Razor's Edge: Compounder Bro And The Covid Cliff

This brutal market in growth stocks really deserves a closer look at what is going on under the hood. I see two big things at work here that are tattooing valuations 1) A Covid cliff and 2) Trading up

The Covid Cliff

We are clearly in the depths of a Covid cliff rerate in growth tech. It now feels like there is not a day that passes where some tech name has round tripped its Covid gains. Investors are finding out that pull-forwards are clearly a double-edged sword for growth stocks. They provide rapid and significant multiple expansion that is by definition unsustainable as they drain growth from the future. They are essentially a patient thematic growth compounders worst nightmare. How often do these investors stress that they don’t preoccupy themselves with valuation? Or that myopically focusing on certain financial metrics is what causes the average investor to miss generationally disruptive companies and wealth creation? The typical compounder bro sees himself as the tortoise versus the hare when it comes to his investment horizon. He doesn’t really need to worry about all the noise typically present in markets or even the occasional disappointing quarter for one of his companies. He literally needs to worry about almost nothing other than the steady execution and disruption of his thematic portfolio companies as his goal is to compound over a decade or more. This is true, but just like Superman, compounder bro has his Kryptonite.

Thematic growth investing works as long as it never runs too hot and there is a healthy dose of skepticism. If for some reason it runs too hot, it becomes no different than a commodity boom.

You end up with capital misallocation, exponential supply growth, and ultimately diminishing returns. The difference is an experienced commodity investor is usually quite attuned to boom/bust cycles and thus much more valuation sensitive. The thematic growth investor is not. As they do not expect near overnight success to arrive in their investments, they have a perpetual valuation blind spot. This is how you go from 10x sales to paying 100x sales for public companies in the blink of an eye. The thematic growth investor doesn’t view mass adoption as bad thing as it is in fact their most central belief. One day the future they are betting on will arrive and by that day their returns will be so significant they won’t need to worry about whether the future is now the present. The only thing that can really turn this approach upside down is an asset bubble forming in their space.

One could argue that we were in the mid stages of this type of bubble before the pandemic hit with a lot of focus on growth at any price startups and increasing evangelism around subscription- based business models and disruptive founder led companies. Then along came Covid and turbocharged all of this. Now, you essentially had to be a blind fool to doubt the momentum of digitization and cloud, and thus with virtually no rational reason to be skeptical that these companies would benefit immensely everyone went all in. In the early days of the pandemic, Daniel and I used to joke on our podcast how long we could make it with the word accelerated being used. Today, nobody wants to talk acceleration anymore as the focus has now shifted to Covid headwinds, deceleration, and ultimately what post-pandemic trend growth looks like.

Some folks obviously view this as frustrating or largely overblown. How can companies that have seen a step function increase in revenues, market share, customers, and usage have stock prices that are lower than they were before all this started? This is the really the covid cliff in a nut shell. Ok, Zoom is growing a lot slower, but like its 4x the size it was two years ago; why is the stock now flat over that horizon?

The short answer to this is that growth stocks tend to trade on what is typically a very high degree of confidence in the 3yr outlook with a layered in even higher degree of confidence in the 12-month fwd outlook. Before Covid you knew that if you owned a high multiple name and they somehow meaningfully missed a quarter you would be in for 20-40% haircut. But for the most part in these names you could absorb this occasional move because well the conviction 3 years out tended to be quite high and the multiples were reasonable enough to allow for pretty rapid recoveries. 2 years of Covid has changed a lot of that. Yes, there are obviously a bunch of companies now experiencing a period of reduced visibility relative to past few years but that’s not really the biggest issue. I’d argue that the real problem here is that there is now a lot more uncertainty around what the post-pandemic trend growth is going to look like. A 500bp change in a 10yr cagr can seriously alter a growth stock's valuation. What exactly was the pull-fwd? I see a ton of people talking about multiples returning to or being lower than before Covid for a huge group of stocks. Well, doesn’t that make sense?

