash flow by the end of 2018.”- NVTA CEO, Q4 2016 CC

Note: NVTA burn accelerated by 40% in H2 2017

“In the short term, we anticipate acquisition and integration related expenses to increase burn, longer term we believe that the acquisition of Good Start and proposed acquisition of CombiMatrix will contribute positively to cash flow, allowing us to reach cash flow breakeven by the end of 2018.”- NVTA CEO Q3 2017 CC

Note: Company burnt through $92ml in 2018

“We're not going to need to do anything [new capital] for at least the next couple of years at this point given our current burn and current trajectory.”- NVTA CEO Nov 2018

Note: In the 10 months since this statement, Invitae has completed a $185m equity offering and a $340ml convertible offering as well as issuing 3.4ml shares for acquisitions and $90ml in RSU’s.

9) While The Overall History Of Management’s Disclosures Regarding Burn and Capital Needs Warrants Caution, Recent Developments Demand An Even Higher Level Of Scrutiny

On the February 19, 2019 Q4 earnings conference call, Invitae’s CEO had this to say about their business:

“In challenging the traditional approaches of high price niche market testing, we have demonstrated that we can rapidly gain share, take advantage of a price elasticity to grow the market, and most importantly, increase the number of patients that will have genetic information put to use for their benefit. We've demonstrated our ability to drive the company toward profitability, dramatically reducing burn by managing volume, revenue, COGS, and OpEx, and while the trajectory of the business is more than compelling, we are truly just scratching the surface in terms of our long-term growth potential. We fully intend to reach 1 million people in 2020 alone, and one day, billions of people on the planet.”

...

“At this critical juncture, we have shown that we can control the four key levers of our business. We have proven that the model works and we've reached the point where we can make the decision to drive toward breakeven in the near term or continue to invest in our competitive advantage and continue capturing the growth and creating new market potential. We've chosen the ladder. Looking forward, We anticipate that the cadence of 2019 will follow 2018, higher burn in the first two quarters reflecting of deliberate investment in selling and marketing and R&D and then a controlled decrease in the back half as we reap the benefits of these investments.”

To put these comments in context, this conference call occurred 60% through Invitae’s very soft Q1 and just a few weeks after CMS had instructed local contractors to start narrowing coverage of NGS germ-line hereditary cancer tests. Invitae’s net cash position at the time of this call we estimate was likely less than $35ml or about a quarter’s worth of burn. Not exactly a good position to be in with looming regulatory risk and softening demand.

Against this challenging backdrop, management gave seemingly business as usual financial guidance. Indicating revenue and volumes would still grow robustly, and that cash-flow trends would be similar to 2018. Then a week and half after this call they announced an equity offering that generated a $185ml in net proceeds.

Having secured ‘existential funding’ from the market with reassuring guidance, Invitae then reported a very disappointing Q1 missing revenue estimates by nearly 20%. They then promptly changed their cash-burn guidance for the year. Management had this to say regarding cash-flow on the Q1 conference call:

“So what does this mean about our burn? We will continue our investments throughout the year and into 2020 and no longer plan for the burn to come down in the back half of 2019. In fact, on a quarterly basis our burn per quarter may increase. For the year, we anticipate burning up to 50% more in 2019 when compared to 2018.”- NVTA CFO, Q1 2019 CC

As Invitae’s main operational lever is a willingness to burn cash selling commodity diagnostic genetic tests, a 50% increase in cash-burn with the same growth targets is tantamount to a massive warning. Going from selling $1 for 80c to 40c is not ‘disruptive growth’. The fact that this literally only relevant update with respect to their financial model came after a necessary capital raise and substantial revenue miss raises serious concerns about what management communicated just a few months earlier.

10) Invitae’s CEO Regularly Conflates Cost with Price Which Has Clearly Been Confusing For Investors

In a June 2019 Interview, Invitae’s CEO had this to say about costs:

“In 2010, the cost of genetic sequencing was anywhere from $5,000 to $50,000 or more for a single test. Today those same tests can be completed for less than a thousand and Invitae has been a major force in driving costs down and passing those cost savings on to the customer. That alone would make us a bit unique in healthcare, which of late is defined by ever-increasing costs even as outcomes degrade.”

