Razor's Edge: Netflix Cat & Mouse

A lot more going on here than subs....

High-level Takeaways

1) Subs better than forecast- Not much to say on this other then that its looking like Netflix will go through the 9-month eye of the death of covid/open up storm with essentially no sub losses. I said last year year if they give back 5% of subs in h1 of this year in a temporary manner it wouldn't be shocking.

2) They quantified content cost spend path- This to me was a big deal as it was not tackled at all on their last seemingly lost and discombobulated earnings call. I interpreted their guide here to mean cash content spend will be around $17bl for next 3 years. It also seemed they were telling you 2022 FCF would be meaningfully over $1bl without wanting to quantify meaningfully.

3) They told you they would be rolling out their password sharing related initiatives at the start of 2023- This could prove quite material to how this thing is modeled and maybe translate into some notable offside positioning for those short as we get closer to year end.

Worst over short-term for sub trends?

Netflix guides to accuracy which basically means they extrapolate whatever they are seeing on churn/gross adds on the day of earnings for the remainder of the quarter. They don't try to guess on potential external variables that have not happened yet, but which could suddenly change that forecast and thus need to be worked in.

When they have deviated meaningfully from their guide its usually been because of some common sense stuff they simply didn't bother trying to discount. Q2 2019 was a good example based on the disney blockbuster movie schedule ahead of disney+ launch and end of game of thrones. They missed big and while maybe I'm biased as I was short then, it was kind of obvious. They then beat big into the Omicron quarter despite 3rd party trackers saying otherwise. Again, common sense due to an external shock. They then missed big on Q4 guide as that reversed and again in Q1 as churn upticked as people really started traveling. Now, I am going to assume their current forecast is benefiting from the brunt of that being over and the price hike churn wearing off, but that they are again not forecasting any sort of consumer shift in behavior away from travel/eating out at the margin as we get into fall. So, let's assume common sense wise forecast error now favors a beat next q on actual subs and guide. So, overall on sub trajectory for now, Netflix looks good vs market sentiment.

What about content costs?