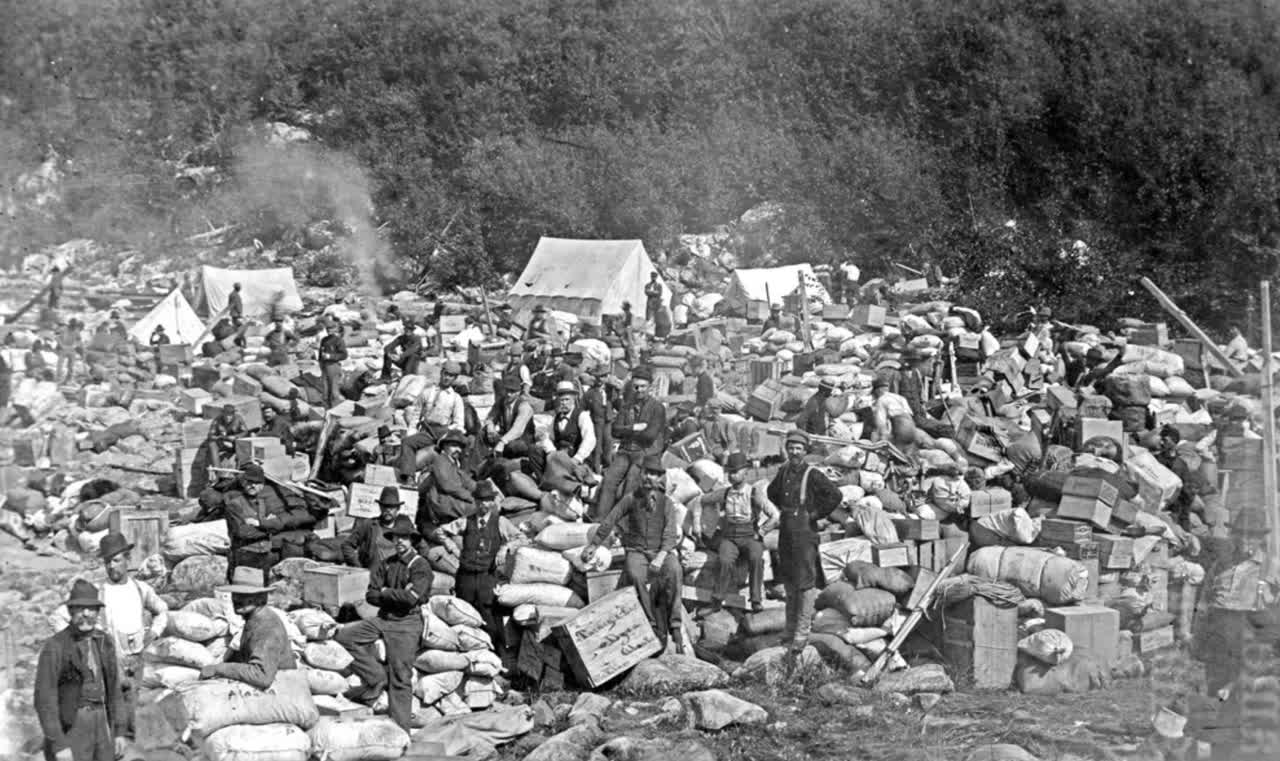

If you were long any investment and I inserted a gold rush of 2 years into your forecast model; would you be able to spot the lower multiple period that came after? Kind of a no brainer if you actually believed that the gold rush was in fact a gold rush. That’s the question with Covid. You can’t say it accelerated everything and then build a model that looks like the same one you had before the pandemic.

I am long some Zoom and it hasn’t been a pleasant couple months since I opened the position, but what is most annoying about it is that it’s a position I opened with the view of minimal growth near-term but still somewhat decent growth for several years to come. Admittedly, I can’t speak as to any confidence in a forecast from here considering the competitive landscape and other variables, but it still seems like they have a decent sized rip and replace opportunity in hybrid work UC.