Invitae has been willing to lose a substantial amount of money per test. For the first six months of 2019, their net loss per billable test was a staggering $456. This is not sustainable and thus by definition not cost reduction. In fact, one can argue that labs desperate for volume in genetic testing are in fact contributing to fraud incentives as earning a legitimate economic profit has become more difficult. This in turn leads to far greater cost burden being placed on the healthcare system, and incentivizes regulators to contemplate reducing access and slowing the pace of innovation.

Invitae’s CEO also made this interesting statement in the same interview:

“To this day, and after many years of inquiry and seeking resolution, the U.S. Centers for Medicare and Medicaid Services (CMS) is still paying one of our competitors somewhere between $600 and $1,000 more for the same services that we offer, again largely as a result of confusion arising from a coding and payment system that doesn’t anticipate technology lowering costs. “

This comment is a clear reference to Myriad, which again is somewhat misleading. Under PAMA CMS set reimbursement rates based on the volume weighted median of private payor rates in 2017. The National Limitation Amounts for 2017 for Invitae’s HCT panel was set at $931. This was well above their media private payor rate of $136.(584% premium)

Myriad’s NLA, which is based on a different billing code, was set at $2503 vs. a private payor rate median of $1615.(55%)

One can argue with respect to why Myriad has secured a different code, but their market based pricing has been higher because they have a differentiated test with respect to perceived quality(20+years of testing will get you that) and interpretive data (proprietary ‘trade secret’ VUS database vs. Invitae which is relying on sharing). However, this has benefited Invitae, and thus makes little sense as an argument. Medicare revenue and volumes for Invitae’s HCT panel are substantial as they are enjoying far higher relative pricing here compared to their commercial rates than Myriad is. Also, Myriad’s business is far more diversified and Medicare HCT has been notably shrinking.

If CMS was to enforce the same rates for both their HCT panels, what exactly would be the incentive for doctors to prescribe Invitae’s test over the company that has accumulated nearly two decades worth of proprietary Variant of Unknown significance data for BRCA testing? A question which despite the pricing disparity also still warrants answering.

11) While we understand what the FANG/Retail crowd might think they have bought into, it is important to note that Invitae also doesn’t compare favorably against the ‘popular’(non-Myriad) laboratory diagnostic testing companies.

We have seen compares to…

Exact Sciences (EXAS)

- Exact Sciences has a patented test backed with a well-powered clinical trial. Its focus is on colorectal cancer, a highly preventable and costly disease for which screening rates are far too low due to the invasiveness of a colonoscopy. It is presently the#1 molecular diagnostic test in volume and $ reimbursed by Medicare.

- In other words, EXAS’s test has no competition, provides a highly-needed and quantifiable benefit, and presently is viewed to save the health system money!

Foundation Medicine

- Foundation Medicine, acquired by Roche in 2018, focuses on testing solid tumor (cancer) cells in order to optimize treatment plans. It has a variety of proprietary data, algorithms, and IP around its testing platform that is difficult to replicate.

- Compared with NVTA’s focus on germline testing– where saliva or blood samples are tested for the presence of certain genes known to correlate to disease states– the process is much more complex, expensive, and clinically important. It is basically the definition of “personalized medicine.”

- As of May 2019, their FDA approved F1 CDx is the sole test with mandatory coverage for one test event in all Medicare solid tumor cancer patients.

In fact, we find the Foundation Medicine compares to be quite interesting as it allows us to remind investors of what the personalized genetic medicine space looks like in companion diagnostics.

The field of personalized genomic medicine, i.e. clinically backed FDA approved companion diagnostic tests, is already a very crowded space filled with life sciences giants.

- Agilent- Received FDA approval Agilent’s PD-L1 IHC 22C3 pharmDx as CDX for head and neck squamous cell carcinoma and non-small cell lung cancer with Merck’s Keytruda. And along with PD-L1 IHC 28-8 pharmDx, indicated for use with Bristol Meyer Squibb’s immunotherapy, Opdivo, are approved for multiple tumor indications and hold 85+ global product registrations

- Illumina-In January, received the FDA’s Breakthrough Device designation for its developmental-phase pan-cancer assay, to be marketed as TruSight Oncology Comprehensive. The assay is based on Illumina’s TruSight Oncology 500 (TSO 500) test, an NGS tumor profiling assay designed for detection and analysis of known and emerging solid tumor biomarkers.