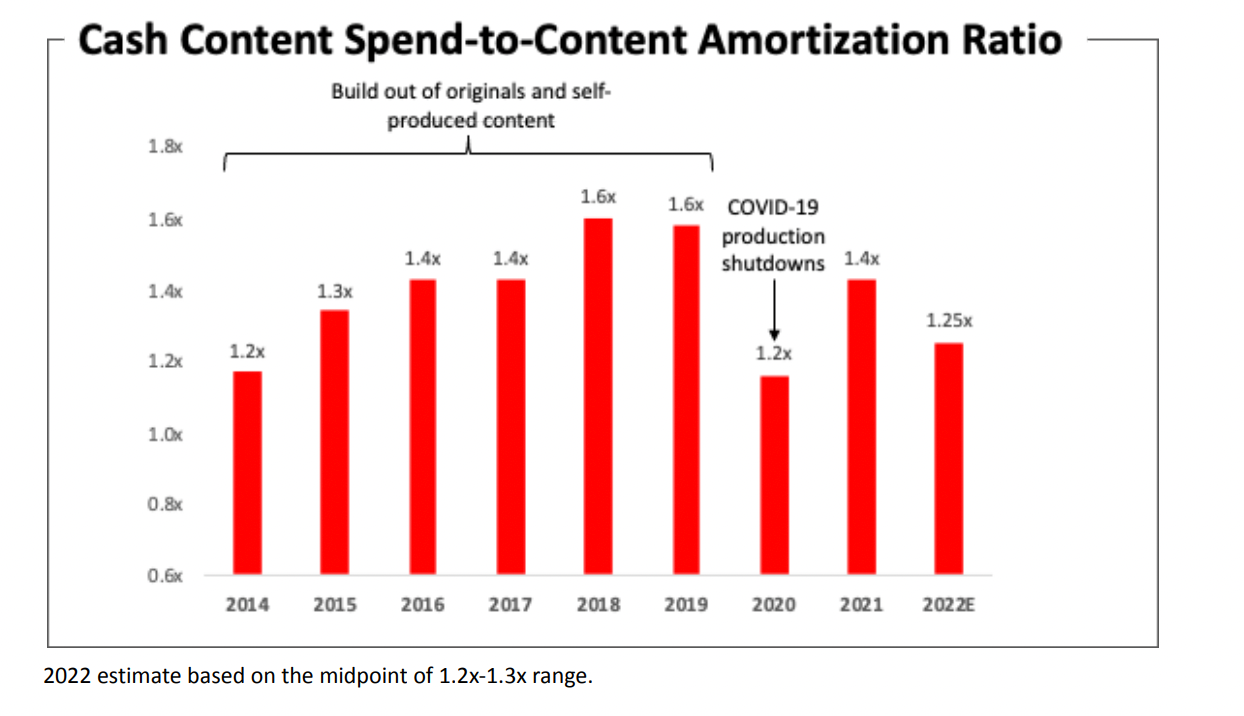

They did not bother getting into this last quarter which I thought was kind of ridiculous as its kind of the most important thing at this point for the economic model. Anyway, they cleared this up nicely yesterday. First, they stuck this slide in to make the point that they are past the investment shift around in house production...

Then they told you on the call that cash spend would be around $17bl for the next few years. I took that as them saying we still finishing off the covid make-up this year but that next two years we are targeting $17bl. So, just on that alone I am assuming consensus FCF for this year of $1bl and $1.8bl for 2023 are way too low.

What About Password Sharing Changes?

This is the potential needle moving news here. Netflix is testing two type of sharing crackdowns. One is and added household fee of $3 a month and the other is an added user feed of $3. I have generally not cared much about this as I have been of the camp that ARPU is ARPU and either u can raise pricing because of the value prop or you can't. I've changed my thoughts here. The way I now see this is it's an elegant way to get found money. Basically, a price hike without any of the consequences of churn as the person paying for Netflix's value prop is largely unchanged. And as you have a bunch of people enjoying the content you're paying for free, there is no incremental sub acquisition cost here. Simply put, some percentage of sharers will now become paying full subscribers and another percentage will come through essentially a defacto friends and family plan $3 add-on. I also imagine that the folks who are spending time watching Netflix with their immediate family across 3+ households will simply pay up as they are not price sensitive.

Netflix claims there are 100ml households globally and 30ml in UCANN sharing passwords. Based on how they seem to be implementing this across tv device id's and ip addresses; I am going to assume their data is accurate. I am then going to assume 90% of them are not multi-domicile owners. So you have about 90ml potential sharers to convert into incremental subs at zero acquisition cost. Let's assume just based on the nature of sharing that on Day 1 of this what happens is they all effectively lose access to Netflix. The true family-plan set up will be resolved by a phone call and simple adding of a user to whoever is paying for the plan. However, I imagine the vast majority, will just lose access and not be picking up the phone to call whoever had been giving them the password for free. Some percentage of that universe immediately converts into a paying sub, and a decent sized tail of it comes on board over the next 6 months. That's a one off sub acquisition event and instant boost to FCF that they have now told you they plan to kick in start of next year. Considering content costs being down on a cash basis closer to $17bl for 2023, you now need to model whatever these one off new subs will be as a fcf windfall next year. Street is not doing that yet as frankly there was no visibility on when or if this wud happen. Now the if is clearly gone and the when appears to be in six months. Kind of subtle but not really, so might want to think about this a lot more if you a bear.

Conclusion

Valuing Netflix still complicated and I didn't get into ad tier impact as that remains something that they still haven't figured out, but I can come up with scenarios of $3b-5bl in FCF run rate by this time next year. That's 100%-200% above street. I can't recall many stocks sucking into that type of shift and as there is an unknown component here, things could actually be even better than that in wildly bullish conversion of whose been sharing. Either way we have a hard time line for for this unknown playing out and that is H1 2023. I imagine stock now becomes a buy the dip as more people figure/adjust to this scenario.

I also think you could now argue maybe management wasn't as discombobulated as they appeared last quarter. Maybe not blaming covid was a conscience decision and that this allowed for the pre-text to grab this free money in the password sharing universe. Not exactly a stretch as I have scratched my head over why they didn't just say chill...you are all traveling like mad...it will normalize...then we will evaluate. Instead, they now look totally justified in doing what they are doing from a consumer standpoint. Hey, there been a ton of surplus here, and we spending all this money on content so maybe the subsidized folks shud pay up versus you. All right after taking one last big price hike.....maybe this was all part of the plan.

Regardless, I have no position in the stock right now, but I am keeping an eye on it again.