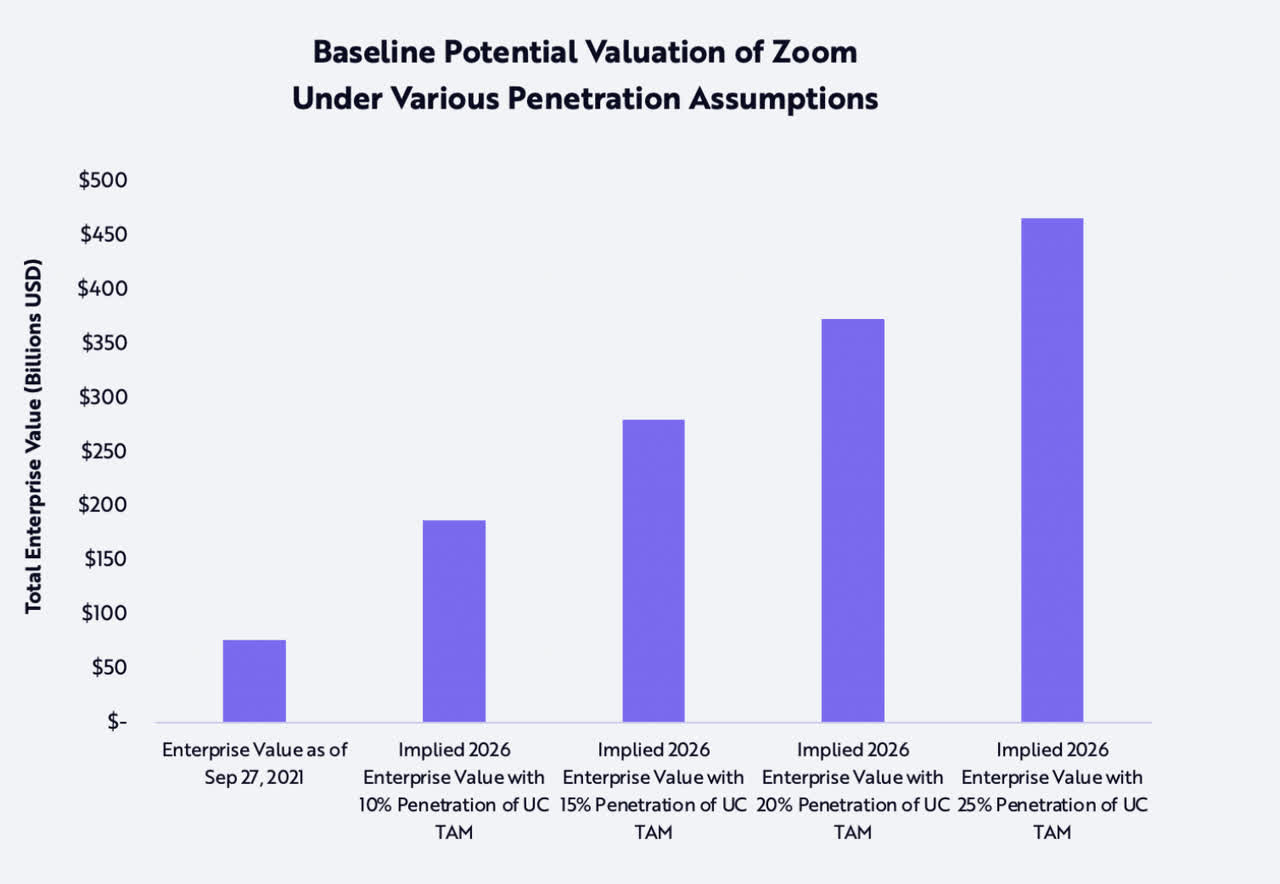

Ark is also a fan of the name, but their expectations are way more bullish.

So, I think a 15% CAGR from here through 2026 is a reasonable model for Zoom which would put it at 8bl or so in revenue then and in the $3.5bl fcf range. So, ZM is maybe good for a $40bl EV today, and you are buying hoping that something like 20% turns out to be more accurate. Ark’s model is interesting because if you really think about it they are essentially arguing it’s going to perform way better from here than it did during covid. A 40-60% 5yr cagr on a business that has scaled to this level already would imply some serious domination in a hypercompetitive UC market. The market has no reason yet to believe any of this is possible, and is in fact worried that they will have a tougher time retaining what they got in covid thanks to increased competition from the likes of Microsoft and others. That’s what is driving the valuation now. There is serious doubt about whether or not you can grow north of 10% and everyone tracking the metrics and landscape has seen no reason to believe otherwise.

But what about if you are not long a Zoom or Peloton and are in a name that’s still firing on all cylinders? Like if AWS grew faster this past quarter than it did in the previous one should you worried about a covid cliff?

The answer here is still yes. Anything that by definition was accelerated by the pandemic is going to experience some sort of period of deceleration. All you really are trying to figure out how much and how long, and then what comes after. This wouldn’t be so bad if valuations had not exploded as they did, but that is the nature of a boom. If your AWS model is a 30% CAGR for next 5 years and it ends up being 15-20% that’s a huge deal. Right now the market is kind of trying to figure this all out and pricing in a cliff for everyone eventually. It also doesn’t help that there are under owned sectors where operational momentum is building coming out of the pandemic to rotate into. The factor element should not be taken lightly in this market, and one day this will also flip again due to crowding.

Trading Up

The other notable issue facing a growth compounder bro today is the trading up problem. In the early days of Covid, it was very easy to focus on a name that was lagging the leaders and argue that there is a good opportunity here. Pagerduty at 12 sales for example looked like a no brainer to someone like me in a tape with Everbridge at 25x sales. When you know these businesses well, it’s easy to reach this type of conclusion in a strong tape. Basically, I can’t go near a Zoom, Docu, Now, etc so let me find something misunderstood that offers compelling risk/reward. However, when you get a ton of supply on the market and everything starts coming down in a dominoes fashion you need to scrap that approach. You no longer need to look for the next Shopify or Roku when you can buy either of those two names at a fraction of where they were six months ago. And for those that don’t want to venture there you have the likes of Netflix, Facebook, Twitter etc. The big boys in this space are going through their own version of the very same problem. Tiger doesn’t need to invest in tons of pre-ipo rounds anymore when it can plop billions of dollars into Facebook or Zoom if it wants to. The crossover days are essentially over for these funds as quality abounds in public markets at very reasonable prices.

And this is why you are seeing companies now reporting on margins goals and profitability targets going forward. The days of selling your stock on just a revenue story are over. There are now plenty of thematic growth public companies an investor can buy which can deliver revenue, profits, and free cash flow growth at the same time. You now have to be a fool to pay a ServiceNow or Atlassian multiple for every dollar of SaaS revenue you come across. Investors simply have too many choices now to fill their portfolio with that just growing fast won’t cut it anymore. This process of trading up is going to be brutal for some because it requires quickly abandoning narrative driven investing that no longer is relevant. If Roku can trade down to a $10bl EV, you need to seriously do a quality assessment of everything you are holding and why. Personally, if my core longs are not yielding at least a 5% FCF yield right now with improving or at minimum very stable operating visibility; I am going to have a hard time defending them.