- Qiagen- On May 24, QIAGEN launched its therascreen PIK3CA RGQ PCR Kit following FDA approval as a CDx for identifying breast cancer patients eligible for treatment with Novartis’ Piqray (alpelisib). Eight days earlier, QIAGEN and Inovio Pharmaceuticals agreed to co-develop a CDx for Inovio’s DNA-based immunotherapy candidate VGX-3100 to treat cervical dysplasia caused by human papillomavirus (HPV). And in April, QIAGEN launched therascreen FGFR RGQ RT-PCR Kit as a CDx with Janssen Biotech’s approved FGFR kinase inhibitor Balversa (erdafitinib).

- Thermo Fisher- First company to win FDA approval for a multi-marker, NGS-based CDx oncology test when Oncomine Dx was authorized for simultaneously screening tumor samples for biomarkers associated with three FDA-approved therapies for non-small cell lung cancer (NSCLC)—AstraZeneca’s Iressa (gefitinib), Pfizer’s Xalkori (crizotinib), and Novartis’ combination of Tafinlar (dabrafenib) and Mekinist (trametinib).

- Foundation Medicine- FoundationOne CDx won the FDA’s first market authorization for a comprehensive genomic profiling assay for all solid tumors incorporating multiple tests. In May, Foundation Medicine and Bayer launched a global collaboration to develop and commercialize NGS-based companion diagnostics across multiple oncology drug candidates and approved therapies developed by Bayer.

- Myriad- In February, Myriad announced that its BRACAnalysis CDx successfully identified patients with metastatic pancreatic cancer who have BRCA mutations and benefitted from treatment with AstraZeneca’s Lynparza (olaparib) in the Phase III POLO trial (NCT02184195). Two months later, Myriad submitted to the FDA the first module of its PMA for its myChoice HRD CDx test, intended to identify patients with ovarian, fallopian, or primary peritoneal cancer who may benefit from Zejula (niraparib), marketed by Tesaro, a GSK (GlaxoSmithKline) company. Also in April, Myriad expanded its CDx collaboration with AstraZeneca and Merck & Co. The companies agreed to use BRACAnalysis CDx to identify germline BRCA mutations in men with metastatic castrate-resistant prostate cancer (mCRPC) who are enrolled in the Phase III PROfound trial (NCT02987543).

- Roche- Roche’s cobas EGFR Mutation Test v2 won FDA approval as a companion diagnostic with AstraZeneca’s Iressa (gefitinib) for first-line treatment of patients with non-small cell lung cancer (NSCLC).On April 23, Roche launched its VENTANA HER2 Dual ISH DNA Probe Cocktail same-day assay, designed to detect the HER2 biomarker in breast and gastric cancer patients who may be eligible for Herceptin (trastuzumab), marketed by Roche and its Genentech subsidiary.

Roche’s acquisition of Foundation Medicine had everything to do with the fact that Merck’s blockbuster cancer immunotherapy drug Keytruda, which is expected to become the world’s top selling drug by revenue the next five years, is going to be paired with FoundationOne’s CDx. As Roche has struggled to compete with Keytruda, this is one way of smartly ensuring they financially benefit of the success of the drug and broader development of other related targeted immunotherapy drugs in the coming years.

So, Roche’s acquisition of Foundation Medicine, is about the worst compare for Invitae’s business model as it is the definition of differentiated science in the genetic personalized medicine space.

12) So, What Is Invitae’s Stock Worth?

The FANG Crowd has made some lofty predictions on the name….

We’ve seen $100 tossed around by the “Amazon of Genetics” crowd. To put that lofty target perspective, that would work out to roughly the market capitalization of Quest Diagnostics. Quest is 50+ years old, employs 46,000 people, has 6k+ patient access points, 2200+ patient service centers, 3700+ courier vehicles, 25 aircraft, and did $7bl+ in revenue last year. It also has a well-developed genetics testing business, and the established infrastructure and economies of scale/scope needed to aggressively expand in this space when the economics make sense. We find it seriously concerning that some investors would consider valuing NVTA and DGX similarly.

