Axie Infinity and blockchain play to earn NFT games have been talk of the metaverse lately. There is tons of excitement around these new blockchain games and the 3rd world phenomena of Axie scholarships. If you are not familiar with the topic, check out

this great writeup by Packy McCormick. But Axie and play-to-earn is not without controversy…..

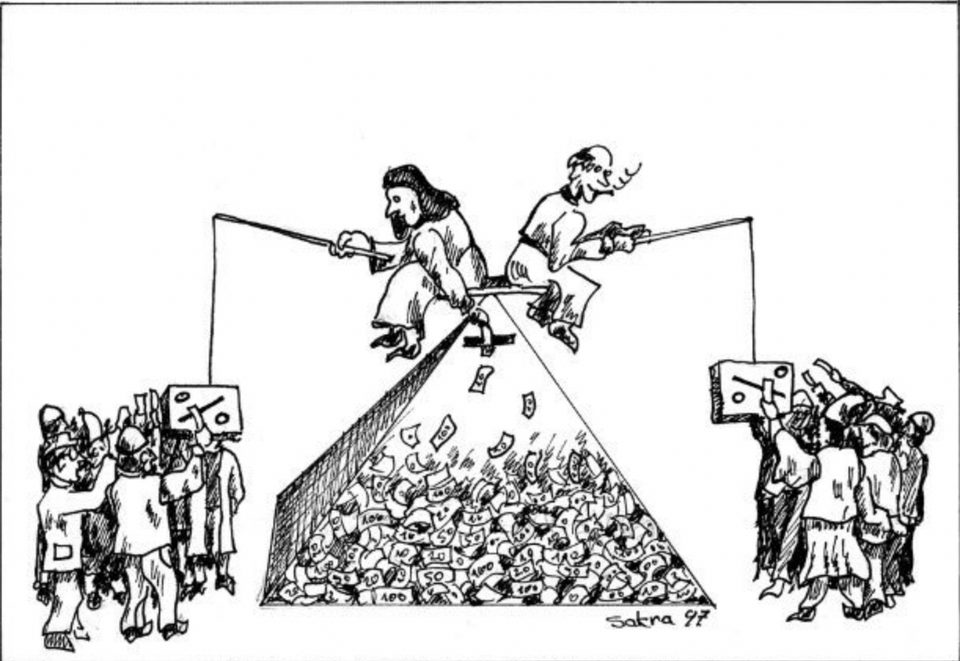

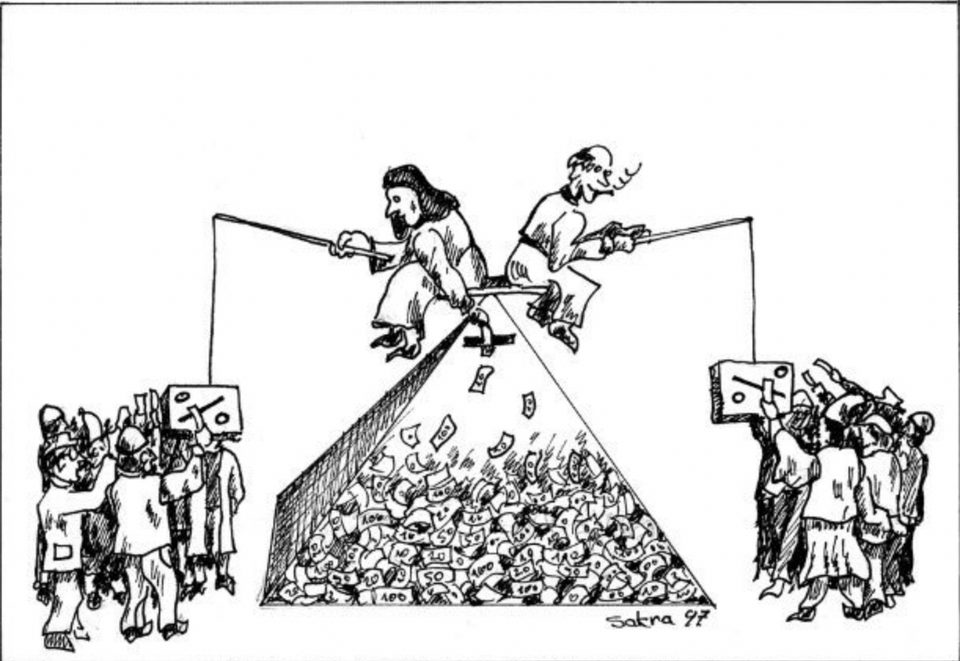

Axie critics have been quick to label the game a pyramid scheme or in more mild criticism an mlm with some structural flaws. Anyway, I figured this is worth a more detailed examination. Let’s start with the basics…

What Is A Pyramid Scheme?

The NY Attorney General

defines it this way:

A pyramid scheme is a fraudulent system of making money based on recruiting an ever-increasing number of “investors.” The initial promoters recruit investors, who in turn recruit more investors, and so on. The scheme is called a “pyramid” because at each level, the number of investors increases. The small group of initial promotors at the top require a large base of later investors to support the scheme by providing profits to the earlier investors.

Pyramid schemes are illegal in New York State, as well as in many other states. Article 23A of the General Business Law of the State of New York §359-fff sets forth the criminality of initiating and participating in pyramid schemes (also known as chain distributor schemes).

Pyramid schemes may or may not involve the sale of products or distributorships. The trend is to involve sales of products or distributorships in an attempt to show legitimacy. This is done solely to sidestep the regulatory agencies, as most state laws prohibit marketing practices where the potential for profit stems primarily from recruiting other investors and not from the sale of products. The bottom line, however, is that in all pyramid schemes, the selling of a product itself is much less important than the recruiting of new investors.

So, how does one make money in Axie?

Well, as far as play-to-earn goes, you earn SLP (Smooth Love Potion) tokens for playing the game. These tokens can be sold on crypto exchanges for cash. You can also use these tokens to fund part of the breeding cost for Axies, which then can be sold to other players seeking to join the game.

But where does the money come from that allows scholars grinding SLP to convert these tokens into cash? The answer is new players. You cannot play Axie without having at least 3 Axies in your account, and you cannot create new Axies to onboard new players into the game without SLP. So, from a fund flows standpoint the “earning” in the game is ENTIRELY DEPENDENT on fresh $ flowing in to pay the existing players. This dynamic is exacerbated by the fact that the money flowing into the game is based on implied yields or payback period for the initial Axie investment/team formation. Throughout most of recent Axie mania this has been in the 1-month range which has works out to several thousand % annual IRR. This has caused the minimum buy-in price to join the game to surge from around a $100 as of two months ago to as high $1300 a few weeks ago (it’s a little over $600 today). In that time period, the games DAU’s have gone from just under 100k to over 1ml. Naturally yields have plummeted in the process and Axie has responded by cutting SLP rewards as breeding yields have come under pressure. But assuming Axie had kept growing at the +100% month/month rate it was at for most of June/July, you would onboard the population of the planet with internet connection within the next year to deliver these yields.