What’s Invitae Really Worth?

This is a tough exercise as we need to somehow incorporate the inherent flaws and risks in the business model:

- What happens to hereditary cancer volumes when Myriad’s private payor contracts start expiring in 2020 and 2021 and are renegotiated lower?

- What exactly is the data strategy within the current data landscape?

- Aren’t Ancestry.com and 23andMe already DTC genetic data giants with superior business models and scale?

- What’s the value in chasing Myriad with volume in hereditary cancer when they already have a superior proprietary database of classified variants?

There are a lot of question and very few answers, but we can still take a crack at this.

Genomic Health, from which Invitae was spun out of in 2015 was sold to Exact Sciences for 5.7x EV/2019 revenue. Genomic Health has a differentiated and proprietary test for colon cancer recurrence which presently is the #2 molecular diagnostic test as measured by volume and $ by Medicare.(#1 is Exact’s Cologuard). As Genomic Health is profitable and experiencing rapidly expanding net margins, Invitae’s valuation should not be anywhere close to its EV. But applying a similar multiple works out to 50% downside.

Myriad has been profitable for ages and we already have covered their business model in detail. It will generate 4x+ NVTA’s revenue this year and offers multiple options on potential growth upsides outside of their hereditary cancer business. It recently traded at a 2x EV/sales multiple.

But what about the revenue growth…..

Invitae has achieved rapid revenue growth over the last two years, and thus we can understand the allure to investors. It should command a premium multiple to companies that are growing more slowly, right?

NVTA’s net loss per billable test was $435 in 2018 and is up to $456 for H1 2019. A company willing to burn through $500 million dollars over a few years providing commodity diagnostic tests can of course achieve revenue growth, particularly off a small base. This is especially true if the industry leader has decided to protect their pricing as long as possible in order to be able to diversify their business. All that NVTA needed to do was buy some sequencing machines from Illumina and hire an army of salespeople and send them out doctors’ offices. The question is what do investors have to show for this growth? Invitae is not an industry leader in volume, revenue, COGS per test, data, IP, or FDA approved diagnostic tests of which they have none.

The large Q1 revenue miss, and the subsequent pivot to a more ‘aggressive investment’ phase is clear evidence the model is already breaking down. They are guiding to a 50% increase in cash burn for h2 2019 and making an aggressive move into DTC because they desperately need to hit revenue targets in order to please their so far undiscerning momentum shareholder base. Essentially, they are locked into a growing volumes at any cost strategy.

The recent capital raises should have set off alarm bells. We believe that management is fully aware of the fact that industry headwinds and the looming CMS NCD risk make hitting current targets a Herculean task even with far more aggressive spend. Consequently, they have raised massive amounts of capital and made rapid acquisitions to position themselves for a narrative transition.

How About ZERO?

Invitae’s business model has been highly dependent on free-flowing capital from indiscriminate ‘growth at any costs’ investors. Should these investors change their mind overnight as they are fully capable of doing, the equity will become virtually worthless. Invitae’s CEO has stated they fully intend to reach 1 million in 2020. At the current run rate, this works out to $450 million in losses. Even significantly reducing loss per test raises questions about the unit economics for next year. We estimate Invitae’s year end net cash position will be roughly $80 million. The recently completed convertible will provide operational cover, but that’s not going to save equity holders. And then you have the CMS risks with respect to germline-testing in early stage cancers, and the sudden explosion in HCT Medicare fraud which have yet to work their way into the financial community focus with respect to this name. Nothing new here is business as usual which isn’t exactly encouraging. However, any CMS policy shift or Medicare related billing concerns, would prove to be immediate and crippling news for this fragile business model.

At which point statements like this….

“And in building that new business, building that new industry, the nice thing about going through the pain of all of this is once we build it and once we hit a certain scale, there is a network effect that will be put in place, where there will be no catching us. In fact right now we suspect we are already there.”

- NVTA CEO NOV 2018 Interview

And this….

“If it’s about your health, if it’s about the health of for yourself looking forward or for your children or for your family, Invitae is providing the answers. Invitae is bringing the same genetic information that the world’s experts across all disease areas all stages of life are relying on. Indeed, we are becoming the #1 brand with these key opinion leaders and experts. We are the one providing this information. We are the company to go to.”

-NVTA CEO CNBC Interview

…..which have so far largely been ignored, can become quite PROBLEMATIC.

13) Why Now….The WeWork Effect

“We are a community company committed to maximum global impact. Our mission is to elevate the world’s consciousness. We have built a worldwide platform that supports growth, shared experiences and true success. We provide our members with flexible access to beautiful spaces, a culture of inclusivity and the energy of an inspired community, all connected by our extensive technology infrastructure. We believe our company has the power to elevate how people work, live and grow.”- WeWork S1

Wework’s recent valuation collapse has triggered a sudden burst in scrutiny of ‘growth at any cost’ story businesses. Structurally unprofitable and capitally intensive story stocks that have coasted on top-line growth despite mounting losses and no technological differentiation or unique economic moats are being exposed and having their valuations rapidly re-rated by investors. NVTA’s saving grace is that its not a recent IPO, and thus has remained under the radar. However, we can think of no better example in the public markets that encapsulates all these recent issues than this company. It literally is a mix of everything that has gone wrong in the recent VC investment cycle. Whether its FANG related speak ‘fools gold’ compares, a social mission like low-cost genetic testing or blood testing for all save the planet story, or selling a dollar for 80c to simply deliver topline growth and boost valuation etc. Pick your poison, NVTA has a little bit of everything that cautionary investment tales are written about.

14) Final Thoughts: Bad Incentive Structures Lead To Dangerous Outcomes

Science takes time. The R&D to develop something that changes healthcare and benefits humanity is not something often suited to quick to capture financial metrics. Traditionally investors in the space have understood these risks and consequently expected to be meaningfully financially rewarded when success is achieved. This is the nature of the game in biotech land. But this type of uncertainty is not easy to sell to investors, and thus it’s no surprise we have seen SHORTCUT approaches become far more popular.

One example of this is was Valeant’s approach of buying established drugs and simply raising prices drastically. This was the financialization model which was easy to sell to investors as the success is instantly measurable with bottom line metrics. But on the other end of the spectrum you have the VC startup era approach to life sciences industry. Here, finding a commodity product/service, and simply investing heavily in sales & marketing to disrupt the industry with ‘price’ and ‘volume’ is the main angle. A social mission obviously doesn’t work well with the former, but tends to be critical to the latter.

Measuring a life sciences company simply on its ability to grow revenue selling undifferentiated diagnostic tests already offered by well-established competitors is a very risky proposition. If a lab testing company can’t earn a meaningful profit on the science being provided, then you are laying a foundation for some potentially very serious problems down the road. What will they be willing to do with your personal health information when their investors finally demand returns? How will they convince doctors to recommend their test over an established leader with maybe an even superior test? The diagnostic industry is literally the one space where you don’t want someone running a ‘growth at any cost’ business model.

Invitae’s current business model should not be encouraged or supported by investors. A company whose CEO is promising a long runway of unrealistic topline growth is likely to only produce negative disruption for the health care system. Sales reps facing ever increasingly difficult quotas to hit will be incentivized to find demand at any costs. Genetic testing demand for hereditary diseases should be organic and based on proven clinical benefits, and that doesn’t comport with someone willing to say we should double volume/revenue every year for forseeable future. Looking at Invitae’s foray into re-selling Illumina’s Verifi pre-natal test one must simply wonder what happens when a company is willing to simply lose whatever it needs to lose to generate volume. What incentives are provided to OBGYN’s? What pressure does this create on the established players with differentiated tests sales reps? One doesn’t need much of an imagination to realize that earning a profit providing a clinically beneficial diagnostic test is a good thing, and that making it difficult for everyone to make money doing this leads to bad outcomes for the healthcare industry. The recent explosion of genetic testing fraud is clear evidence of this. Labs desperate for volume that isn’t there are willing to engage with opportunistic individuals or in direct schemes to create this demand on their own. Consequently, CEO’s who promise investors volumes and revenue doubling as far as the eye can see under the promise of saving lives and the healthcare system money should be carefully scrutinized. The laboratory diagnostic testing space doesn’t need another Theranos.